Gold Could Double Its Price in the Coming Years

Ray Dalio’s Warning: Why You Need Gold Before It’s Too Late

The global debt stock and overall Global Liquidity are closely interconnected. Debt must either be repaid or refinanced. To put it another way, with $350 trillion in outstanding public and private debt, and an average maturity of about five years, this means that $70 trillion needs to be refinanced annually.

According to estimates by Capital Wars (Michael Howell), 75 out of every 100 dollars transacted in global financial markets today represent a debt refinancing transaction.

This process requires substantial balance sheet capacity across the financial sector, which is what we define as Global Liquidity. The relationship between Global Debt and Global Liquidity typically hovers around an equilibrium ratio of 2.5 times. In simpler terms, every $1,000 in new debt requires $400 in liquidity to support its refinancing.

When liquidity is insufficient, refinancing problems trigger financial crises. Conversely, when liquidity is abundant, financial bubbles can form. (These are the typical Global Liquidity Cycles.)

So far, nothing we didn’t already suspect. Essentially, we are in a cycle of bad debt that can only be repaid with more debt, making it increasingly difficult to meet repayment obligations. This dynamic drives exponential growth in global liquidity.

When it comes to inflation hedges, gold has historically been the best ally.

But how is it possible that gold has maintained its value over time, given that it seemingly "serves no practical purpose"? Its enduring value lies in its scarcity, high extraction costs, and ability to persist over time (more so than across space).

The ancient Egyptians were among the first to recognize these unique properties, using gold to adorn their pharaohs' tombs.

But has gold really preserved its purchasing power so well throughout history?

Historical estimates suggest that every 10% increase in Global Liquidity corresponds to a 15% rise in gold prices. Over a shorter, more recent period, Bitcoin has outpaced this, rising as much as 45% for every 10% increase in liquidity.

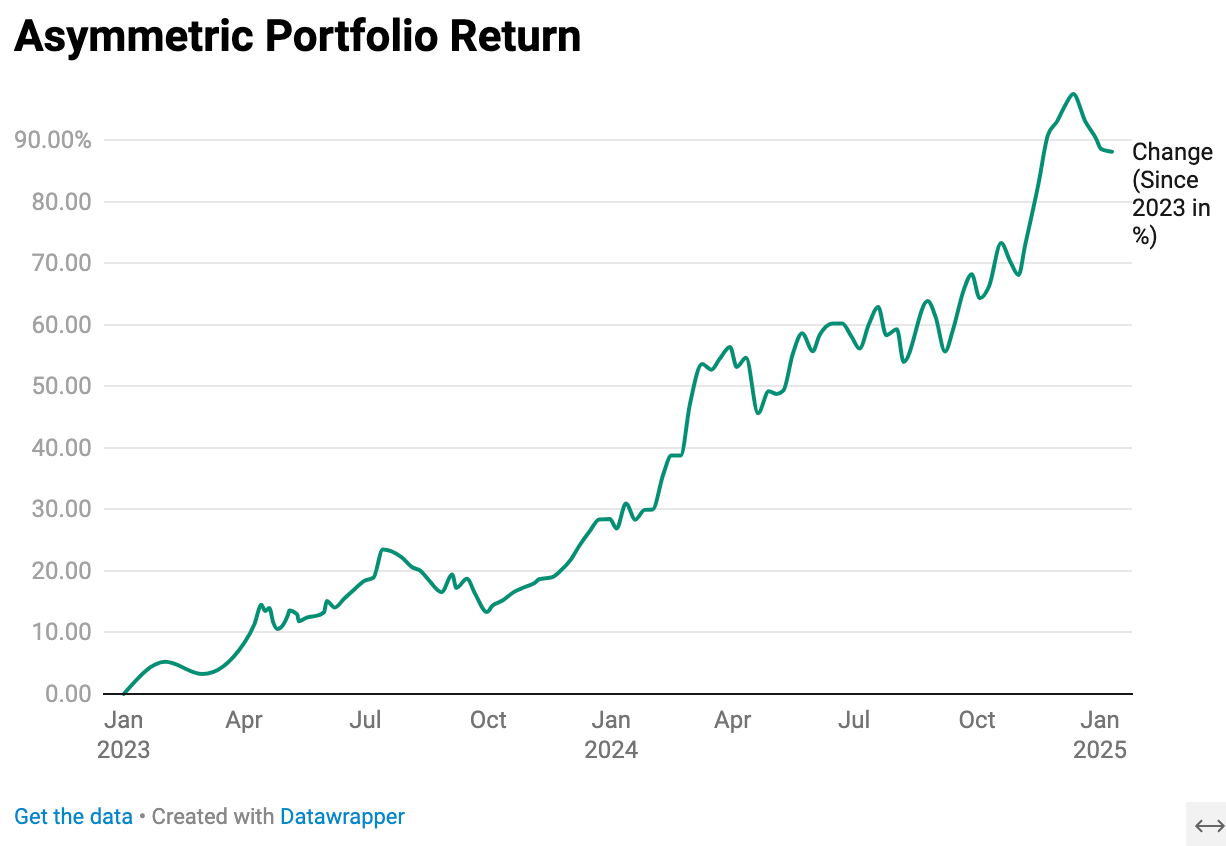

Why do I believe gold offers an excellent return/risk profile? Because, as mentioned earlier, gold has consistently outperformed liquidity. And as the chart shows, we haven’t even returned to pre-COVID highs yet.

