How to Protect Your Wealth When Money Loses 8 Percent a Year

The Simple Math That Will Destroy Cash Holders

If you have spent more than five minutes reading about finance this year, you already know what I am going to tell you. The game has changed.

But not because a random newsletter writer says so. The numbers do.

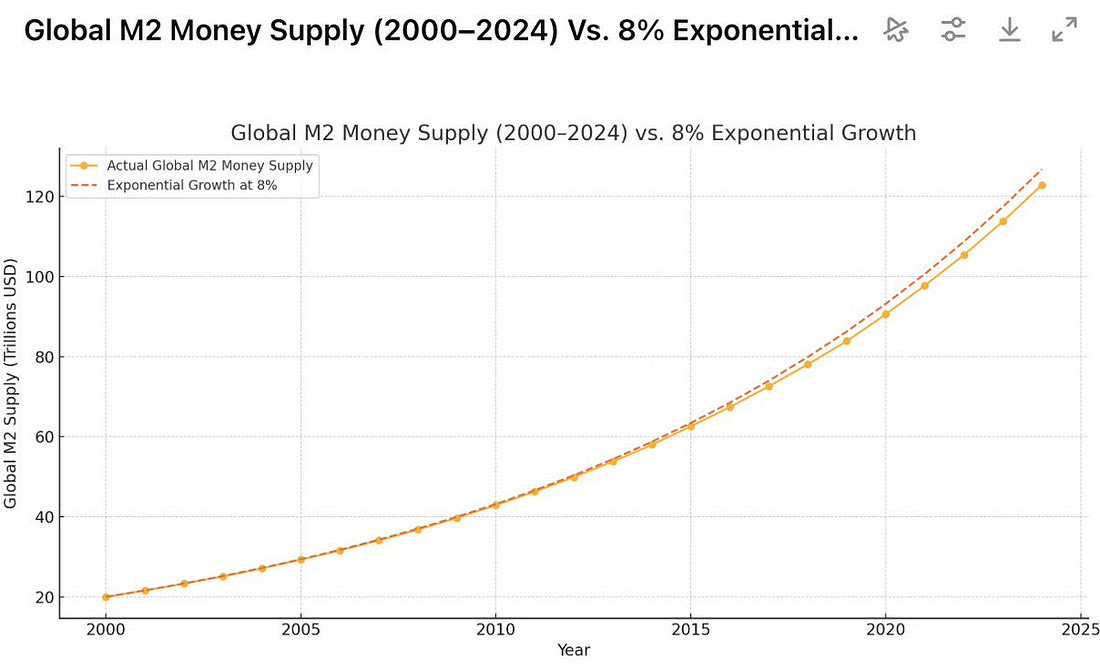

Since 2000, global money supply (M2) has grown, at an 8% annual rate. Not magic, just monetary policy.

The problem is, debt has too.

US national debt has grown, coincidentally, also at 8% per year.

See where I am going?

We are running on a treadmill that never stops. If your wealth does not grow at least at the same rate as money supply and debt, you are getting poorer. No matter what your neighbor says.

Now, what about assets?

