Many People Have Opinions About Bitcoin But Only He Has Gotten It Right

Floor in November around 15-17k?

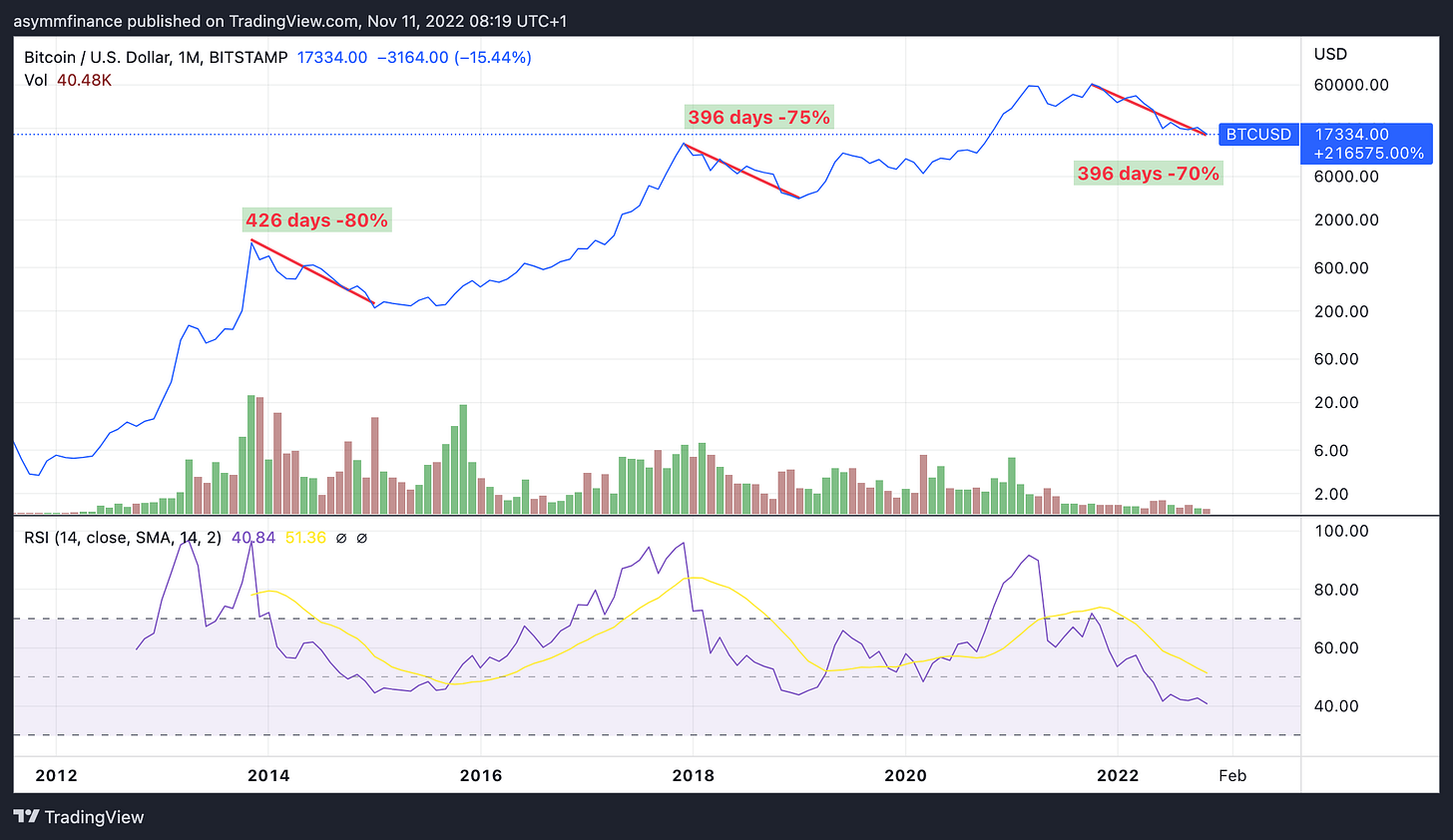

This week has been one of the worst for Bitcoin in a long time. It was just over a year since it hit the highs; since then, it has done -70%. For those of us who have been in this world for a long time, it is easy to understand that capitulations in Bitcoin are very painful for investors both economically and psychologically. We are not saying that you lose 70% of your invested savings. We are saying that the price of Bitcoin is even below where it was more than five years ago.

This pain in the share price is inversely proportional to the returns that can be acquired. There is no doubt about that.

But this begs the question: where is the limit? Is the value of Bitcoin $0? Do we have a low, and will we see a high again in a few years?

Many questions enter the average investor, which did not enter more than a year ago with the price of Bitcoin at $69k.

Have we hit the bottom for 19,473 times?

The investment community makes a lot of bets about where the bottom will be in the markets. They make complicated charts, and based on these, they generate a lot of noise and/or fear in investors.

When you make a lot of predictions, you usually end up getting it right, and it looks like that makes you an expert, but you are not. What is complicated is to make a few predictions and get them right. But it is even more complicated to make very few accurate predictions and get them right.

However, there is one crypto investor in the community that we have been following for a long time who has undoubtedly got something right.

In a newsletter he sent out in June 2022, he said that the Bitcoin price was going to fall to 15-17k in November this year.

It did not seem very complicated to get it right looking at a simple chart as the one seen at the beginning. Considering that the fall from the highs was going to occur between 395-430 days after the peak and that the fall was going to be around -70 and -80% (15k-20k).

When we talk many times about the investment system, we talk about these kinds of aspects in the markets. Situations not seen in the last 5 years and that occur very sporadically, such as VIX >40 or Bitcoin dropping -75%. But we have a lot to gain if we know how to take the fear out of the equation and invest and sell when our system tells us to.

This week we have increased our position in Bitcoin. In the following chart, we see how our return would increase, only having 1-2.5% in Bitcoin. We are talking about one of the most cyclical assets we know. Moreover, it is worth having Bitcoin in an asymmetric and de-correlated portfolio.

In case you haven't noticed, every day, we like the technology behind it more and more, and as Saylor says: "There is no person who has studied Bitcoin for more than 100 hours who hasn't invested in it".

The FTX case

This week saw a Luna 2.0 case. This time with FTX. This is a CENTRALIZED exchange that has falsified part of its balance sheet and made unreported transactions. Of course, we are talking about a crime, and the founder should be tried for it.

However, amidst all this noise, we see that the Bitcoin network remains unchanged. It has never been corrupted and has not been hacked. This makes it a much more anti-fragile network with each of these crashes.

But speaking of systems, the investor we talked about before has one to buy and sell Bitcoin.