Disclaimer: This article was written on Monday morning. We already anticipated the inflation data last week and in this article, we have done it again

Since mid-2021, we have warned you that a complicated time has been coming. We did not doubt that we would have great inflation in the markets, which would affect all kinds of sectors.

The main affected was going to be the average citizen. We were also right about the Fed's solution: raising rates and cutting monetary injection.

We do not consider ourselves geniuses either, but it seemed obvious what would happen after artificially flooding the markets with liquidity.

On the other hand, we warned that interest rates were artificially low, and it was the ideal time to buy a house with a fixed-rate mortgage.

Perhaps the only thing we failed to do is that we thought the markets could fall more steeply. We thought that the Nasdaq could fall around 40%, but it has fallen up to 30%. The types of stocks that have been hit hard have been the high-risk stocks. These have lost more than 70% of their value in just one year.

What to expect for 2023.

Once inflation went through the roof and central banks started raising rates, this was all over the news. Add to this the Ukraine war and all the scandals in the crypto world.

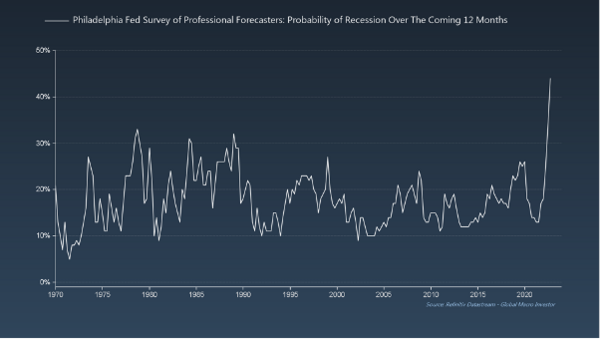

What has happened? All this has meant that we are looking at one of the most heralded recessions in history.

Everyone expects a recession soon. This confirms several things:

We live totally biased by the news.

We are like a flock of sheep.

We have already explained to you several times that markets always try to do as much harm as possible to as many people as possible. And what are people doing?

Protecting themselves with PUT options. It has been 20 years since we have seen this index at these levels.

As always, opportunities are there for the taking. There will be many people who didn't take advantage of the 2020 liquidity injections. Others who did not take advantage of the incredibly low rates of 2021. Others who will not take advantage of these multiples.