Ray Dalio To CNBC: "Of Course Cash Is Still Trash".

This situation has happened before, and we show you.

Fear grips the financial markets. There seems to be no asset in which to take refuge:

Equities: -20% from highs

Bond: falling, and we are losing purchasing power

Bitcoin / Ethereum: -60%

...

And what about cash? Ray Dalio has done it again and has answered to CNBC in an interview published this week at the Davos 2022 forum that: "cash is still trash", without the slightest hint of doubt.

In the same interview, the interviewer also says: "But equities are not a good option either", to which Ray nods and says that this statement is absolutely true. So, where should we invest our capital? Do we have a choice? Or do we have to "Carpe Diem" and spend it all? Ray gives the solution, but first, let us give you some context.

All the indicators tell us that we are in an extremely bad environment in the markets, and the first thing we should do and this we would like to be very clear about:

"DON'T GET OUT OF YOUR INVESTMENT SYSTEM."

Systems give you money, and changing systems take it away.

If you are a passive investor, continue to invest in your index funds.

If you like growth stocks, keep buying Zoom or Tesla shares.

Whatever your system is, stick with it. Even if this recession seems to have no end or that the end is much more critical remember this: "Everything reverts to the mean".

You must analyze why your portfolio has gone down and if your portfolio was really robust enough.

But keep in mind that everyone is terrified:

And in every sector:

As if that were not enough, this week, they have announced the biggest drop in new home sales in the US in the last nine years.

This last data has made us reflect on why most people lose money when it comes to investing or why most people are not rich, and it is because they do not know the financial markets.

They waste much of their time studying for a career but don't spend a minute of their lives learning about personal finance.

Fortunately, this is not the case for you if you are here.

Why do we say that the housing data is interesting data?

Because Ray Dalio is just what he said, he said that we should invest in REAL ASSETS.

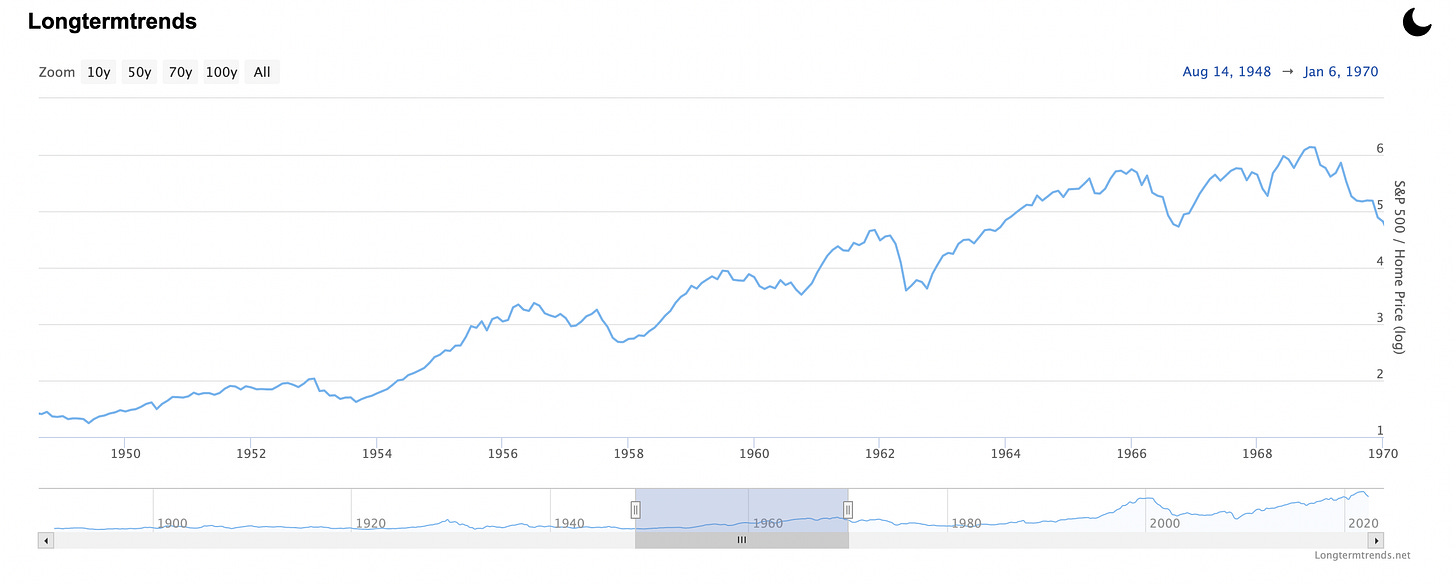

And what does he call Real Assets? Mainly Gold and Real Estate. We are in a period very similar to the '60s-'80s, where the price of houses multiplied x4 and the price of gold did +1,000% in 20 years.

Home Price Index

Gold (yellow line), S&P500, and Dow Jones (red and blue line, respectively)

But what are people really thinking? We are facing a 2008, and the housing price will collapse, and people are fleeing from this type of asset.

We warned about this in the following article:

How Warren Buffett Turned $1M Into $230M During The Previous Inflationary Period

And taking out mortgages at 1% during inflationary periods is the best thing you can do. Imagine taking out a $500k mortgage on a home worth $600k. If you multiply its price x4 for the next 20 years, we are talking about an annual yield of 15.86%.

Undoubtedly, what we have just told you may be one of the greatest lessons you will receive today.

If you want to collaborate with this project, do not hesitate to subscribe, it is the only way we have to keep this going.

Here is the Ray Dalio Interview.

And now, our portfolio👇🏼