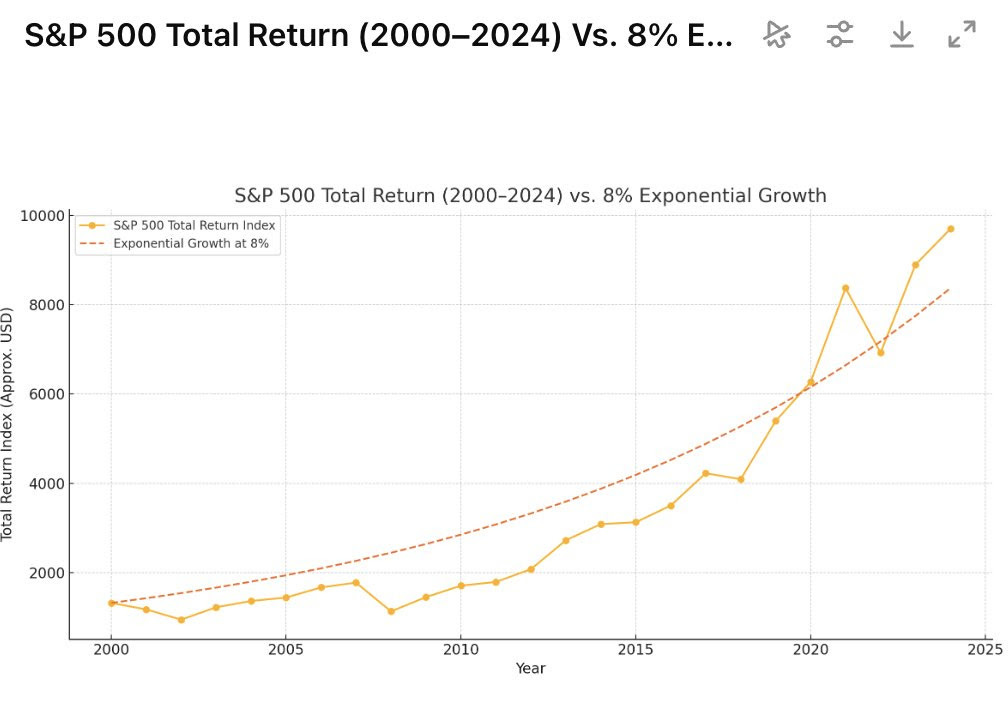

The S&P 500, including dividends, has also delivered roughly 8% annually.

Of course, with volatility, taxes, and fees. After taxes, many investors end up with around 6% net.

And housing?

Worse. Total return from appreciation + rent has been about 6.5%, not counting property taxes, maintenance, and other headaches. Translation: not good enough.

So what is left for the average investor?

First, to understand that our greatest ally is time. The magic of compounding only works if you stay invested and avoid catastrophic errors.

But time alone is not enough.

You must buy assets. And not just any assets, but those with certain characteristics:

Limited or hard-to-expand supply (hard assets).

Low correlation to the rest of the system (some may fall, others may hold or rise).

Ability to generate real cashflow (dividends, rental income, sustainable yield).

Why? Because investing is not a game of certainty. It is a game of probabilities.

Putting everything in the S&P 500 and assuming the future will repeat the past is naive, especially if you're dollar cost averaging blindly. If you happen to live through a Great Depression or a secular bear market, you may be trapped with no real returns for 40 years. It has happened before, it will happen again.

That is why portfolio architecture is key. You must diversify into uncorrelated assets, and always favor those with a hard component, not manipulable, not easily inflated.

Fiat money is nothing. It is just a medium of exchange that loses value through policy. If your portfolio is heavy on cash, you are sitting on a bucket full of holes.

Let me show you a simple example. One that should be taught in every school.

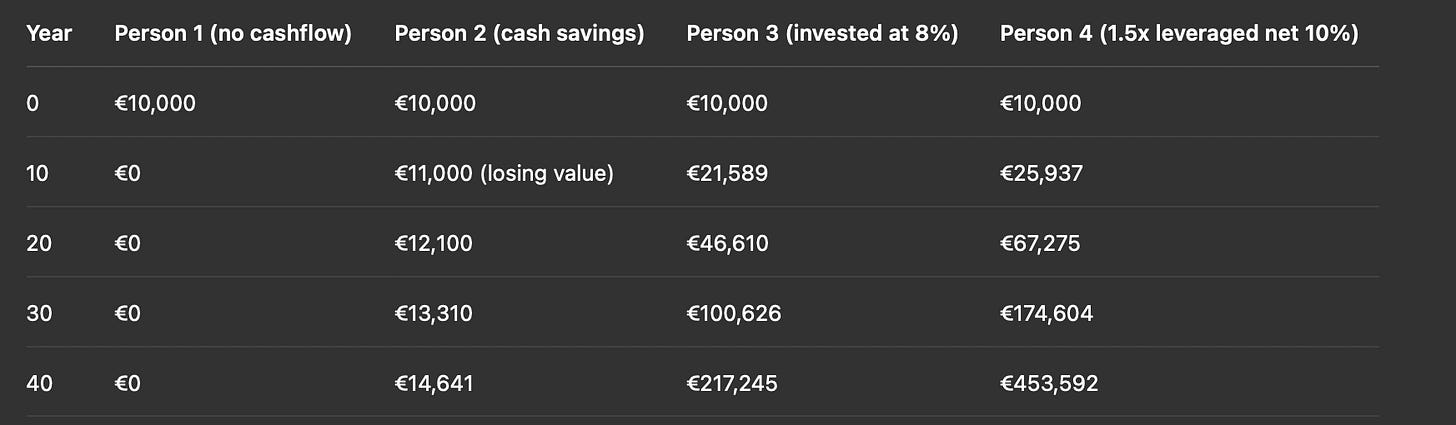

Imagine four people, all starting with €10,000.

