The Most Asymmetrical Investment Idea In The Last 40 Years

You will regret not buying more than you will regret buying and having it reach $0.

Today we want to talk to you about one of the most asymmetric investment ideas we have ever encountered.

It is Bitcoin. Bitcoin as a blockchain technology and as a token. It is an idea that is hated by many and loved by very few. I know that as soon as you read the word Bitcoin, many of you stopped reading and probably unsubscribed. But let us tell you why it is an excellent asset to hold in an asymmetric portfolio and what % allocation should be held from our perspective.

Global Investment Assets

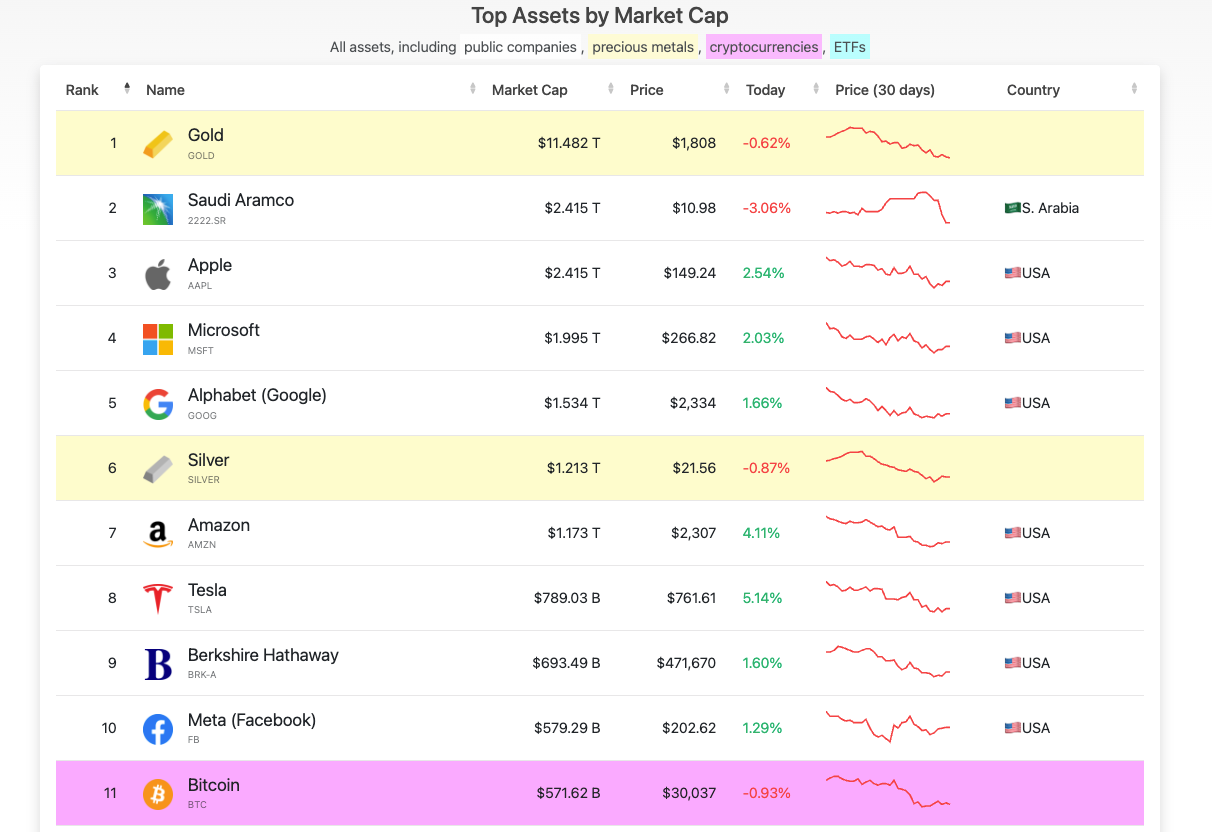

Let's start with all the assets in the world that are investable. According to Institutional Investor, we have:

Despite a year of economic uncertainty, financial assets, including stocks, bonds, and other investment funds, globally reached a record $250 trillion in 2020, according to a report by BCG released on Thursday. An additional $235 trillion was in real assets, led by real estate ownership, making up 48 percent of total global wealth.

This implies that we have:

Stock + Bond + IF = $250T

Real Estate Assets = $235T

On the other hand, we could add:

Art = $22T

Gold + Silver = $13T

M2 Cash = $130T

The total would amount to $650T.

This means that Bitcoin, with a market cap of $571.6B is 0.08% of all the money in the world.

We know there are projections and there are limits, but currently, there is 4.5% adoption globally.

According to the graph above, we see that adoption is very similar to what the Internet was in 1997. According to estimates in the year 2025, there should be an adoption of $1B of users, and this number could double in just five more years.

Here we can make several assumptions:

1% Global Market Cap --> $375k/Bitcoin

2% Global Market Cap --> $750k/Bitcoin

3% Global Market Cap --> $1.125M/Bitcoin

1B BTC Users --> $235k/Bitcoin

2B BTC Users --> $500k/Bitcoin

It seems that all of the above scenarios, without being far-fetched, give an upside of at least x10 until 2025.

Worst case scenario

The worst-case scenario is that it goes to $0, but let's imagine a drawdown as we have seen several times in high volatility assets of 80%. This would imply that from the highs ($69k), it would reach $14k.

If we consider that from that low, we could reach $350k (pessimistic scenario), we would be talking about a possible upside of 25x, while in the worst-case scenario, the downside would be 0.8x. This implies a risk-reward of 30 to 1.

Following the formula Market Priced Likelihood of Reward = (Risk/Reward) / (1+(Risk/Reward)).

We have that the probability of reaching $1M/Bitcoin is 2.6%, while the probability of reaching $14k is 97.4%.

This implies that the possible downside is $16k, and the gain is $1M.

Profit = 1M * 2.6 = 2.6M

Loss = -16k * 97.4 = -1.5M

Adoption

Considering the network effect and that the network of miners, networks, and, above all, users increases, this implies that the network continues to gain greater adoption, and it is much more complicated to leave it.

This is commonly referred to as the network effect, and in the age of technology, it is really important.

Inflation and Central Banks

This is the most common investment thesis used, but one that we should not forget. The BTC code is immutable and subject to 21M tokens. A very similar philosophy is followed by central banks. #irony

Elon Musk has already said it, and it is that this policy has led us to inflation unprecedented in the last 40 years.