This week the Fed made the largest interest rate hike since 1994. A 0.75% increase. On the one hand, it explains how inflation is today, how the price of life has risen, and how excesses are expensive (in any area of life). Currently, the real inflation, the one perceived by the ordinary citizen, is around 10%, according to the following website.

On the other hand, Powell has given a message of "calm". He has told the public that he will try to control this inflation as soon as possible and that once this inflation is under control (around 2%), we will return to a "normal" economy, or what amounts to the same thing with infinite QE.

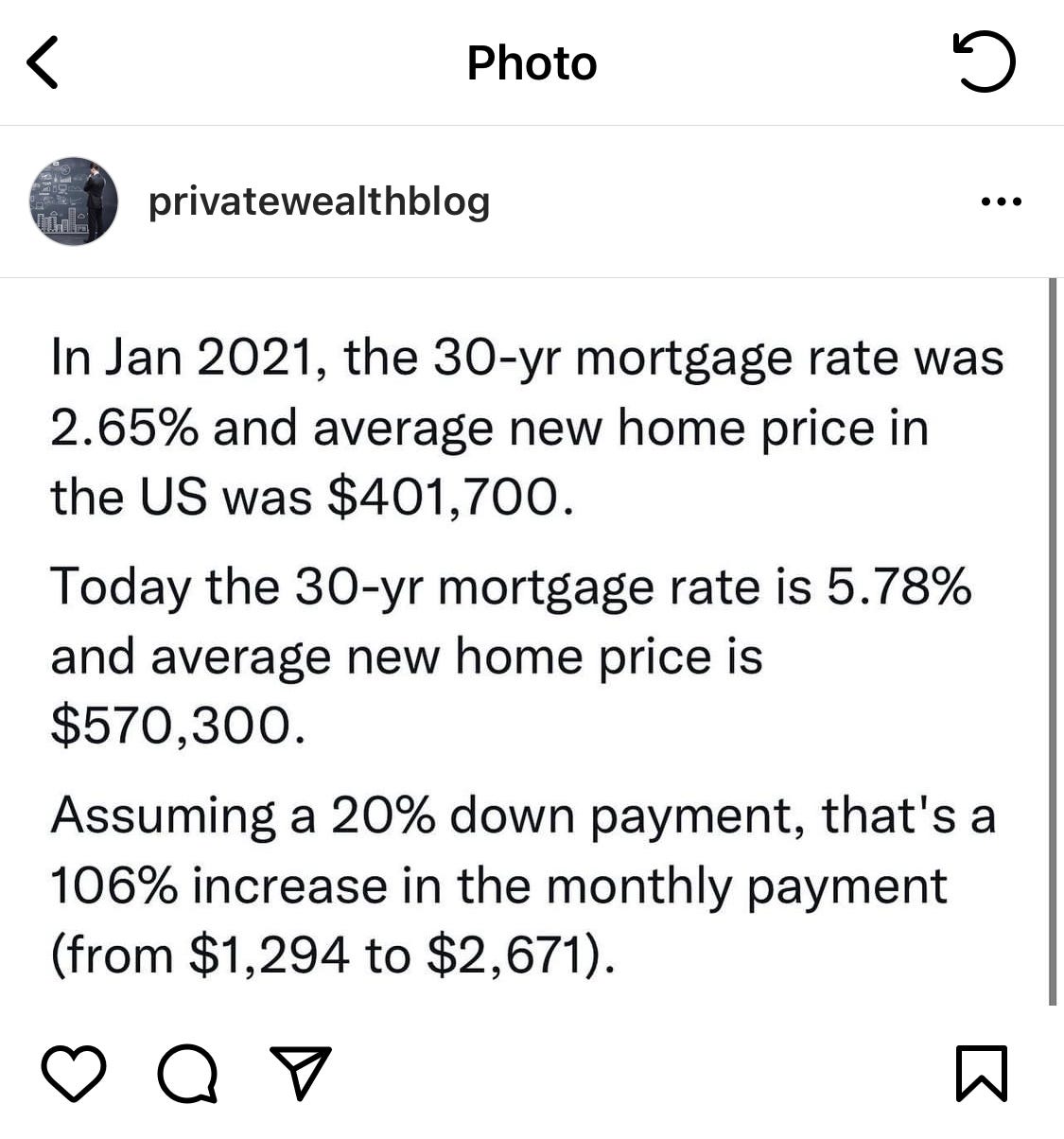

This 0.75% rate hike is higher than what you could get a mortgage at just a few months ago. We have already warned that it is in extreme situations that we must act, and when a low mortgage is given to you, maybe you should take it.

