Gold Hits Record High!

Eurozone Inflation Plummets

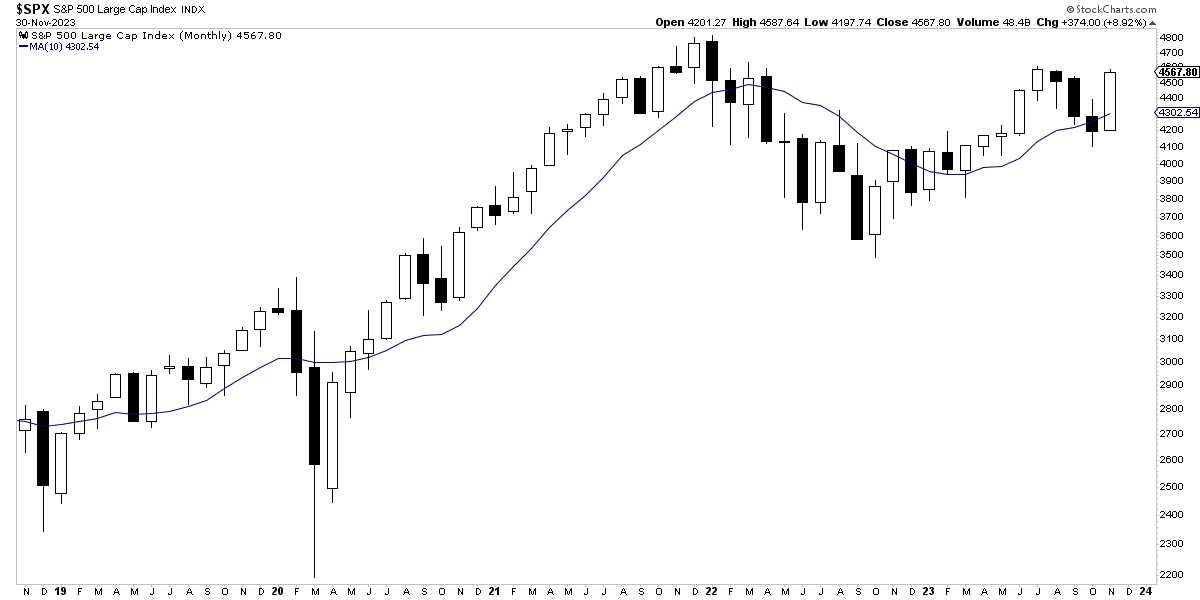

In November, financial markets experienced a remarkable period, marked by a significant upswing. We highlight the advance of the S&P 500, which rose by 8.92%, reversing three consecutive months of decline. This upward trend was not limited to the United States but was also observed in Europe, exemplified by the DAX's growth of 9.49%.

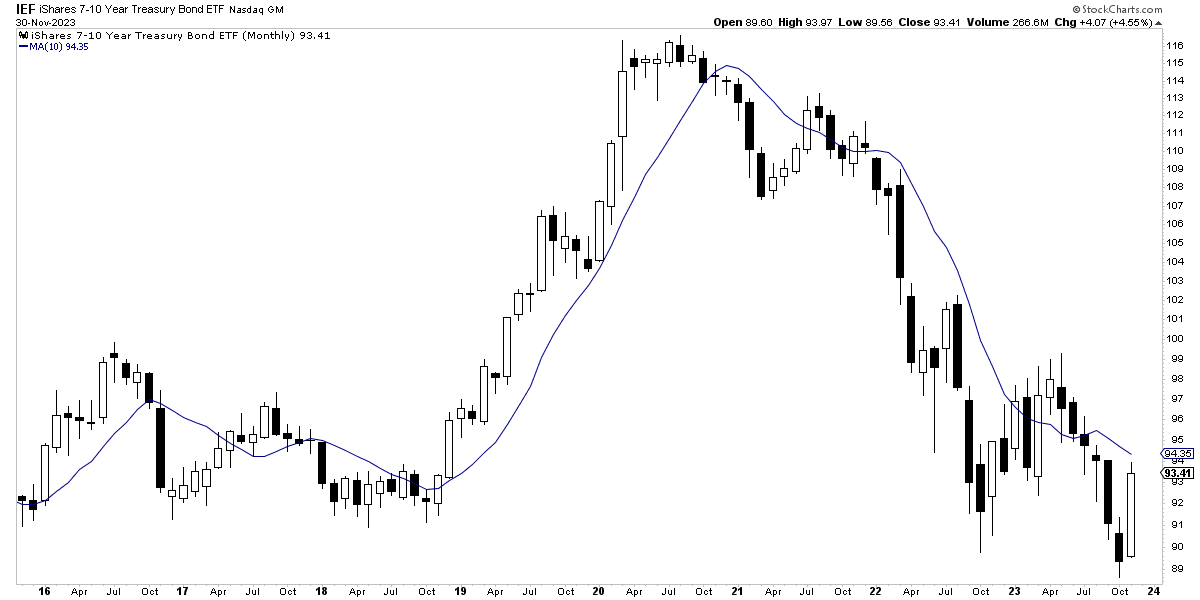

The impressive performance of the S&P 500 in November has been a historical milestone. This rise is largely attributed to the outstanding performance of sovereign fixed income, specifically the "IEF" ETF, which recorded its best month since August 2011. This advance is particularly noteworthy as it followed six months of decline in a context of market unrest.

The U.S. sovereign fixed-income ETF, which includes bonds with maturities between 7 and 10 years, also showed significant growth. It's important to recognize that interest rates, essentially the cost of money, play a crucial role in market dynamics, explaining the notable movements observed in November.

Over the past year, I have analyzed how a decrease in interest rates could fuel a bull market, a trend that began in October 2022. Although I initially anticipated that this reduction would result from a decrease in employment, the truth is that the decline in long-term interest rates was due to a perception of inflation control, with the market anticipating rate cuts in 2024.

Recently, inflation data in the eurozone have shown a significant decrease, even in underlying inflation. This phenomenon has had a positive impact on various assets, including stocks, bonds, and especially gold, which achieved its highest monthly closing in history, with an increase of 3.15% in November.

Recently, inflation data in the Eurozone have shown a significant decrease, even in core inflation. This phenomenon has had a positive impact on various assets, including stocks, bonds, and especially gold, which reached its highest monthly close in history, with a 3.15% increase in November.

In the context of investment, I have emphasized that diversification is not limited to including various sectors in a portfolio, but also involves owning different types of assets. Gold, for example, has proven to be a valuable component in any portfolio since 1970. In the current economic environment, cash flows from central banks are a key factor in increasing the value of assets, beyond traditional cash flows.

As a reduction in interest rates for 2024 is anticipated, while long-term estimated inflation remains stable, we see a favorable trend for investors.

Gold, in particular, has shown outstanding performance, as reflected in its price on monthly charts.

In addition to advances in traditional assets, November has been a month of widespread progress in the market, extending beyond the "magnificent 7" (large companies like Apple, Google, or Nvidia) to a broader spectrum of values. This reflects a more accurate evolution of the economy and is a positive indicator of a sustainable bull market.

The Russell 2000 index, which includes small-cap companies in the U.S., has also shown significant growth of 9.20%, starting from key support levels from 2022 and 2023.

As we approach 2024, it's crucial to be well-positioned in the market, considering factors like interest rate drops, halving, fixed income at lows, and gold at highs. From our analysis, we will continue to focus on maintaining a diversified portfolio with extremely low risk, keeping a significant percentage in cash (30-60%).