How to Turn Debt Into Your Greatest Asset

The World We’ve Been Given to Dance In

You can be a herbivore, a Democrat, a liberal, a Republican, or whatever you like. However, there are certain rules of the game that we must follow. If you’re a basketball fan, you know that if you commit five fouls, you're out of the game, whether you like it or not.

Why do I mention this? Because I’ve been receiving emails from subscribers asking me about other types of investments, such as bonds, real estate, and so on.

I have nothing against these alternatives. In fact, as I’ve always said, they make a lot of sense for certain types of investors. When it comes to Real Estate, it's easy to see how you can receive monthly income through rents. However, from a broader economic perspective, it doesn’t always make sense, especially since in most countries, you're required to pay taxes.

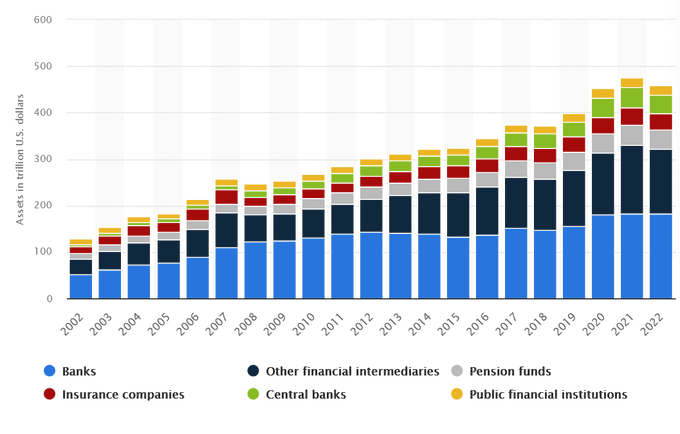

So, what are the rules of the game in our current economy? It's very simple, and it can be summed up in one word: LIQUIDITY.

Liquidity is the force that drives everything.

I know many might think that in a world where technology is deflationary (a computer 50 years ago cost more than a current MacBook with far less power), we should be able to adapt the economy to this deflation.

But the reality is that we are compelled to generate more liquidity/capital than needed to ensure that assets continue to increase in value, which in turn lubricates the next cycle of economic growth and limits debt defaults.

Obviously, this injection of liquidity has a series of negative implications. The most obvious, and one we’ve discussed many times, is that it tends to create a gap between those who own assets and those who don’t.

Liquidity generates two effects: one visible and one that isn’t. The visible effect is the rise in the prices of goods. Call it inflation, an increase in the CPI, or whatever you like. Basically, this means that avocados, for example, cost more.

However, there’s an invisible implication that few understand: the loss of value of the currency (or money debasement). This means that our money is worth less over time.

To put it in perspective, if the CPI historically tends to be between 2-3% annually, currency devaluation could be around 7-10% annually.

If we add both factors together, we need to achieve at least a 10% annual return just to maintain our purchasing power.

But who wins?