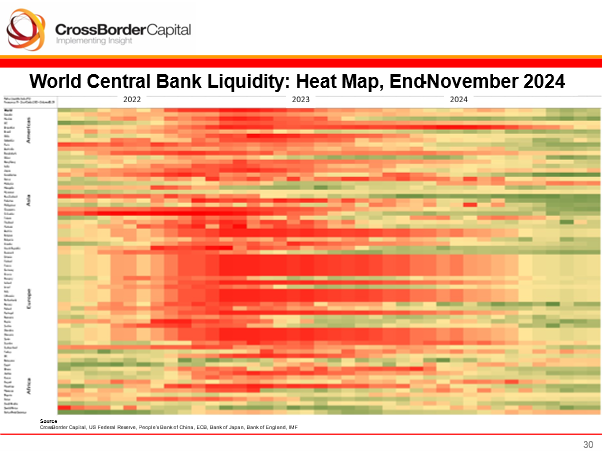

On top of this, central banks' conditions are improving, with increasing liquidity injections (marked in green on the charts).

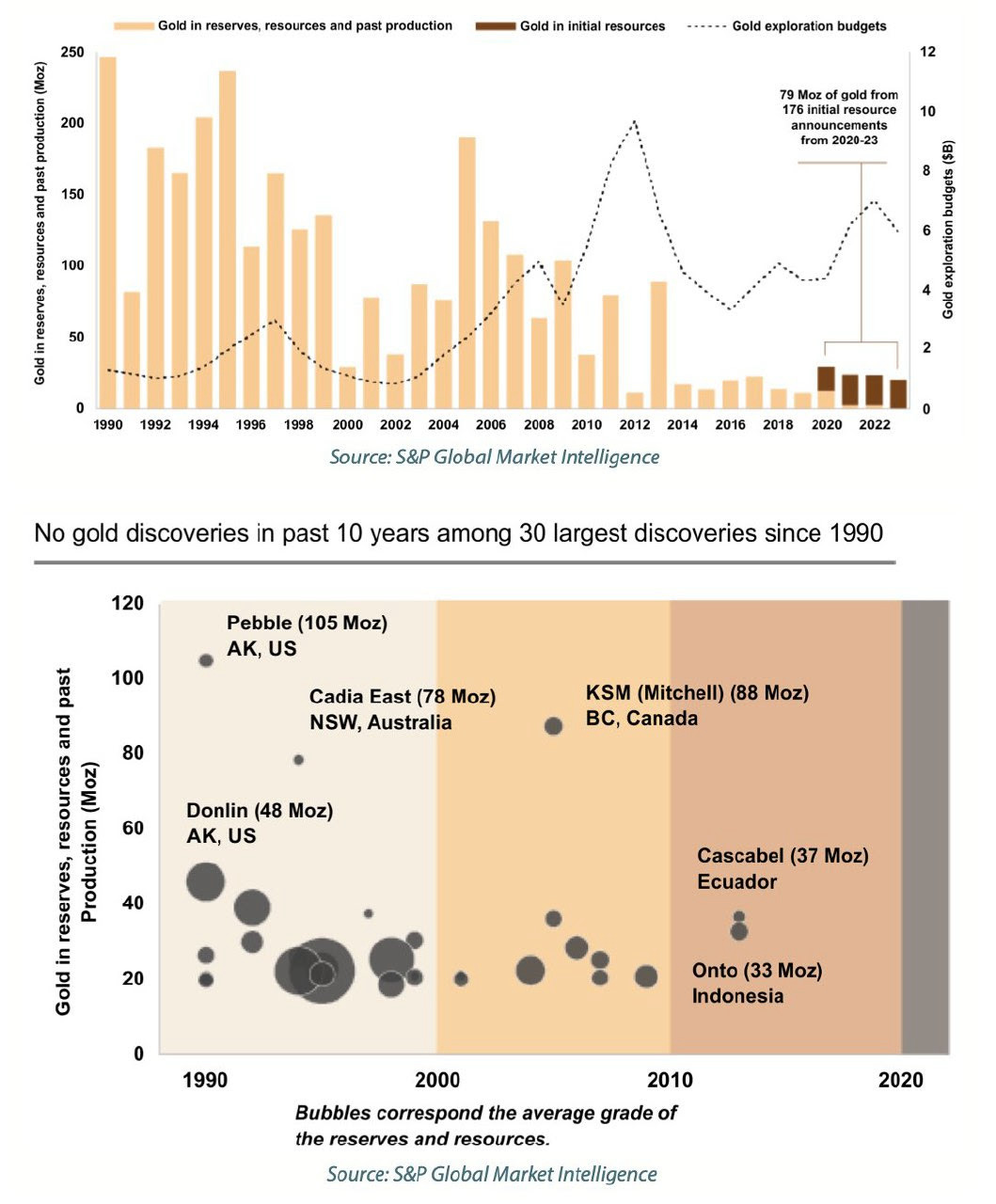

Supply dynamics also come into play: annual growth in gold reserves and resources has declined by approximately 90% since the 1990s, despite significant increases in exploration budgets during the same period.

As Ray Dalio aptly put it: "If you don’t own gold, you don’t understand how the economy works."

Now, our asymmetric portfolio in detail