Weekly Paid Newsletter 01/09/2022

How to get up to 50% return on your Stablecoins

A couple of weeks ago, we talked about how to benefit from some cryptocurrencies with little risk and getting an annual rate of up to 5%.

If you haven't read that newsletter yet, do it before reading this one. Today, we will show you a powerful technique to get between 8-50% return during sporadic market situations and minimal risk.

Cryptocurrencies are currently black and white. Several people love them, and several people hate them. Some say Bitcoin is worth $1M, and others say it is worth $0. There is no in-between.

Like everything else in life, it is neither one thing nor another. Cryptocurrencies have their utility, and we should treat them as such.

Yes, indeed, they do not provide cash flow, just like gold, but regardless of that, we must value the utility they have.

Last week I read that an $80M transaction was made in Bitcoin for $1 in just 20 seconds. This milestone can only be achieved through a decentralized network.

Moreover, as you get into the world, you can see the enormous capacity of this type of asset and how we can benefit from it. As always, the early adopters will be the ones who get the most significant slice of the pie.

Today we are going to introduce Stablecoins. The cryptocurrency market adopted Stablecoins to decrease market volatility since this vast volatility prevented the adoption of cryptocurrencies by most investors.

Stablecoins aim to provide stable prices. Given the market's high volatility, cryptocurrencies do not allow to maintain the size of an investment portfolio or to multiply it in the long term. This is why the idea of Stablecoins arose to provide investors with relative stability in the market. With Stablecoins, it is easier to have profits or freeze them in a relatively stable cryptocurrency. The possibility of waiting for periods of large fluctuations to pass or using them to make everyday purchases.

All Stablecoins do not work in the same way, and we have, mainly, three different types:

- Stablecoins with fiat collateral are backed 1:1 by a FIAT currency.

- Cryptographically backed Stablecoins: decentralized, they rely on open software.

- Algorithmic stable currencies: these rely on smart contracts to regulate their stability.

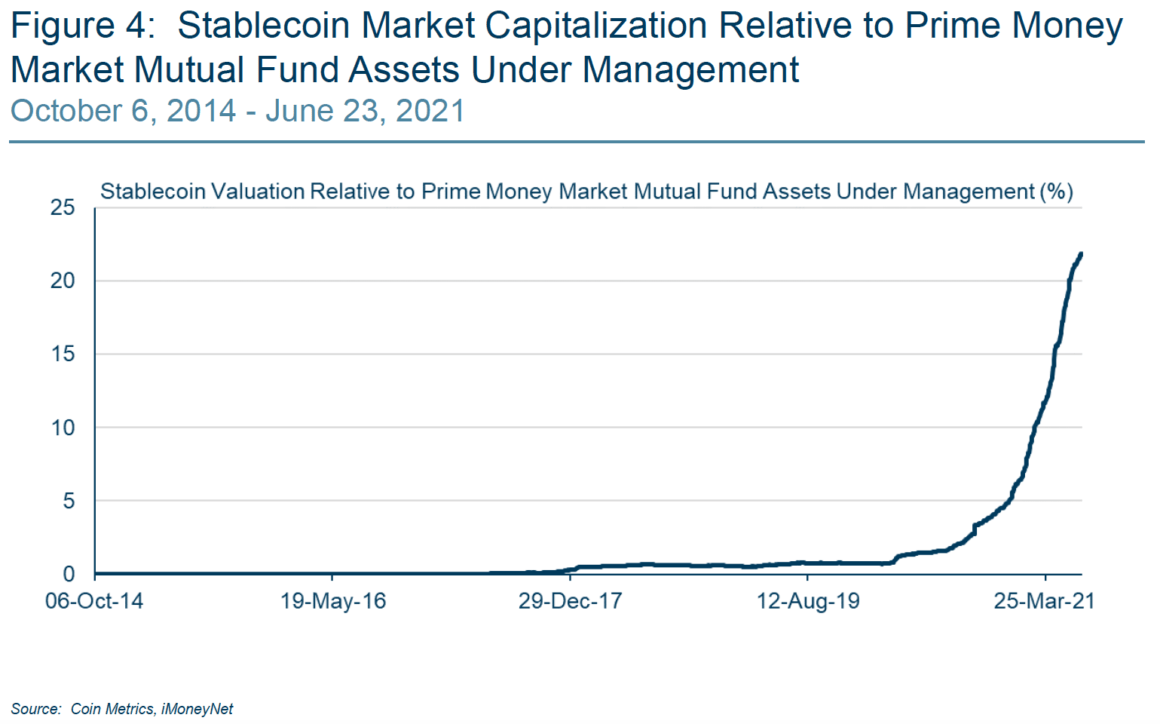

Their popularity has risen, and they are part of the present and the near future.

We are going to focus on the first type and specifically on USDT and USDC:

USDT (Tether): is a Stablecoin with a declared value of $1. However, Tether Limited, the centralized authority for USDT, is not audited. This has caused it to be fined by several financial regulators.

In addition, it is known that Tether, as we see below, is not 100% backed by real money.

USDC (USD Coin): another of the main Stablecoins in the USDC. Unlike the previous one, USDC is fully backed by cash and equivalents and short-duration U.S. Treasuries, so that it is always redeemable 1:1 for U.S. dollars. This makes it much more reliable than having the money in a bank or country with a political or economic problem.

We will talk about how to use these currencies optimally and achieve a passive income of up to 50% per year.