Ray Dalio Is Right: Real Estate Is Broken

Why Real Estate Can Kill Your Freedom

I saw Ray Dalio’s take on why buying and holding real estate is no longer an effective investment strategy. It is not the first time he says it, but this time his reasoning landed with more weight.

He broke it down into three ideas.

First, real estate reacts more to interest rates than to inflation, which in today’s macro setup means it will likely lose ground in real terms.

Second, it is a fixed, visible asset, easy to tax.

Third, it is nailed to one place, which makes moving capital slow and complicated when you need to act.

The more I think about it, the more I realise those three points all connect to the same thing. Real estate is a control point. It is heavy, slow, and exposed. If the political or monetary environment tilts against you, the state can tax it harder, lenders can squeeze it tighter, and you have no way of escaping quickly.

And here is the part people underestimate. The real risk is not a bad year of returns. It is losing freedom. If your main wealth is sitting in plain sight, you are at the mercy of what I call TAGs: taxes, audits, grabs. Three small letters that can cut off your autonomy completely.

I have seen this happen. A property cannot hide. It cannot cross a border. It cannot pivot to cash when you smell trouble. If your independence depends on something that can be taxed, frozen, or seized at will, you do not really own it. You are renting it from the system on terms they can rewrite whenever they want.

Now, historically real estate has worked very well in a large percentage of cases. On paper, it makes perfect sense. You buy, you let the cashflow slowly cover the cost, and one day you own it outright. The math feels clean and logical. What most people do not see is the silent erosion along the way. Maintenance, taxation, tenant issues, regulation changes. A roof that needs replacing at the worst time. A new zoning law that suddenly cuts your rental market in half.

From my humble point of view, I think it can still make sense to own real estate, but with a very deliberate approach. Not every property is the same. If you buy something expensive, it is usually because it is good, in a good location, and that kind of asset will rarely depreciate significantly. But if you buy something cheap, it is often because there is a hidden problem. It could be the neighbourhood, structural issues, or a constant need for costly renovations. In those cases, the apparent bargain can turn into a slow financial bleed.

I do not pretend to have the single correct answer here. In fact, writing this is as much about clarifying it for myself as it is for sharing with you. If I had to act today, I would probably break it down into two or three clear steps to keep my freedom intact while still benefiting from what real estate can offer. First, I would never put a majority of my capital in a property I cannot sell quickly if needed. Second, I would make sure the financing terms are stable and predictable for years, so I am never at the mercy of a sudden rate spike. Third, I would always keep liquidity outside of this investment, ideally in a safe jurisdiction, so I can act fast if the environment changes.

Because in the end, the real question is not whether real estate will appreciate or not. It is whether owning it increases or reduces your ability to move when you need to. And if you get that wrong, no yield or capital gain will save you.

I remember a video I saw years ago of the founder of Telegram. He said that he owned nothing but cash and several million in Bitcoin.

That was it. His reasoning was simple: in that configuration, he was truly free. He could move anywhere, at any time, and adapt to any political or financial shift instantly. That level of flexibility is the purest form of wealth. Real estate will never give you that. And maybe that is the core lesson here. It is not about owning things. It is about owning your freedom

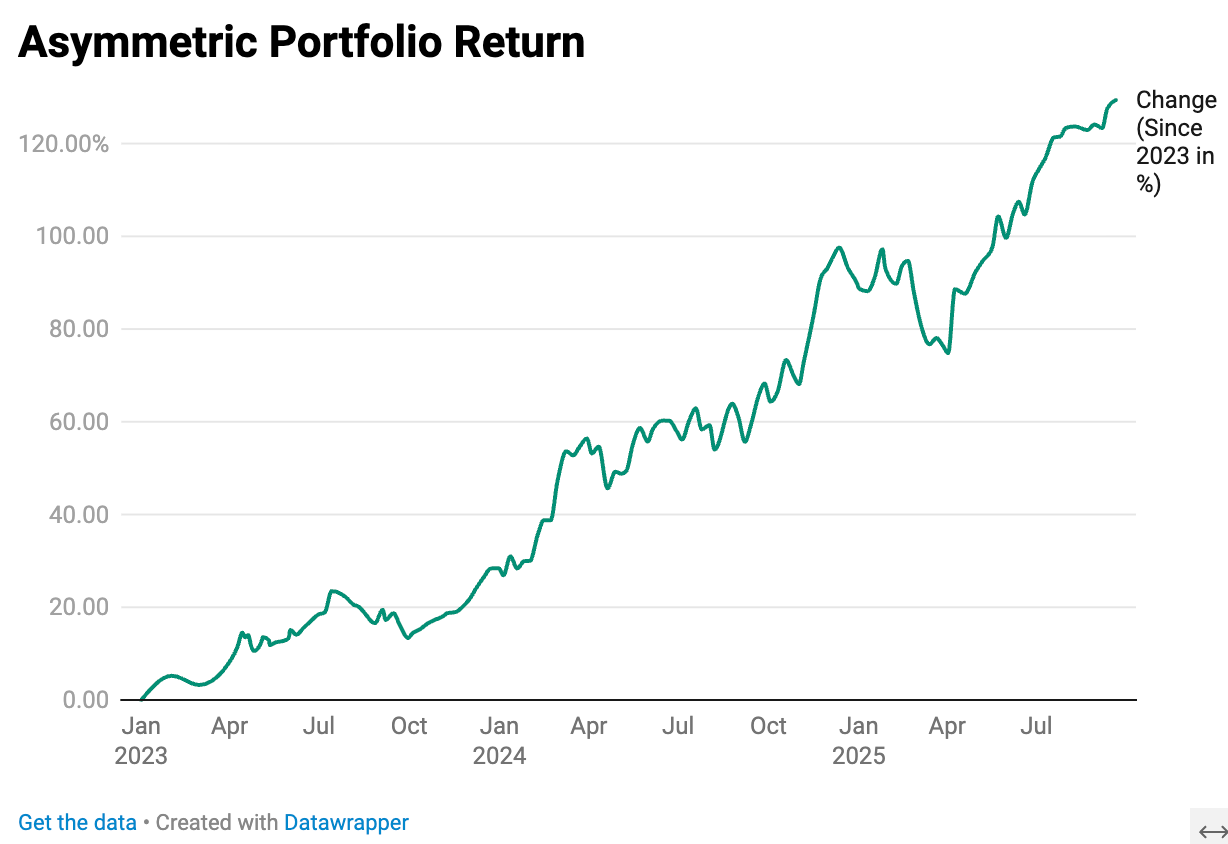

Now our portfolio in detail

CAGR > 33% with more than 40% of the assets in cash or similars