Perhaps there are many reasons to think that the same will happen in the crypto world, as we commented a few days ago.

What will happen?

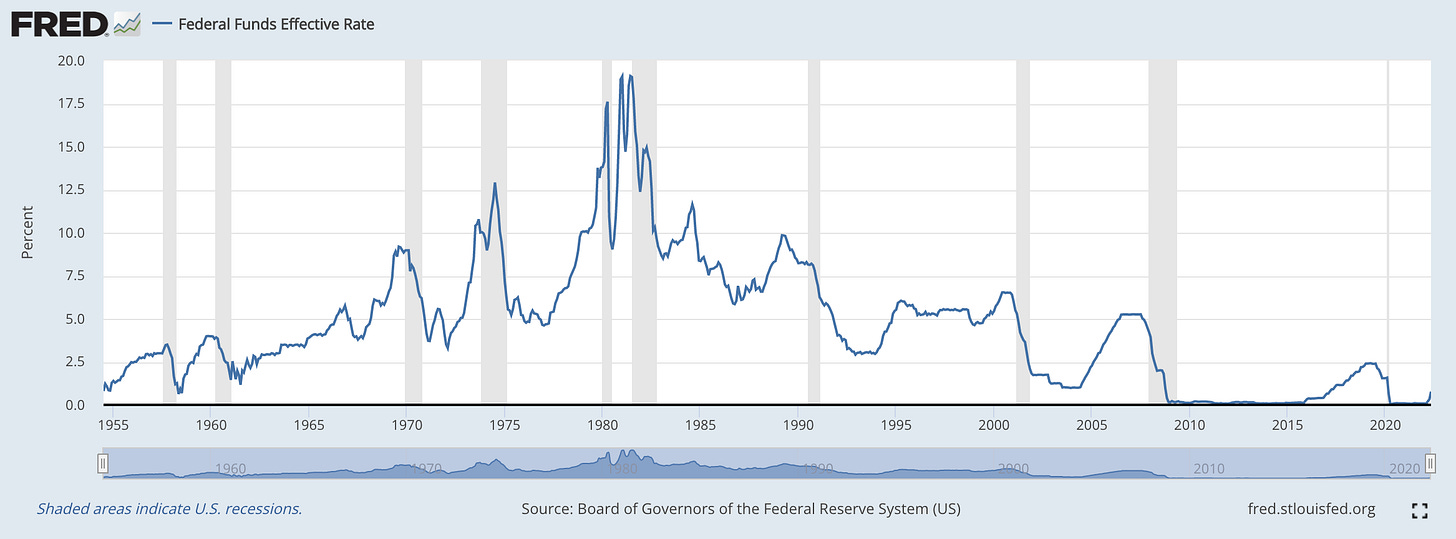

Many experts have taken to the social networks to say that there has not been a cycle of rate hikes without a recession and that if now the hikes are getting stronger, this will mean a much tougher recession.

The history is clear, and it seems that ALWAYS after rate hikes, the economy experiences recessions. The main problem is that sometimes these periods can last up to 10 years (1960-1970, 1990-2000).

As we have always argued, sooner or later, we will face recessions. Most likely, these recessions will drive markets to extremes, and if we are well-positioned, we can make a lot of money to buy much cheaper at the right time.

A precious lesson.

One of the best-performing investors with the least visibility is Mark Spitznagel (CAGR >70%). He has a modest Hedge Fund, but his participants have made a lot of money with it.

Mark introduced the Amor Fati concept, an extremely valuable concept that today I am going to teach you how to implement regardless of whether you are a growth, value, contrarian, ... investor to get extraordinary returns.

As I mentioned before, many people tend to underestimate having a hedge, and honestly, I think it is the most asymmetric position we can take. Having a strategy that allows you to cash in when you need it most is a must. It may be that the strategy may have returned close to 0% (this is not our case), but the fact of sleeping peacefully and knowing that when the home run comes, you will not have to worry about money anymore makes us never abandon this strategy.