My Biggest Investing Mistake

The Painful Truth About FOMO and Markets

Everything goes and everything comes back. And along the way, we all get distracted.

It’s not an empty phrase. It’s what happens when you’ve spent years knee-deep in the market. You see it in gold, in stocks, in Bitcoin. They go up, and you feel the FOMO. They go down, and people treat them like they never had any value. You forget about them just when they’re closest to giving you the joy you’ve been waiting for. That’s the game. Everything goes and everything comes back.

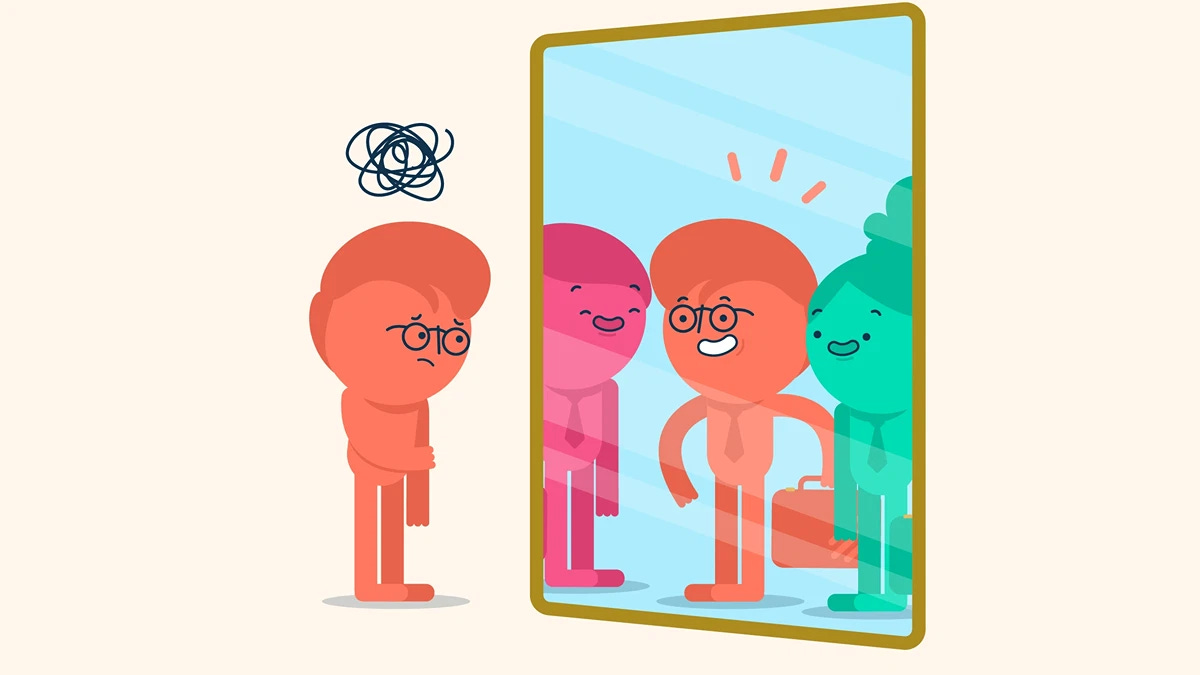

Today I want to confess my mistakes. Because there are plenty. And if something saved me, it was having a simple and diversified system. Not diversified in the traditional sense of owning 200 assets with no conviction. I mean diversification by role: cashflow, reserve, optionality. Assets that serve different purposes in different moments. That way of thinking has helped me stay intact.

But that doesn’t mean I haven’t fallen into traps. Quite the opposite, I’ve stepped on all of them. Buying more gold just as it surged…