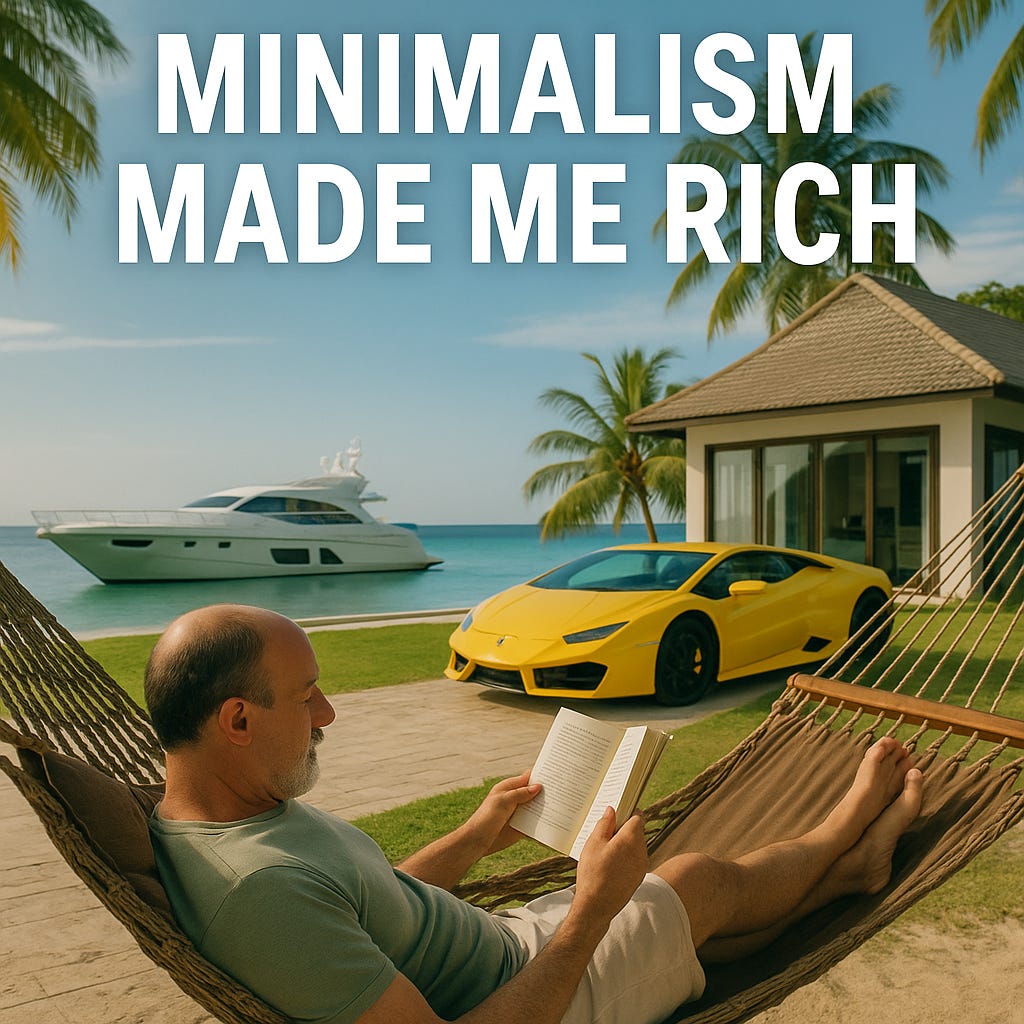

Minimalism Made Me Rich

Renting Everything Was My Best Investment

More than four years ago, I started down this path.

It all began with a quote I read in a book. I don’t remember if it was James Clear or someone else, but it basically said:

“If you really want to learn something, teach it.”

That’s exactly what I’ve been doing ever since.

Over 400 articles.

Every week.

Once or twice per week.

Without missing a single one.

This newsletter has been much more than a habit. It’s been a system.

A process that has taught me to become a better investor, to think more clearly, and to build real financial independence.

It has also, as cliché as it may sound, helped me work toward a better future for my children and the people I care about.

Because like it or not, money does help with happiness.

It may not be everything, but it solves a huge percentage of real problems.

In fact, many of the most serious family conflicts don’t start with ego—they start with financial stress.

Along the way, I’ve made mistakes. Plenty.

But I’ve learned even more.

And that’s what matters.

You can see it when I talk to friends who audit IBEX 35 companies or advise on billion-euro mergers, yet have no idea what a Ledger is, how a Trezor works, or why anyone would want to own Bitcoin.

If you ask me what the most important idea I’ve learned is, I honestly wouldn’t know what to say.

Because the real value hasn’t come from one single insight—it’s come from the process itself.

And from sharing it.

Sometimes you think, “I wish I had known this from the start.”

But over time, you realize you’ve gotten here precisely because you didn’t know at the beginning.

And that’s not something you can shortcut.

If there’s one idea I’d keep from this whole journey, it’s this:

Minimalism.

Minimalism in life.

Minimalism in investing.

Minimalism in how you build wealth.

The world pushes you toward the opposite.

Accumulate more, scale more, own more.

More assets, more complexity, more everything.

But the more I’ve learned, the clearer it’s become:

Freedom doesn’t come from having more.

It comes from needing less.

Let me give you some examples.

People often want two homes—a primary residence and a beach house.

But that comes with extra taxes, responsibilities, theft risks, maintenance headaches, and worst of all, it mentally anchors you to vacation in the same place every year.

Some tell me, “But I rent it out on Airbnb and only use it one month a year…”

And I respond:

What about tenant messages?

Property damage?

Parties, broken furniture, upset neighbors, license issues, key logistics?

It’s a prison disguised as an asset.

The same applies to cars, boats, jets.

Every new possession is a new responsibility.

Eventually, your things own you.

And it’s not just the upfront cost—it’s the negative cash flow that drains you slowly, and the fact that most of these things lose value every single year.

So what’s the alternative?

Renting.

People say renting is more expensive long term.

And they may be right.

But they often ignore the opportunity cost of immobilized capital.

They also forget the mental cost of managing what you own.

And that, to me, is more expensive than any monthly payment.

The same thing happens with portfolios.

Most people try to diversify so much that they end up diworsifying, as Peter Lynch said.

In reality, you only need three or four well-chosen ideas that make sense.

In fact, when subscribers ask us how to hedge against tail risk without complicated OTM options, our answer is always the same:

Keep your portfolio simple, diversified, and aligned with your time horizon.

That alone is your hedge.

So how do you build something like that?