Should We Brace for a Volatile 2024 in the Market?

Puru Saxena's Market Vision for the Upcoming Year

Now, with eyes set on 2024, the million-dollar question is: what will happen in the markets? Will we continue with the Nasdaq marking a 40% return so far this year? Or should we brace ourselves for uncertainty?

These are the questions we face most frequently. Today, we are going to share our opinion but from the perspective of one of the most well-known macro investors on X (Twitter). This investor primarily focuses on high-quality, innovative stocks. Interestingly, when the markets lose momentum, he shields his portfolio.

What does it mean for the markets to lose momentum?

Markets, like much of life, have cycles. We see periods where growth surges abruptly and other generally shorter cycles where everything crashes drastically. We might witness a loss of 40-50% of our capital in just a few months/days.

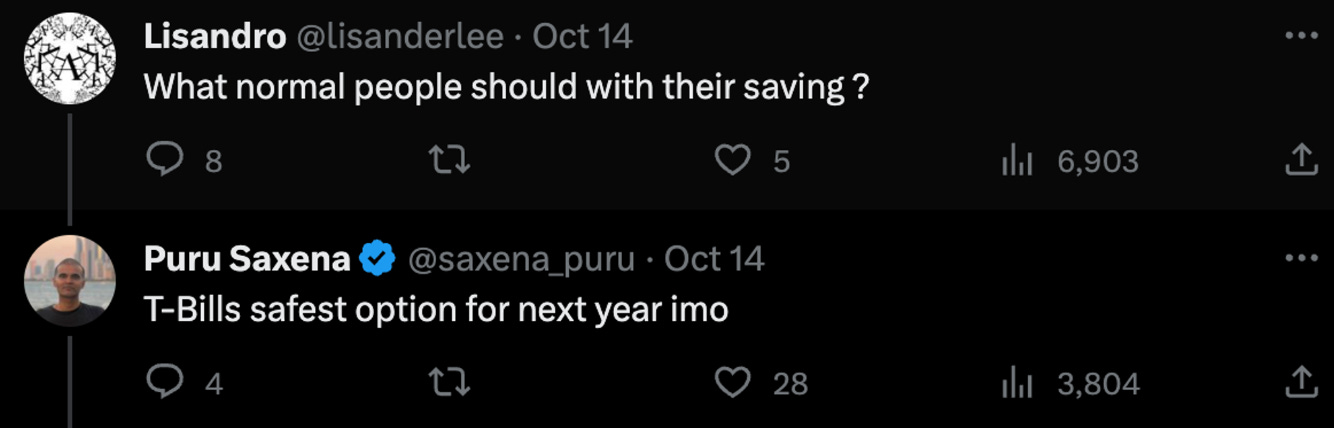

The investor we're introducing today is Puru Saxena. He suggests that we might see a significant market pullback in the first half of 2024. His theory is based on the inversion of the interest rate curve. Though you might believe, naively, that "this time it's different", an inverted yield curve consistently leads to a severe recession.

This makes a lot of sense since an inverted yield curve essentially indicates that you will earn more from your savings in the short term than if you keep them tied up for a longer period.

He's right about one thing:

The market often presents opportunities we fail to seize. Looking at the Nasdaq chart shown earlier, you might think, "why shouldn't I invest my money here?" But you'd typically be mistaken. It's time to search for opportunities. For instance, one clear option is investing based on interest rates, where we can earn a 4% return without lifting a finger. A $1M investment in this asset yields a daily $110.

With that money, you can:

Be in the top 1% of daily global income.

Buy insurance against black swan events that could potentially earn you even more money when the recession hits.

Wait for more opportunities.

The opportunity is now.

Did we say this? No, Puru Saxena has also publicly stated it:

He's not the only one. Howard Marks, one of the most esteemed macro investors who also appears on the Forbes Billionaires list, warned about it in his latest investor letter.

What do we do at Asymmetric Finance? We've been investing in these types of assets for a long time to gain returns, whether through stablecoins or now nearly 20% of cash in our portfolio. Without a doubt, many will make the mistake of investing, as always, in the best-performing asset from the past year, which likely will be the worst possible choice.