7 Money Lessons I Learned Skiing in the Alps

Stop Wasting Time: Build Wealth Like This

I just got back from skiing in the French Alps. A week with spectacular conditions: clear skies, bright sun, perfect snow, and not a single gust of wind. I’ve returned with a series of lessons about money that I’d like all of you to apply to your own lives.During this trip, I also had the chance to visit Geneva (Switzerland), the birthplace of Patek Philippe watches and one of the countries with the highest density of millionaires in the world. A place that naturally makes you reflect on wealth and lifestyle.But let’s get to the point. Here’s what I’ve learned during these days on the slopes:

Money buys experiences, and life is all about that

Although we often promote saving and investing here, we must not forget that the ultimate goal isn’t just to have the highest possible number in your bank account. Life is about experiences: traveling, sharing moments with loved ones, and creating memories that stay with you forever.As Naval Ravikant says: “In 100 years, no one will remember you.” So why not enjoy life while you’re here? I’ve already talked before about how to optimize your health to live longer, but those extra years only matter if they’re filled with meaningful experiences. Don’t be stingy with yourself—use money to truly live.

If you follow the herd, you’ll never fully enjoy life

After years in the financial sector, this year I decided to take a week off during low season to go skiing. The difference was incredible: while on weekends I barely skied 25 km due to crowds, during weekdays I exceeded 40 km daily without waiting in line and enjoyed perfect weather.The lesson is clear: we should all aspire to have control over our time. If you’re only able to live your dreams on weekends, you’re limiting your life. Be your own boss or find ways to make your schedule more flexible.

The key is having a steady cash flow to live well

We’ve talked before about how much money you need to live your dream life. According to a billionaire I recently listened to, with €20,000 a month you can enjoy luxury without limits. Applying the 4% rule (I won’t explain it here), you’d need €6 million invested to generate that monthly income; however, if you achieve higher returns (like 15%), that figure drops drastically to €1.6 million. The focus shouldn’t just be on accumulating wealth for its own sake but on generating consistent income.

Leverage other people’s work

One of the biggest secrets to scaling both in business and in life is learning how to delegate and leverage other people’s talent. You can’t do everything yourself, and trying to do so will limit your growth. Surround yourself with a competent team, outsource tasks that don’t directly contribute to your main goals, and focus on what truly adds value. Time is your most valuable resource—use it wisely.

Use the Cantillon Effect to your advantage

The Cantillon Effect explains how those who receive newly created money first (like banks or large investors) benefit before inflation erodes its value for everyone else. In simple terms, this means being close to sources of wealth creation gives you an edge. Invest in assets that appreciate with inflation, such as real estate or stocks, and stay informed about monetary policies so you can position yourself strategically.

Legally reduce your taxes

Tax planning is essential for optimizing your finances. Take advantage of deductions, exemptions, and tax credits available in your jurisdiction. For example, investing in pension plans, donating to NGOs, or structuring your income through efficient tax vehicles can significantly reduce your tax burden. Always consult a tax professional to ensure compliance while maximizing benefits.

Build assets that generate passive income

True financial freedom is achieved when your passive income exceeds your expenses. Build assets like rental properties, dividend-paying investments, or automated businesses that work for you even when you’re not present. This not only provides financial stability but also gives you the freedom to focus on what truly matters to you.

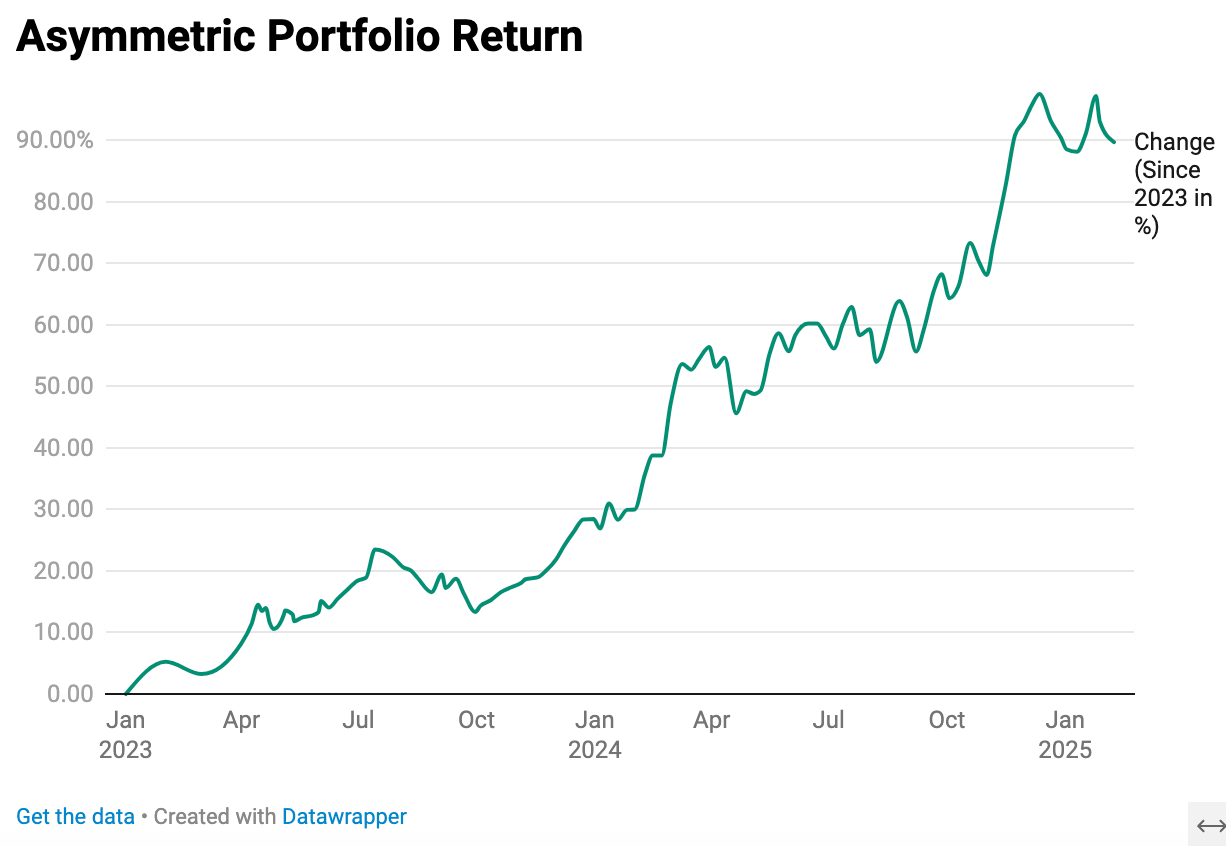

I believe that one of the most eye-opening trips regarding what we should truly seek in life has made me more convinced than ever that 5 hard years are worth it for an easy life—or a hard life otherwise. Now, we’ll show you our portfolio in detail.