Reactive Monetary Policy: Why Your Inaction Matters

Global Chaos: What You Need to Know and How to Capitalize

Right now, there is chaos and uncertainty in the world. We have the ongoing conflict, over a year in, between Russia and Ukraine. On another front, one of the bloodiest and ruthless wars we've witnessed in a long time is raging between Hamas and Israel. China and Taiwan continue their trade disputes. And, as if that wasn't enough, there's an unprecedented debt crisis where trillions are being printed monthly. By the way, if you're looking for an eye-opening book on this topic, I have a recommendation for you.

Another significant social issue is the lack of decent housing. People can't afford it. How is it that some can't divorce simply because they can't access housing? This is true poverty; the middle class is disappearing. It's already a challenge for couples to buy a home together.

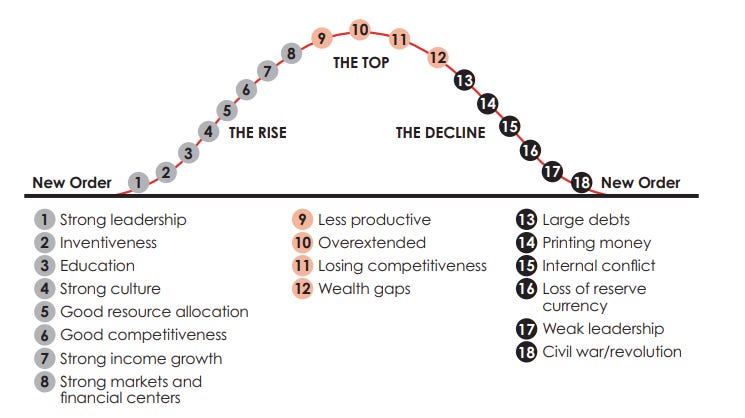

We are in an unprecedented social paradigm. We have lived in a welfare state for many years, and now, as Dalio rightly points out, we are spiraling into a seemingly inescapable downturn.

If you can't interpret the chart, we're on the right side of it.

In uncertain times, humans want to act to gain a semblance of control. This is evident in the constant reactions of the central bank to whatever is happening globally. If things look grim, they'll cut interest rates and print money. If prospects seem solid, they'll raise rates and sell assets off their balance sheets. They've yet to realize that doing nothing is also an action.

From a human perspective, I understand the difficulty. For a moment, imagine spending every day at your job, sitting without touching a computer key, sending an email, or taking a call. Day after day.

You'd probably feel worthless. But economically speaking, you're far more valuable than you think.

The entire world follows a reactive monetary policy that requires humans to understand complex situations and predict how today's decisions will impact the future.

Not only is this insane, but it's proven nearly impossible over the years. Humans are terrible at grasping complex situations. Try getting a group to agree on handling Russia, Hamas, our national debt, or inflation.

Where Opportunities Arise

A seasoned investor friend once said that sometimes it's not about selling at a good price, but buying at one.

He's right.

At the point of purchase, an investor is more confident that they're making the right move.

For instance, last November, almost a year ago, we recommended investing 5% of your portfolio in Bitcoin at $16k per Bitcoin.

Since then, we didn't know if it would rise to $50k, stay the same, or even drop. What we were certain of was that the purchase price was good.

Now, we'll continue following our system and will know when to sell. We don't know if Bitcoin will be at $100k or $1M when we do, but there are signals and a system we must adhere to, especially with one of the most cyclical assets we know.

We've said many times that liquidity drives the market. Likewise, it drives Bitcoin, and we're now in a phase of increasing liquidity.

Every good investor has one task: manage risk. That's why a significant portion of our portfolio is in cash. Nowadays, we can achieve a 4% return without lifting a finger.

In conclusion, instability breeds opportunity, and we're currently surrounded by plenty.

Thank you for staying with us. Now, let's dive into our portfolio.