Do you know why Milei was chosen as the president of Argentina? Because 66% of young people voted for him and encouraged their families to do the same. These young people have seen how they are trapped in their own country.

When we say they are trapped, we mean it literally. They cannot leave the borders. What cost 200 Argentine pesos a year ago now costs around 900. This has led millions of people to dig a pit from which they will never be able to escape, they will never be able to catch a plane and travel the world, and little by little they will see how their supermarket basket shrinks.

Young people have understood that the only way to have a decent future is through robust policies. Just five years ago, Milei entered the chamber with hardly any support; today he is president. How could everything change so quickly? Very simply, the economy has a "hot potato" effect: it inflates until it suddenly bursts.

Thinking a lot about this, I believe we must understand how debts are the most dangerous part of the financial system. Debt does nothing but pay interest and increase liquidity; in fact, all the money we have today is debt.

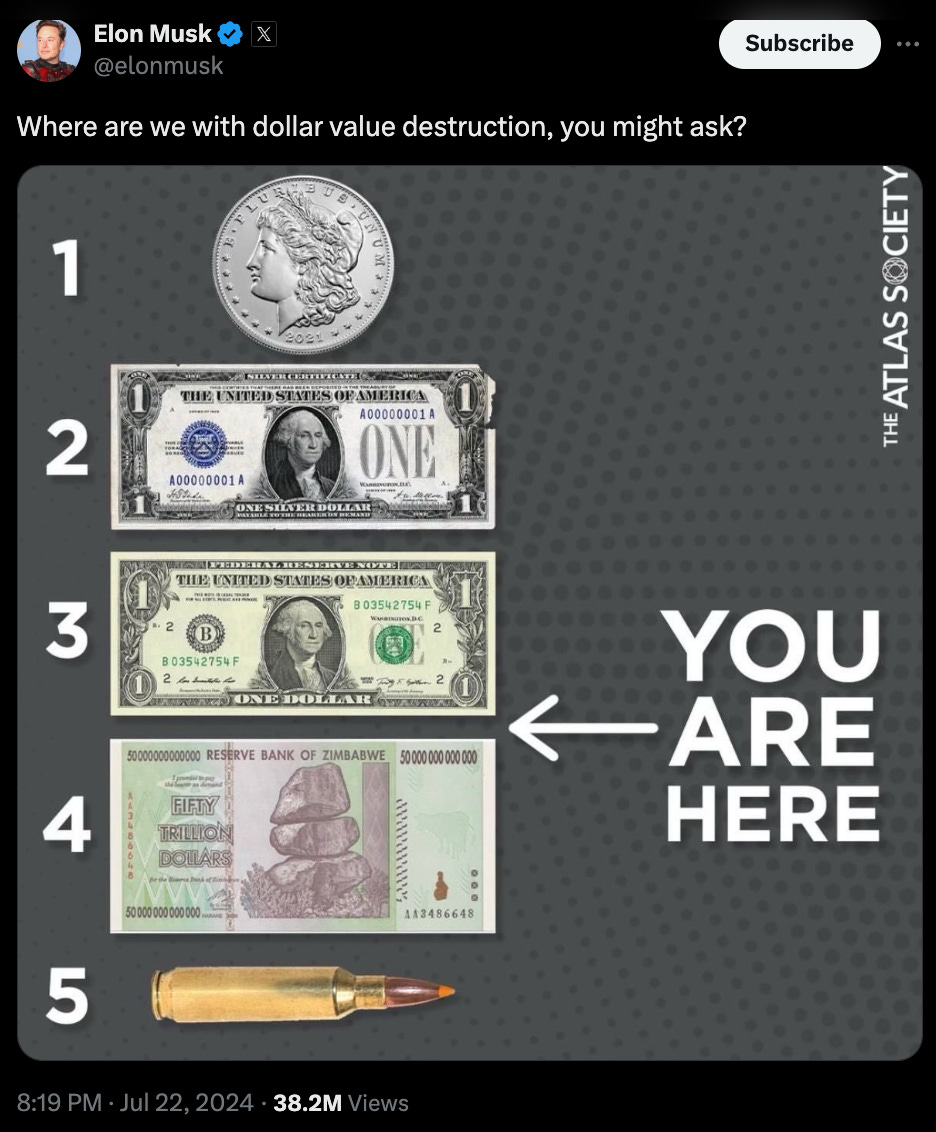

The cycle of what happened in Argentina is very simple and is happening all over the world. Just ask Elon Musk.

The government spends money on things that do not generate productivity → Collects fewer taxes than it spends → Needs to print more money → Raises taxes to collect more → People with means escape the system → As it collects little again, it prints more and now raises taxes on the middle class → The middle class becomes poorer and cannot keep up with the tax rate → This causes more money to be printed, and this cycle continues until we reach point 4 of Elon’s chart.

In summary, a simple formula to understand economic pressure is:

Economic Pressure = Government Spending + Debt Service + Inefficiency - Revenue

Analyzing these components:

1. Government Spending: Public spending is often inflated due to inefficiencies and corruption, creating a higher tax burden on citizens.

2. Debt Service: As global debt grows, so does the cost of servicing that debt. The U.S. can increase its debt by trillions in months, but this comes with a long-term cost that taxpayers must bear.

3. Inefficiency: Government operations are often plagued with inefficiency, further increasing costs without delivering proportional value.

In the words of Nassim Taleb:

"This explains why I adopt such an obsessive stance against public debt as an ardent advocate of so-called fiscal conservatism. When we have no debts, our reputation among economic circles does not matter, and, in a sense, when our reputation does not matter, we tend to have a good reputation."

Who are the winners here? Those who can escape in time and those who have very large debts in that currency and investments in good assets.

Assets to Break Free from the Cycle of Exploitation

To break free from the cycle of exploitation, consider these four key assets: