Inflation Alert: Signs of Economic Shift

Navigating the New Inflationary Cycle

Don't say I didn't warn you. This week, the inflation data was released, and it presented a somewhat concerning figure.

In the US, the general inflation rate was 0.4% instead of the 0.3% expected by the consensus of economists, with the annual inflation rate finally being 3.5% instead of the expected 3.4%.

You know, inflation almost always advances, so the question is whether it does so at a faster or slower pace, and today's data was bad because it's rising at a faster pace than anticipated.

As I have been explaining since 2022, the economic cycle since the pandemic is not like those seen since 2008 or even earlier, where inflation was almost nonexistent and the only concern for the market and the Fed was whether there was growth or not (what I call disinflationary cycles). And that since the pandemic, we had to understand the cycle differently since we had entered an inflationary cycle, where, of course, whether or not there is growth is important, but it is equally important whether prices accelerate too much or not.

The best example we have of this is what happened in the 70s.

Let's go back to the early 70s, where high inflation led to double-digit interest rates. This was a huge loss of purchasing power, where the best investments were in housing and gold. When everything seemed to be under control, a worse wave of inflation hit the markets again, and as you know, inflation and markets are not good friends.

Look at what happened.

Well, given that we are still in an inflationary cycle (and remember that annual inflation has not dropped for 9 months), such a rebound in inflation would be a very negative factor for the stock market.

The argument is simple: if inflation rebounds, the Fed will no longer be able to cut rates and would even have to raise them, which would ultimately lead to an economic recession because such high interest rates would be too restrictive for the economy as a whole. And in an environment of inflation and negative growth, a major bear market could occur, as both are the main factors that feed such markets.

And if the Fed takes these actions, what will happen is that everything will fall, no matter whether you analyze Apple's balance sheet, Microsoft's, or whatever you want, everything will fall. Hence, it is so important to make a top-down or macroeconomic analysis.

In this way, the market is very sensitive to any idea that inflation is going to accelerate and break above the 9 months it has been consolidating. Looking closely at the data released today, I have to be honest and say that I am worried because the data are not positive.

Why am I worried? First, because the annual inflation has stagnated and has begun to exceed its own 10-month average, a sign that alerts to a potential change in inflationary trend.

Second, because less volatile inflation, known in English as sticky inflation, which is an index of those prices that are not so volatile because they incorporate to a greater extent future expectations about inflation, that is, they are not so influenced by current fluctuations, is not only not improving but worsening.

Even if we take a moment to observe their monthly variations, we see that the month-to-month variation for March (the data known today) is the second worst since September 2022. It's a measure that is well above the pre-pandemic range. In fact, it's in the range of the relatively high inflation period of 2021-22. That is to say, it does not seem that inflation is very controlled according to this data.

Of course, the market can do whatever it wants, and in the short term, it's untamable, but I can't think of a better excuse to enter some type of correction than the inflation data observed today.

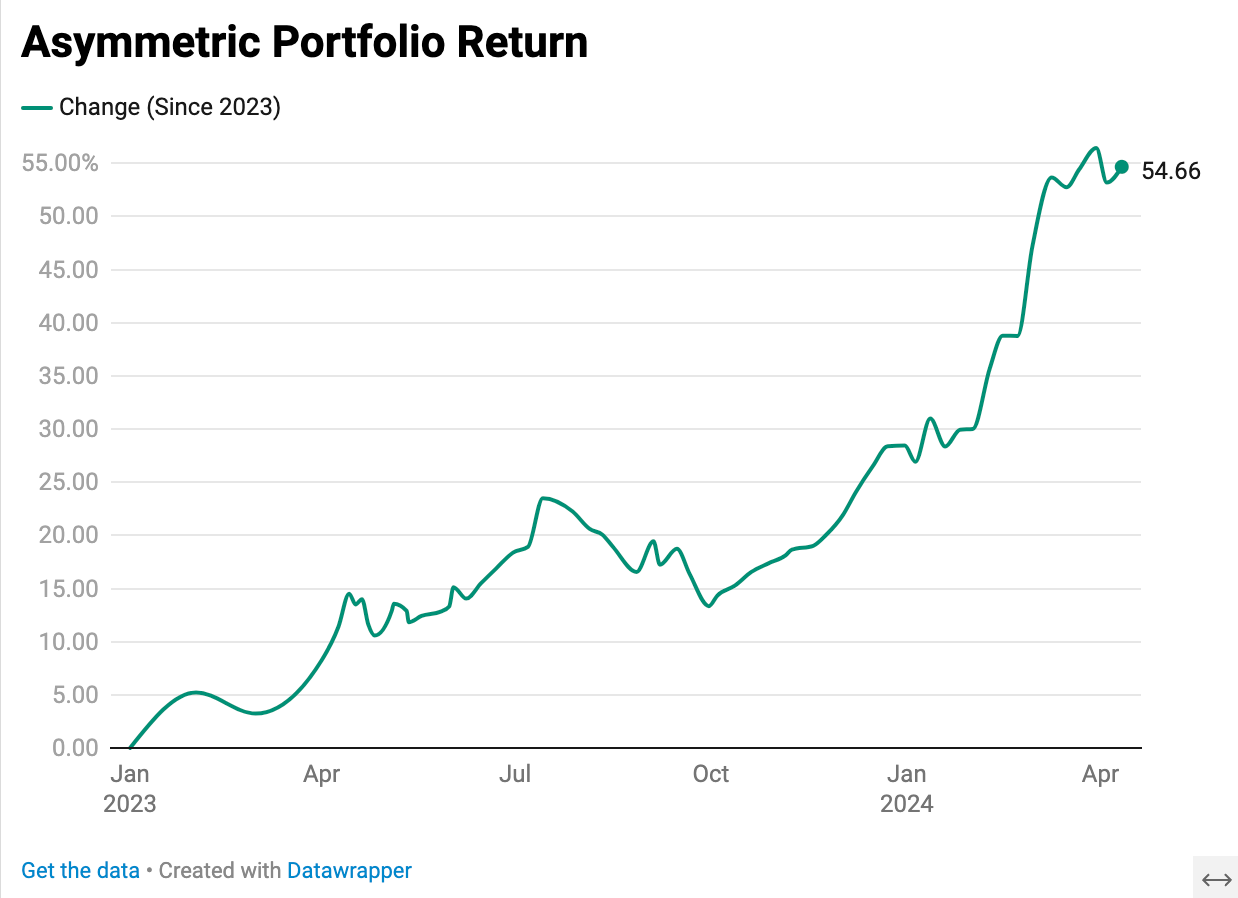

Meanwhile, our portfolio remains very close to historic highs.