When No Asset Is Shelter And A Crash Is Near

Loss of value of the federal reserve

Many of the emails you send us have the same question, "Why aren't any assets doing well during this recession?"

It isn't very comforting to see the panorama we have today. It is bleak. The only positive asset (together with commodities) is cash, but we must bear in mind that inflation in the US today is around 8-9%. Therefore, we could say that commodities are the only asset class making money.

An asset that, in general terms, has a direct negative impact on your daily life because they are products that you use to cover your basic needs: gas, electricity, etc.

Let's look at the history.

"History does not repeat itself, but it rhymes".

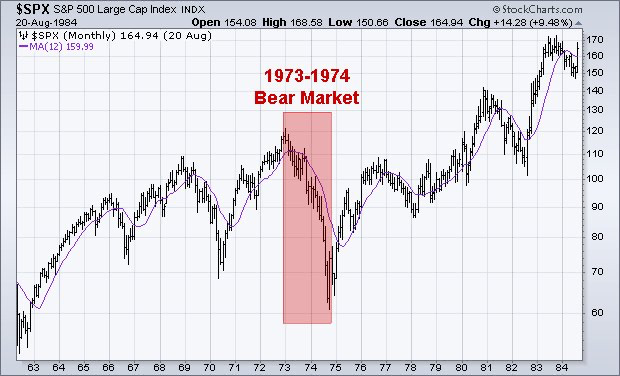

No two recessions are the same, as the triggers may have been different. However, this one meets conditions very similar to those of the recession that originated in 1973.

During that recession, the market dropped 50% of its value between 73-75.

Several reasons lead us to believe that we are very close to a crisis of this magnitude. The main reasons are:

Bubble everywhere

We have been warning since September last year that all stocks are trading at multiples infinitely above their historical average. Generally, this usually ends with major recessions.

When in this article we told you where Charlie Munger had his money, we said that it was surprising that Berkshire had most of his wealth in cash, and as you can see, they were not wrong as his portfolio has outperformed the S&P 500 since Covid.

Buffett and Munger have been in the industry for a long time and have been through similar crises. Many times we should be reflective and listen to them.

On the other hand, market prices have been abusive throughout this period. Covid was the trigger, and this may cause us to live through one of the worst recessions of all time.

During the Nifty Fifty era, many of the stocks that were leaders are still leaders today, as is the case of Coca-Cola, McDonald's, or Pfizer, but during those years, they saw the value of the company decrease by more than 50%.

As we have always said, indices are an excellent long-term alternative, but there are periods when we must assume these falls.

Today's leaders (Amazon, Apple, Microsoft, Google, etc.) will most likely still be leaders in 30 years. However, their share prices are still too high. Today, it was thought that nothing could interrupt the upward path of the best stocks. But, as is always the case in the markets, when only bullish projections are made, a slight change of wind is all it takes for the house of cards to collapse. Two months later, the Nasdaq 100 is trading down more than -20%.

Loss of value of the Federal Reserve

The 1973 bear market began early that year with initial declines in the heat of a Federal Reserve that had begun a series of rate hikes to curb high inflation (the highest in decades at the time) generated by several previous monetary and fiscal excesses, as well as the collapse of the Bretton Woods system, Vietnam War spending and Nixon's price and wage restraint (all of which were to no avail).

Today there is a strong parallel with what happened then. Only this time, the fiscal and monetary excess that has pushed inflation higher than seen in the last decades has been caused by the authorities' response to the pandemic, where states went into massive debt to finance the partial paralysis of economic life and where monetary authorities again lowered rates to 0 and bought massive amounts of assets to sustain markets and economies.