Real Story: How Real Estate Creates Freedom… and Then Takes It Away

Why Simplicity Outperforms Complexity

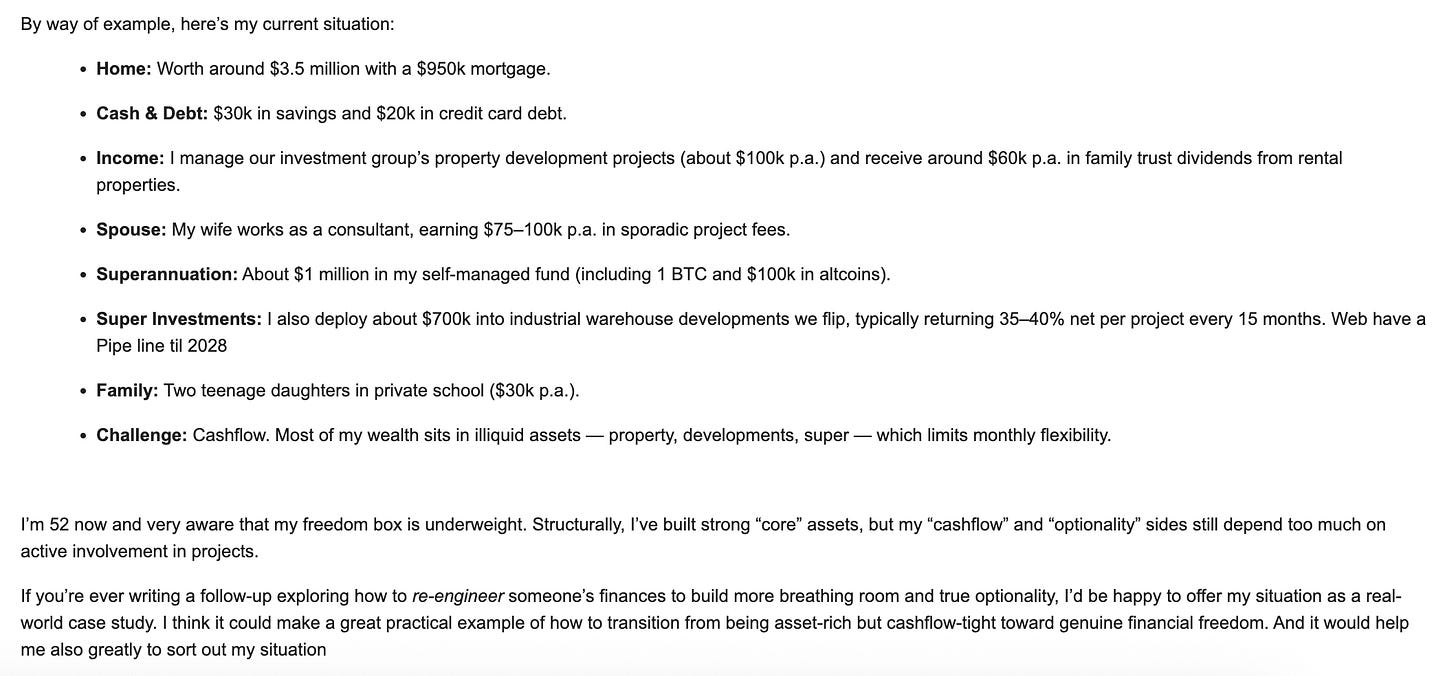

Lately I’ve been getting a lot of emails from readers sharing their situations. Some are trying to build from zero. Others, like this one, have already built something real but feel that something isn’t clicking.

This message caught my attention because it reflects the stage most investors eventually reach: when the architecture looks perfect on paper, but the system feels heavier than it should.

The reader is 52. Owns a $3.5 million home with a $950k mortgage. Manages property developments with solid returns, has $1 million in super, and two daughters in private school. In short, a life well-built. A strong core.

But what’s interesting isn’t the structure it’s the hidden tension behind it. Most of the wealth sits in property and developments. Assets that, yes, produce returns, but are also fragile in ways we rarely talk about.

Real estate looks like a cashflow engine, but it’s also a slow-moving liability. It ties your liquidity, depends on leverage, and, unlike what the spreadsheets suggest, it depreciates physically and financially. Maintenance, taxes, and obsolescence quietly erode returns. What looks stable in year one becomes rigid by year ten.

And yet, we all love property. It gives the illusion of control. It feels tangible. But the more I study real systems of freedom, the more I see that control is the enemy of true leverage.

Because the real wealth doesn’t come from managing things. It comes from letting time do the work.

There’s something in this reader’s case that works beautifully the disciplined architecture, the antifragile mindset, the fact that he’s thinking in terms of boxes: flow, core, optionality. That’s rare. Most people don’t even get to that stage. But when I look deeper, I see what I call the “builder’s trap”: everything is well-constructed, but nothing is light.

Too many moving parts. Too much dependency on activity. Too many returns that require human effort.

And that, ironically, is where simplicity becomes the ultimate sophistication.

I often think of something Pavel Durov once said that freedom doesn’t come from owning many things, but from needing very few. It’s a concept most investors resist until experience humbles them. You can build a complex architecture of assets, and it will still underperform a few simple positions held long enough to let compounding do the real work.

The example of the NBA player who lost his Bitcoin keys and ended up outperforming almost everyone is perfect. He did what no investment advisor could: he removed himself from the equation. He couldn’t overthink, rebalance, or optimize. He simply disappeared from the loop and time did the rest.

That’s the paradox of real freedom. The less you do, the better your system behaves.

So, when I look at this reader’s case, I don’t think the problem is “more flow.” He’s generating plenty. The real challenge is that the architecture still depends too much on complexity. The system breathes, yes, but it doesn’t flow naturally. It’s mechanical, not organic.

And that’s because property, while great for leverage and tax optimization, is not eternal. It’s a temporary vehicle. It works best when used strategically, not emotionally. The great mistake is believing it’s the final destination.

Real estate produces cashflow, but that cashflow is not the same as permanence. Maintenance costs, changing regulations, credit cycles, even demographics everything in property is cyclical. You can’t just project an Excel into the future and assume stability.