One Indicator That Has Not Failed in 100 Years

Marty Zweig Breadth Thrust

I was thrilled to witness a rare Marty Zweig Breadth Thrust (ZBT) trigger yesterday. For those unfamiliar with this technical indicator, the ZBT is a powerful signal that suggests a significant shift in market momentum. It occurs when both the NYSE Advance/Decline Ratio and the NYSE Upside/Downside Volume Ratio exceed certain thresholds within a short period.

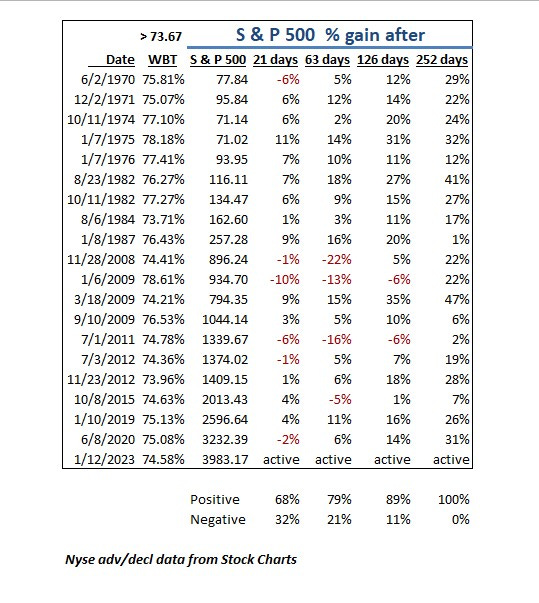

The ZBT has been around for decades, and it has a proven track record of accurately predicting major market moves. In fact, since 1945, there have been only 23 ZBT triggers, and each time it has occurred, the market has experienced a strong tailwind for the S&P 500 index (SPX). This means that investors who heed the ZBT's signal and invest in the market at this time could potentially reap significant returns.

The ZBT's accuracy is hard to ignore. Marty Zweig, the late financial analyst and author of "Winning on Wall Street," was a strong proponent of the ZBT. He famously declared, "Don't f** with breadth, don't f** with Zweig." His faith in this indicator was well-placed, as the ZBT has helped investors avoid major market downturns and capitalize on significant gains.

So what does the ZBT trigger mean for the current market climate? Well, for starters, it suggests that the recent market turbulence may be coming to an end. After months of volatility caused by concerns over inflation, rising interest rates, and global economic uncertainty, the ZBT trigger could signal a shift towards a more stable and profitable market.

Additionally, the ZBT trigger could provide a boost to certain sectors of the market. Historically, industries such as technology, healthcare, and consumer discretionary have performed well in the aftermath of a ZBT trigger. This means that investors looking to capitalize on the ZBT's signal may want to consider allocating their funds towards these sectors.

What is clear, however, is that within a year, the chances of seeing the indices rise above their current levels are high. This has always been the case in the past.