Person 1: spends everything, lives paycheck to paycheck.

Person 2: saves 10%, but keeps it in cash.

Person 3: saves 10% and invests, earning 8% annual return.

Person 4: saves 10%, invests at 8%, and uses 1.5x conservative leverage (with 4% debt cost). This is how to use debt strategically.

Now, let’s see what happens over 40 years:

Now add the cashflow.

If Person 4 holds a portfolio yielding 5% net, by year 40 they would be generating more than €22,000 per year in passive income.

Person 3 would be generating about €10,800 per year.

Person 2 would remain poor, with eroded capital.

Person 1 would still be running on the treadmill.

The takeaway is brutal:

Time is your ally, but only if you buy assets.

Fiat is just a medium, not a store of value.

Investing is a game of probabilities. You must avoid concentration risk, even in the S&P 500.

Hard, uncorrelated assets protect you from extreme events.

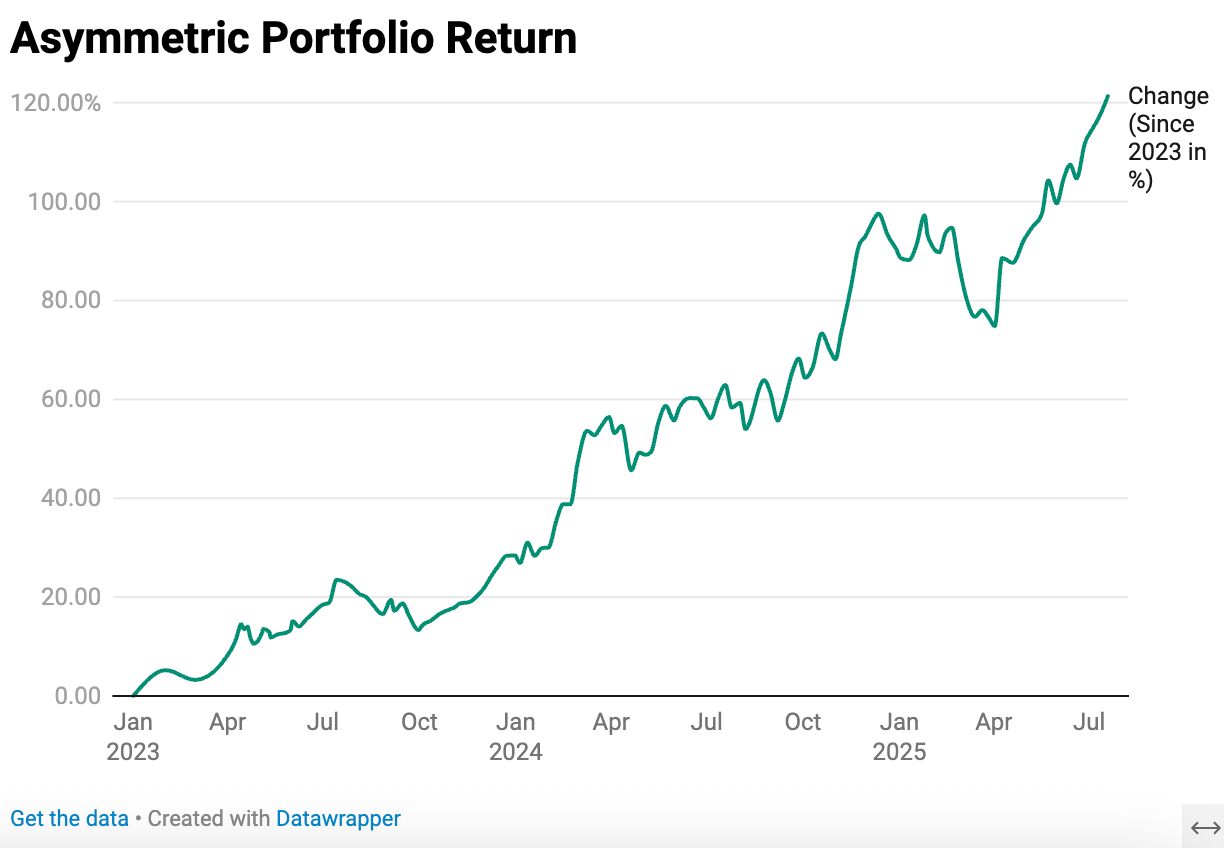

The rats in this game have changed. Those who do not adapt, will be devoured.Now the Asymmetric Portfolio in detail…

ATH 🚀