Lower Inflation: Good or Bad?

Inflation's Unexpected Turn: Unveiling the Impact on Global Markets

This week, we had the chance to analyze the U.S. inflation data. As always, this figure is extremely important as it was expected to move the market. As you know, investors are more influenced by the decisions of central banks than by the value that the stocks themselves could bring to the market.

After months of correction in the markets - since July in the United States and flat in Europe since February - at the beginning of this month, elements began to emerge suggesting that the bull market, at last, seems to have enough momentum to launch a second bullish phase.

Later, we will discuss how we have adjusted our portfolio in relation to these data.

And for all these reasons, last Tuesday, November 14th, was an important day in this respect, thanks to the better-than-expected inflation data. While general inflation was expected to rise by 0.1%, the surprise came with a null change from September to October (0%), leaving the year-over-year inflation at 3.2%, a tenth less than estimated and down from 3.7% the previous month.

This lower figure was entirely expected. We warned more than half a year ago that inflation had peaked and we would see it decline over the next year to year and a half.

Friendly reminder. If you want to see the real U.S. inflation data, don't go to FRED, go to Trueflation.

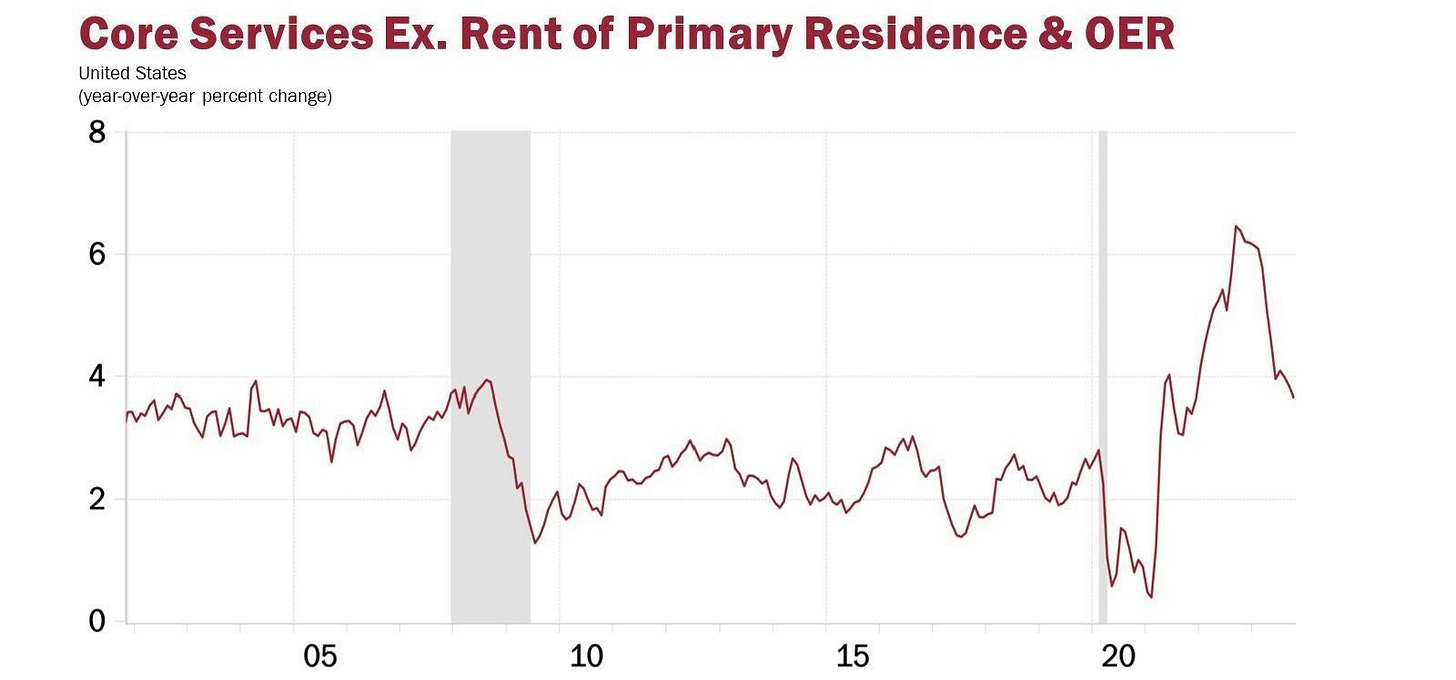

However, the brutal reaction of the markets was mainly due to the fact that core inflation also surprised on the downside, especially the core inflation excluding real estate, a metric closely followed by both the FED and the market, as real estate inflation is a lagging metric.

Core inflation excluding real estate surprised on the downside and continues to decline.

As we have been doing for quarters, let's observe the evolution of inflation with the same metrics we use month after month to get a coherent view of it over time.

Thus, the general inflation - not core as the previous one - excluding real estate data remained at 1.5% year-over-year, a level that, as we can see in the following graph, is within the normal range observed before the inflationary crisis born in 2021 due to monetary and fiscal aids used to tackle the economic effects of the pandemic.

