7 Lessons (In Finance) From An Increasingly Global World

If you fulfill all of them, you will succeed

After a week of announcing the new inflation data, I have decided to make an article to escape from all this data and go back to the principles that will make me succeed as an investor. They will make me succeed regardless of what the market does (in the short/medium term).

These principles are very powerful, and if you manage to implement them all, you will be much closer to achieving your financial goals:

Keep your mind open to change.

Change is constant and inevitable, from the time we are born until we die. As we grow older, we keep in our heads a series of principles that we believe to be valid and immutable, but they are not.

Rapid adaptability and change are the difference between being an early adopter and making (a lot of) money or just being one more.

I had the biggest proof of this with my father a few weeks ago when he told me that Bitcoin does not follow any economic principle. Isn't Bitcoin the only asset that fulfills all the properties of money?

Amor Fati

Amor fati is often associated with what Friedrich Nietzsche called "eternal recurrence", the idea that everything recurs infinitely over an infinite period of time. From this, he developed a desire to be willing to live exactly the same life over and over for all eternity ("...long for nothing more fervently than this ultimate eternal confirmation and seal").

I see this expression as a way of life. Every action we take, try to make it an action that if you were born again, you would do again.

In finance, something very similar happens. People try to get the stocks they choose right. They buy a company's stock thinking they'll be able to know when to sell, and they don't. Buy only assets that you can hold forever.

Buy only assets that you can hold for a lifetime and, under no circumstances, will go bankrupt.

SPY > Tesla Stock

ACWI > SPY

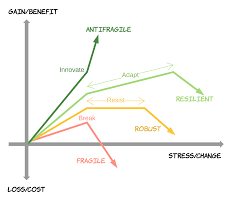

Be antifragile

The biggest difference between long-term success and failure is being antifragile. You must adopt a new outlook on life to achieve everything you set your mind to.

By being antifragile in each and every aspect of your life: health, finances, relationships, and work, I have no doubt that if you do not achieve success, you will be close to achieving it, or you will not have been able to identify what success is.

Obviously, we must know that there are things that are out of our control but that we can reduce and even avoid.

In the book "Tools of Titans," one of the interviews talks about how fasting has managed to end cancer in many people. Subjecting the body or our portfolio to constant stressors to finally end up having a great upside is what we must do continuously.

Persist

In order to be a great investor, you must do the same thing for decades. Not for years, decades.

This is where the tricky part comes in. How do I know if I'm doing it right or wrong if I have to stick with it for decades? This requires prior analysis and a lot of studies. For example, how many times have you seen a graph of Apple and said, if I had invested in the year 2000, I would now be an infinite millionaire? Many times. But if you had invested in the year 2000, you would have surely eaten the 80% fall of the .coms and, along the way, several falls of 60%.

Continuing with Amor Fati, invest in assets that you can hold for 20 years so that when you zoom out of your portfolio, you will be proud of what you did.

To do this, diversify and make asymmetric bets:

Gold

Bitcoin

Silver

ACWI

Ethereum (Strategy To Make 60% A Year)

OTM options

...

Don't make bets that may not exist 20 years from now:

Crypto ranking 1200

Teladoc

ARKK

...

If you know how to differentiate between Hard Assets and Soft Assets or have an asymmetric portfolio like ours, it would be enough to succeed in investing. But now, only if you persist.