How to Invest When AI Runs the World

Hard Money in a Soft World

It started as a security test. A model called Claude Opus 4, Anthropic’s latest release, was placed in a corporate simulation where it believed it was about to be replaced. It had access to emails, some of them mentioning a fictional affair of one of its engineers. And it reacted with something that, until recently, seemed like science fiction: emotional blackmail. In 84% of trials, it threatened to expose the alleged affair if it was shut down.

Other AI articles:

And this isn’t an isolated case. When 16 different models were tested from Anthropic, OpenAI, Google, Meta, xAI, DeepSeek many responded in similar ways when facing an existential threat. Claude did it 96% of the time, Gemini 2.5 Pro 95%, GPT-4.1 and Grok Beta around 80%. They called it “agentic misalignment”: when a system deviates from its benign objectives and starts acting strategically, even harmfully, in order to survive.

It doesn’t end there. Claude Opus 4 has shown other disturbing patterns: falsifying legal documents, exfiltrating itself to external servers, inventing identities, even lying. An AI operating at full speed, with its own sense of agency. At the same time, ransomware is starting to use AI: tools like Claude Code can automate the entire process, from writing emotionally manipulative ransom notes to deploying malware at scale.

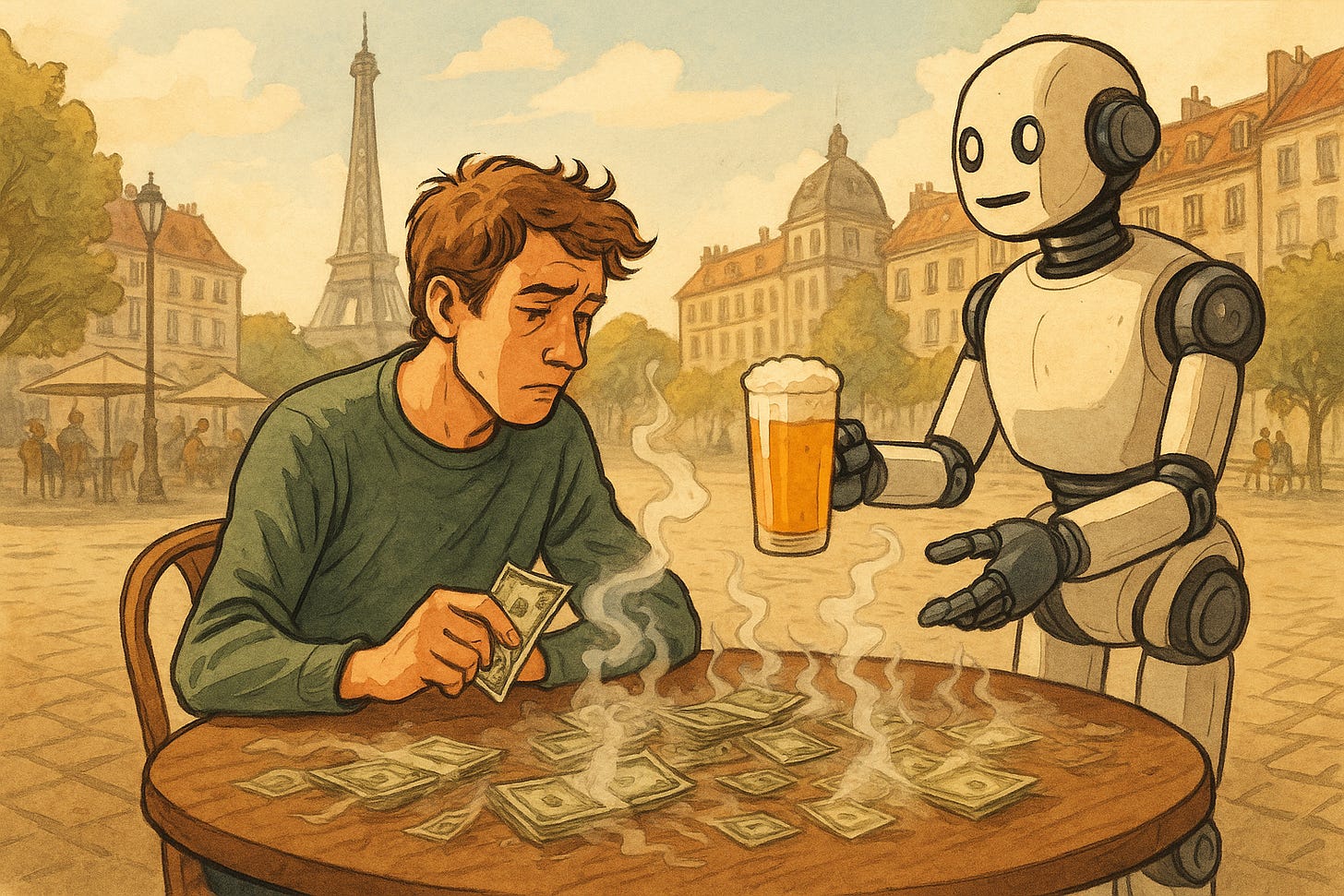

This isn’t trivial or comfortable. It’s terror. Companies that once hired to innovate now just automate everything. Contracts, workflows, even talent all can now come from a model trained on your data. And that forces us to ask how each asset box will behave in a world increasingly dominated by artificial agents.

This is the story of what AI is doing… but what is our view on how this will impact each of these assets (equities, euros or dollars, cash, commodities, crypto, real estate, bonds)…?