What Will Happen to the Market After the US Inflation Data?

Market overview

We have been in the markets for a long time and have never seen so much concern about Fed data. This is not normal for those who have not been in the markets for a long time.

In the past, investing was much more focused on company analysis. Today, 0.1% in inflation data is more important than whether Amazon comes out with a product that will revolutionize the industry.

It is sad, but at the same time, it makes us realize several realities.

On the one hand, we realize that if our entire future is in the hands of the central bankers, it seems very complicated to think that at some point in our history, they are going to let us sink into an unprecedented recession. Let's say that the economy is rigged, and if they get to appreciate that a very big recession is on the way, they will try to avoid it.

High-growth companies, in particular, and the market in general, will tend to rise in the long run because of what was explained in the first point. In the above, we have not said what their weapons are, but they have summarized in 2: Interest rates and liquidity.

The higher the liquidity, the higher the market rises, and those scarce resources such as gold, silver, or bitcoin increase their value.

The main problem does not come from the terrible things that can happen to the economy or that have happened in the past but from the terrible things that they do not know can happen to the economy. They mainly start from a mental framework about what has happened historically and how it has been remedied. But there are many things they don't know, that they don't know (black swan). Hence the importance of diversifying across assets, brokers, exchanges, etc. Always have an asymmetric position.

As we have been saying nowadays, a good macro investor will earn much more money investing than a good fundamental investor, and this is sad.

This week it was time to give the monthly and annual CPI data. Perhaps this was one of the most important data of the year due to our situation.

As we had said, the S&P 500 futures plunged -3.8% when the data was announced.

However, when everyone feared that the day would end even worse, the index rebounded more than 5%. This makes last Thursday the day with the biggest market movement of the year. One of those days that make history.

Let's see what has happened in the markets on those days when there has been such a pronounced upward movement.

I think it seems clear what could be the trend in the next few days (at least in the short term). A small rebound in the markets. I repeat, at least in the short term.

However, in the medium term, the outlook is very different. The world's leading economists argue that this recession has just begun and that we still have a lot of pain ahead of us.

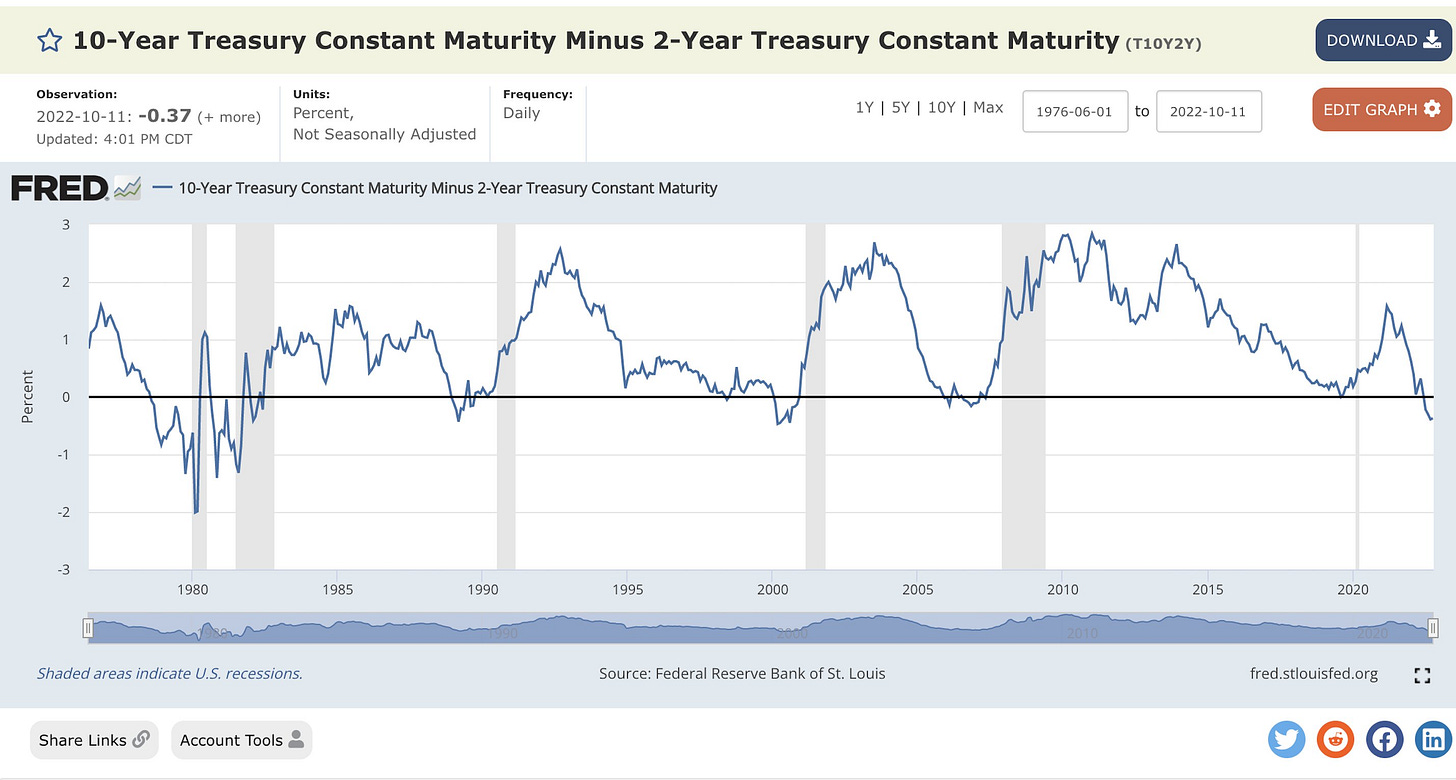

Whenever the yield curve has inverted, there has always been a recession. Every time, without exception.

This may be the exception that proves the rule, but it looks like history will repeat itself.

Jeremy Siegel, despite not letting the presenter speak in the following interview, comments that if the largest liquidity injection in history lasted in a bull market from March 20 to November 21, we could not expect the reverse situation (QT and rate hikes) to stop inflation in just seven months.

He believes that at least this situation could worsen until the middle of next year. This would mean much more pain in the markets.

It seems that a (further) recession is very close.

We will take advantage, as we have done in all market rebounds, and buy more hedges for our portfolio so that we can be covered if Jeremy Siegel is right.

If there is anything better than being in cash during a recession, it is making money when the whole market is cheaper than normal.

Now our portfolio