Our Global Market Overview

What can we expect from gold, crypto, equities, high yield bonds, etc.?

This week has been marked by the announcement of the GDP (QoQ) Q4, which has been 6.9%, somewhat below the 7.1% expected, if we add that the price of products is at maximum. It indicates that the average consumer notices that the cost of the shopping list and the minimum products is moving up and is cutting their consumption. However, this figure is much higher than the one presented in Q3.

What is happening in the world?

Ukraine's Defense Ministry said Russian forces are preparing to resume offensive operations. Adding to investor nervousness, the US noted that Russia is just shifting its strategy. Meanwhile, the top Russian peace negotiator Vladimir Medinsky confirmed that the nation's position on Crimea and the Donbas are unchanged. Interestingly, the safe-haven dollar remains depressed around local lows despite global risk sentiment turning sour.

High inflation and higher interest rates pose an immediate threat, and if the bond market warnings are to be believed, recessions may await us.

There’s no guarantee with these indicators, and the 2’s and 10’s remain uninverted. There are parts of the US yield curve, but that’s not a clear signal in itself.

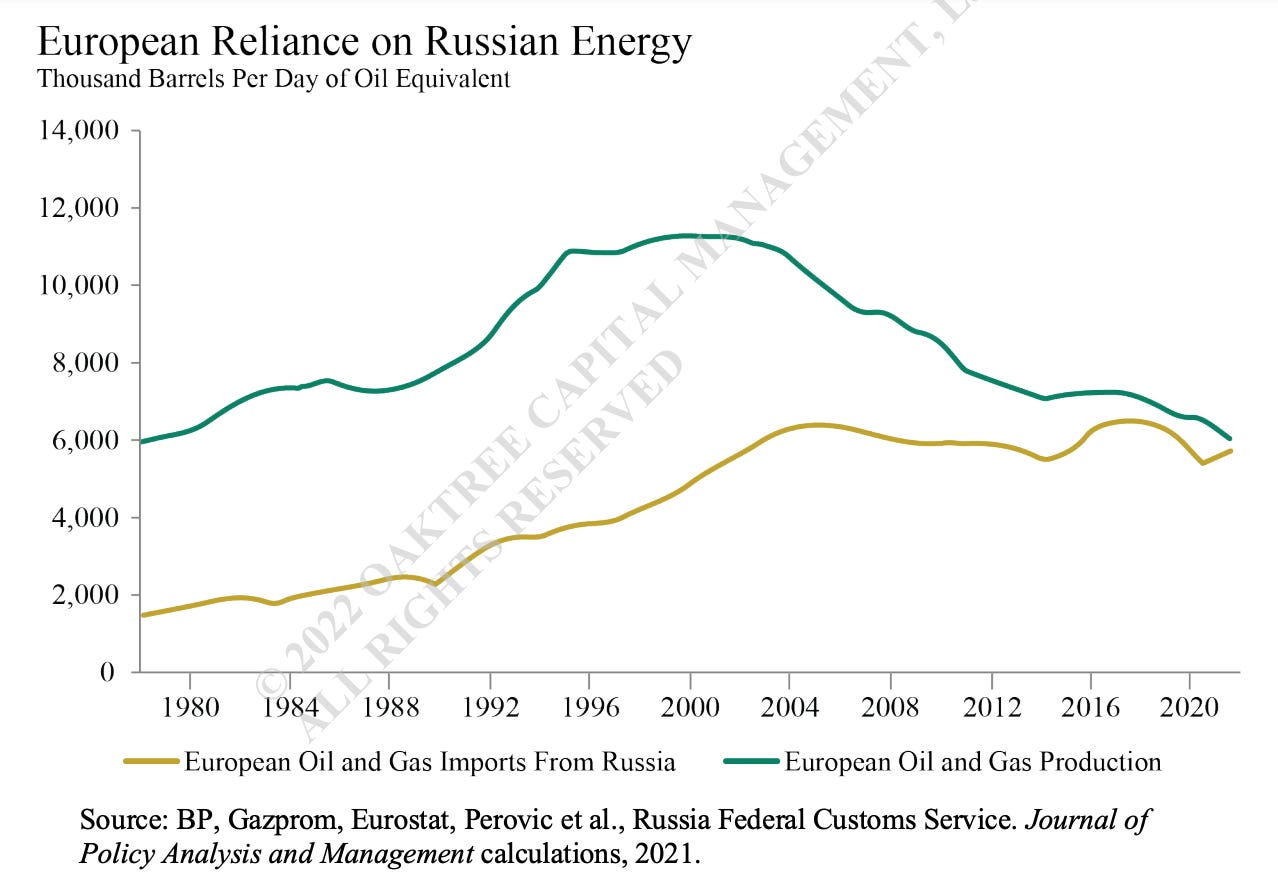

Europe is in big trouble. ECB is trapped, unable to hike but forced to pretend they are doing something about inflation.

The price elasticity of crude oil is estimated as $20 per 1% demand destruction. Massive swings.

$140 oil from 2008 is not comparable to $120 today due to a massive increase in the monetary base. I reckon oil prices closer to $200 today would be more like $140 in 2008. Bad news as prices can get much higher.

Needless to say, Russia is a major exporter of many commodities, including 8%+ crude oil and 10%+ natural gas.

The market can turn around, and correctly implementing a Covered Calls strategy can be very profitable. Below, we explain how we implemented this strategy in our portfolio, and we have obtained +5% in 4 months.

How are we thinking about dealing with it? What can we expect from gold, crypto, equities, high yield bonds, etc.?

We’re seeing further profit-taking in bitcoin on Wednesday following the surge and breakout earlier in the week. Plenty of barriers to the upside remain, including $50,000 and $52,000, while key support below falls around $45,500, having been such strong resistance this year.