Weekly Paid Newsletter 08/15/2021

Our Strategy has a +21.98%YTD performance. This week we have made a partial sale of crypto that we tell you in detail in the newsletter.

We share with you, as every week, the movements we have made in our portfolio in detail so that you can replicate an asymmetric strategy that benefits from fluctuations in markets with extremely low risk, since at least 40-60% of our portfolio is found in very low-risk assets (cash, gold, silver) and without giving up very similar profitability, even higher than that of the benchmark index (REF. $SPY). In addition, below, we explain in detail the reason for each of our movements.

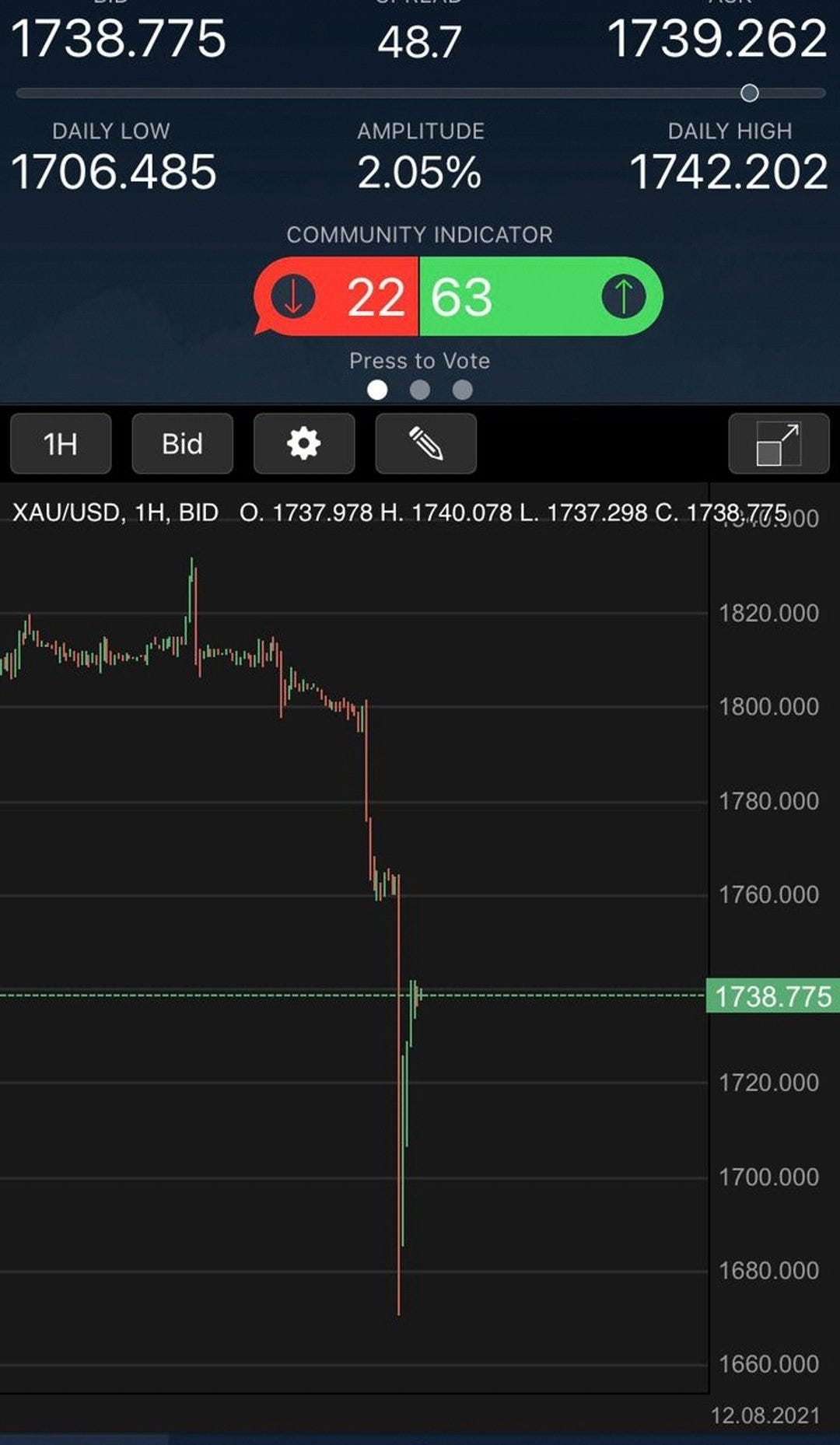

The past week was marked by sharp falls in gold and silver. In the last newsletter, we talked about how this fall could continue throughout this week as it happened during the session on Monday. That day the price reached $1,700 during the session, as we show you in the following image, a price slightly higher than the drop target that we set ($1,670). In our opinion, gold is an asset that is an excellent store of value and we are very comfortable having it in our portfolio.

On the opposite side, cryptocurrenci…