It has also been my continuous suggestion to observe this same data according to its intermonthly variations, to try to understand if the readings we are observing are within the normal range with respect to recent history. That is, to understand if inflation is accelerating or not, beyond the year-over-year readings.

And with a sweet drop of -0.10% in October compared to September of this year, indeed we can say that inflation is behaving within the historical range and, therefore, is evolving without a significant acceleration of prices as we saw during the inflationary anomaly of 2021-22.

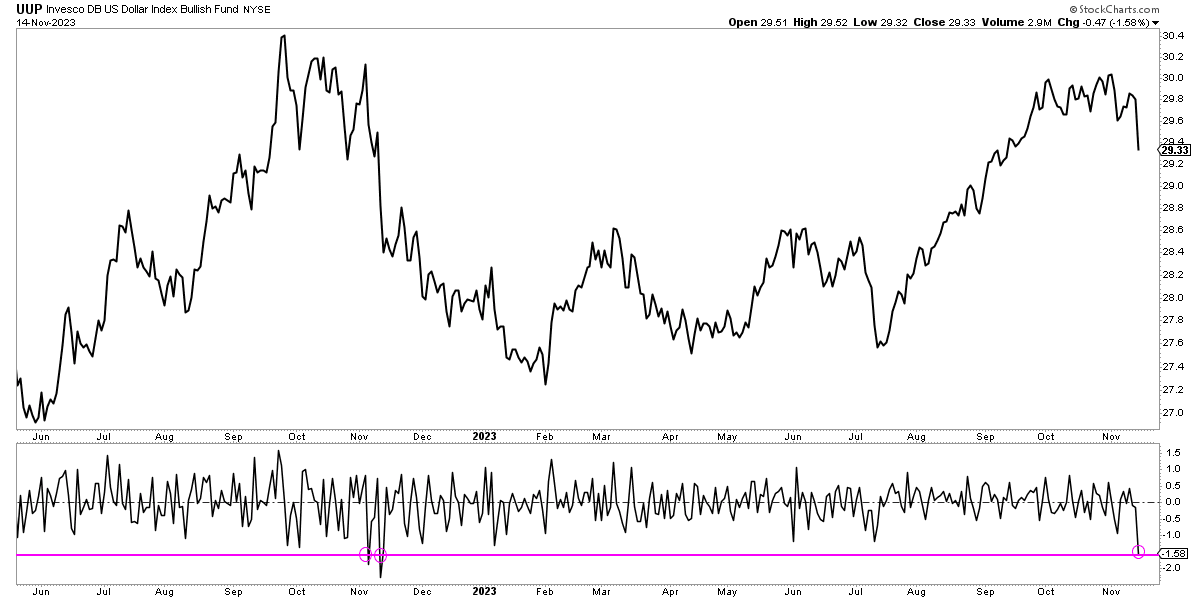

The most important movement was that of the U.S. dollar, whose dollar index declined a strong -1.58%, a large magnitude not seen in a single day since November 2022, when the bull market that began in October 2022 was emerging.

This was the most important movement of yesterday because the dollar's decline, thanks to the expectation that the FED will not raise rates or will even cut them, is typical of "risk on" or risk-taking phases.

If we look at what happened in November 2022 when the dollar was falling sharply, that coincided with the most bullish phase of the markets until February 2023, the date when the dollar started to rise again.

And if we look at a long-term chart of the dollar index, we see that when the dollar index declines, this usually coincides with the best phases of risk assets such as stocks or Bitcoin: 2017, 2020-21, or 2022-23.

Call me crazy, but we have been warning about this for a long time… You have already missed more than a 100% rise since we mentioned all this.

What is the most relevant thing about all this?

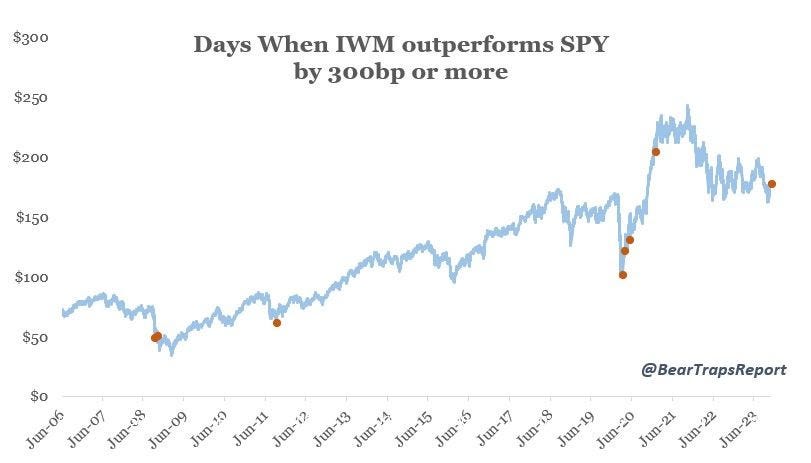

When in a single day the Russell 2000 rises more than 3% over what the S&P 500 itself rises, that is usually very significant, as it tends to occur at the beginning or near the beginning of bull markets.