Weekly Paid Newsletter 10/31/2021

A company to buy for the next 5 years. Asymmetric Portfolio +21.67% YTD.

Big tech earnings week, what to expect from Google, Microsoft, Facebook, Amazon, and Apple.

Has the cycle of high-growth companies ended: eBay, Netgear, Teladoc, Twilio, or Upwork?

Tesla to the moon?

New inflation news, how could the indices react?

A week full of news, the large technology companies have given us key results and news for the future of their businesses. This week we will comment on these companies that we highlight below and what to expect from them in the short and long term:

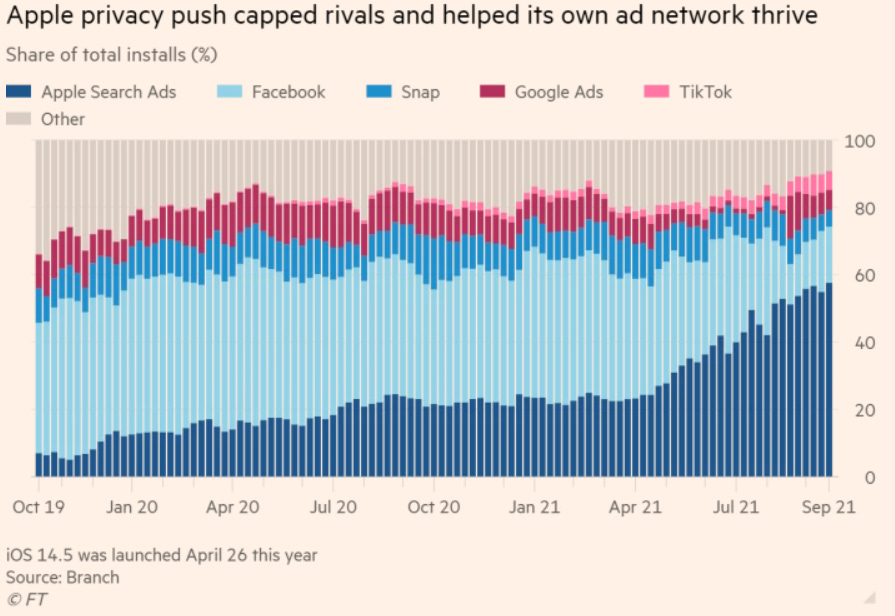

Facebook ($FB) loses revenue and guides lower amid Apple changes, but stock rises.

Just the week in which Tesla has surpassed Facebook in capitalization, Facebook has fallen in results. The company's revenue came in at $29B (35% YoY), but almost $500M below consensus. Monthly active users also fell below analysts' expectations.

"I'm excited about our roadmap, especially around creators, commerce, and helping to build the metaverse." - Mark Zuckerberg (FB CEO)

These statements were very much in line with the big news that materialized on Thursday of changing the company's name to 'Meta'. The company has been hiring and investing very aggressively within its Oculus (AR/VR) segment to build its metaverse pillars for the long term and this could be the beginning

It looks like this may be the company's salvation after seeing how it is losing ad market share when ads account for 90% of the company's revenue.

Still, the company is bullish on its share price and has made $50B worth of share buybacks in recent weeks, although from our point of view it would not be a company to enter at this point in time.

The next company to report results has surprised us very pleasantly and is an excellent idea for any portfolio for the following 5 years...