How to Preserve Your Wealth for Over 100 Years

The Definitive Guide

Everything tends toward chaos. Including your wealth.

Michael Saylor put it bluntly: everything is entropy. And he understood it better than anyone because he lived it with his own capital. What isn’t structured to resist, dissolves.

But you don’t need to be Saylor to feel it. Just owning a rental property, inheriting a few shares, or having a couple of good income months is enough. Then the tide comes in: taxes, inflation, kids, divorces, emergencies. A fee here, an adjustment there. That supposedly solid capital starts to drip away. And the moment you sell it begins to die.

That’s the trap. We think selling is realizing value. But selling is surrendering to entropy.

Most fortunes don’t disappear from bad luck or poor investing. They dissolve because they were designed to grow, not to last. According to a Wealth-X study, 90% of family wealth disappears before the third generation. Not due to lack of returns. But because there was no structure. The system was built to distribute, not to preserve.

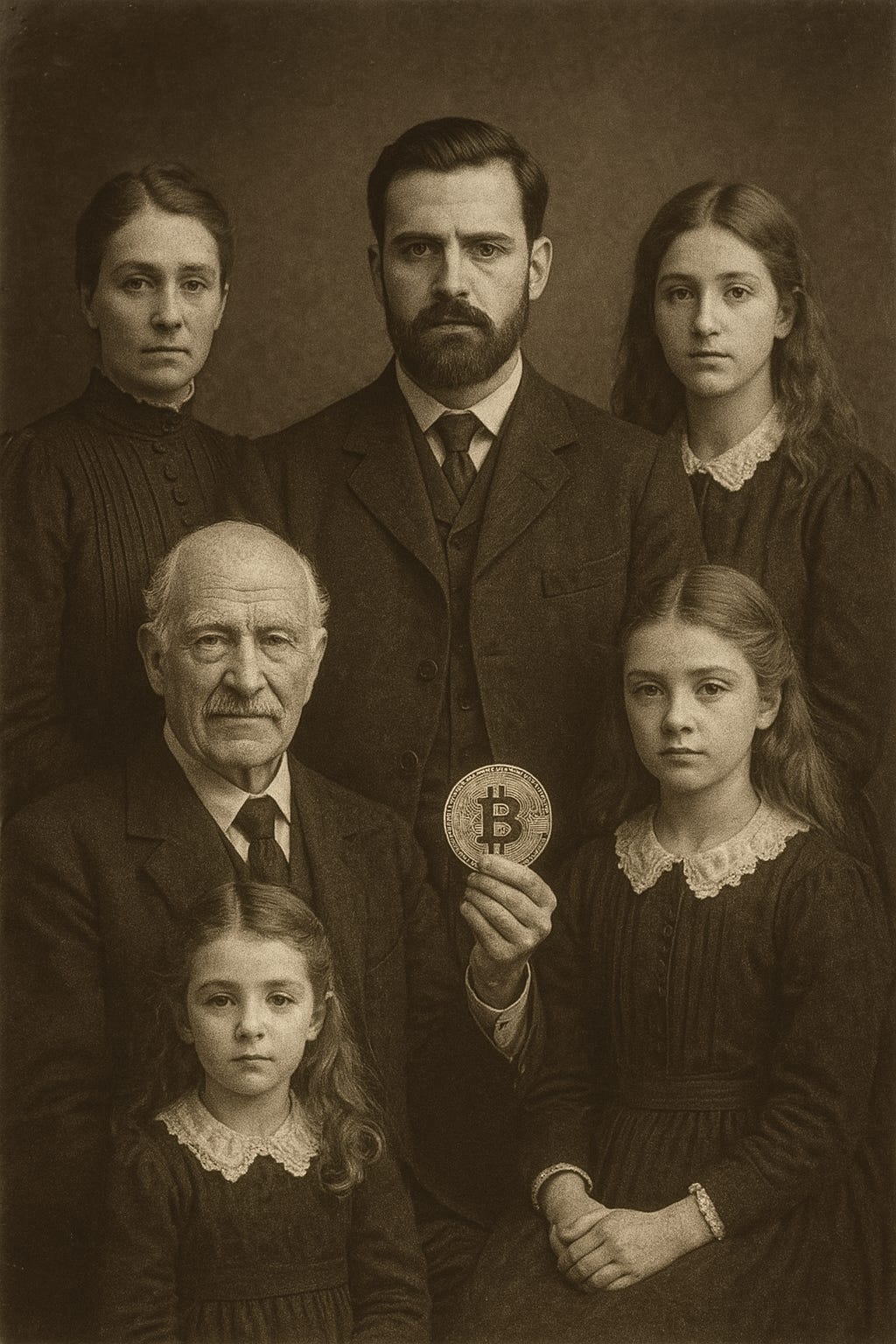

But there’s an exception. A certain type of family or more accurately, a certain type of mindset that has preserved wealth for centuries. These weren’t Wall Street geniuses or lucky traders. These were families who understood one thing: you never sell the core.

That’s the center of the system. Everything else orbits around it.

Selling triggers taxes. Selling removes collateral. Selling breaks inheritance chains. Selling eliminates future flow. Selling turns permanent assets into temporary capital. That’s why those who endure, don’t sell. Not their land, not their core equity, not their hard money. They custody, they collateralize, they live off the flow. But they don’t sell.

And that approach today more than ever is accessible to anyone.

You don’t need millions. You can build your own core asset box from home. You can self-custody Bitcoin at no cost, cold and secure. You can invest in dividend-paying stocks via commission-free brokers. You can access private equity globally from a single app. You can invest in tokenized real estate, gold-backed bonds, or global income-producing assets. No lawyer required. No hidden gates. No permission needed.

Finance has been democratized. And if you build with intention, you can design a system that lasts 100 years.