Best Insights from Howard Marks' Portfolio

His top five positions account for almost 50% of his portfolio

As we navigate the current business cycle, it’s important to remember the lessons shared by legendary investor Howard Marks. In a conversation four years ago, Marks shared his insights into how he navigates markets successfully in a world dominated by moral hazard and political polarization. Today, his insights seem more prescient than ever.

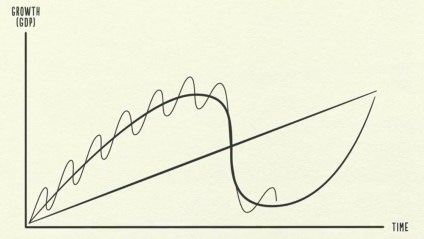

One key lesson that Marks emphasizes is the importance of recognizing when the broader market becomes too optimistic. When too many people have too much money and are too eager to invest it, the bidding can go too far and the winner of that auction can actually end up being a loser. Marks advises investors to take defensive action when they see the heated part of an up cycle. His experience has enabled him to make aggressive portfolio moves when he sees a familiar cycle shaping up.

Another lesson from Marks is that cycles tend to rhyme. He has seen a lot of cycles and has learned to recognize when a familiar pattern is emerging. When he sees the heated part of an up cycle, he takes defensive action.

He emphasizes that he is not afraid of being wrong and believes that being too far ahead of your time is indistinguishable from being wrong. The best skill an investor can have is the patience to wait until their thesis is confirmed.

Marks also believes that it is impossible for any investor to ever know what’s coming next. He cautions against assuming certainty, and believes that overpriced and going down tomorrow are not synonymous. Something can become more overpriced and that’s how you go from a bull market to a bubble. It’s important for investors to recognize that there is zero certainty, and that’s okay.

Marks also discusses the issue of moral hazard in the economy. According to him, the Federal Reserve has created moral hazard by repeatedly bailing out markets. This has resulted in the tail wagging the dog, with finance becoming the tail and the economy becoming the dog. This attempt to prevent market fluctuations and recessions remains an ongoing issue today. Marks believes that this change in the game to benefit the betters is a problem that needs to be addressed.

Finally, Marks points out that capitalism is under threat in America. With growth slowing, the wealth gap widening, and automation on the rise, he believes that a wave of populism should be expected. Today, his observations seem more relevant than ever. The shifting political landscape in America and the threat to capitalism is the biggest problem facing the U.S. in the next few decades, according to Marks.

As we navigate the current business cycle, it’s important to keep these lessons in mind. Nothing is a sure bet, but recognizing when the broader market becomes too optimistic and taking defensive action when a familiar cycle emerges can help investors to navigate uncertainty. Waiting until a thesis is confirmed and avoiding assumptions of certainty can also help to mitigate risk. Additionally, it’s important to be aware of the issue of moral hazard in the economy and the threat to capitalism in America. By keeping these insights in mind, investors can better navigate the challenges of the current business cycle.

Master lesson from Marks' portfolio.

..