A Little Break In The Markets Before The Final Crash

Consumer confidence at 40-year lows

There seems to be a totally aligned sentiment that we are going into recession. I see many people resigned to the fact that this is going to happen, and it is impossible to avoid it. In fact, we have been getting emails about this for a few months now:

How much could the markets pull back?

Don't you consider reducing exposure in position X and then buy cheaper?

Etc.

As if that were not enough, the major newspapers and economic magazines worldwide have been continuously announcing this catastrophe. The latest to join in has been Goldman Sachs, which has said that the markets are about to retreat an additional 20%.

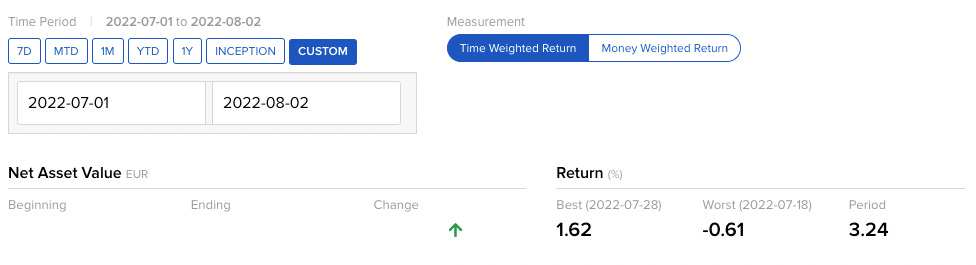

However, what we have seen during the month of July is the best month for the S&P500 since 1938, and surely all those who send us the above questions have not taken advantage of it. Since July, we have grown our portfolio in that period by 3.24%.

This increase is below what the markets have done. However, our YTD is -2.54% versus -20.75% for the Nasdaq.

Most investors are going to lose money

The average investor is really fu***d. Pardon the expression, but that's the way it is. The human being has a psychological bias that does not allow him to invest or at least limits him to situations totally contrary to what he wants to happen in his portfolio.

This is going to make the vast majority of investors decide to do absolutely nothing (or sell their entire portfolio), that this appetite for investment will decrease and return once the indices are very close to their highs.

Why do we know this will happen? The University of Michigan Consumer Sentiment Index, which measures consumer confidence in economic activity, is at a 40-year low.

As if that were not enough, we should add that average wages increased by 5.11% in the 12 months to June. This figure is much lower than the increase in prices during that period (9.1%).

In addition, 35% of U.S. households are having trouble paying their bills. You can tell they don't read Asymmetric Finance...