The Behavior of Absolutely Everything in Life is Cyclical

Warren Buffett's Secret Revealed

The behavior of absolutely everything in life is cyclical. It's never a straight line, and if you try to make it so, you're playing to lose.

If there's an engineer in the room, it's technically called the Brachistochrone Curve. But for the rest of us, what this means is that the fastest way for a ball to reach the lowest point is through a curve, not in a straight line.

When applied to the world of finance, this means that more volatility equates to higher returns.

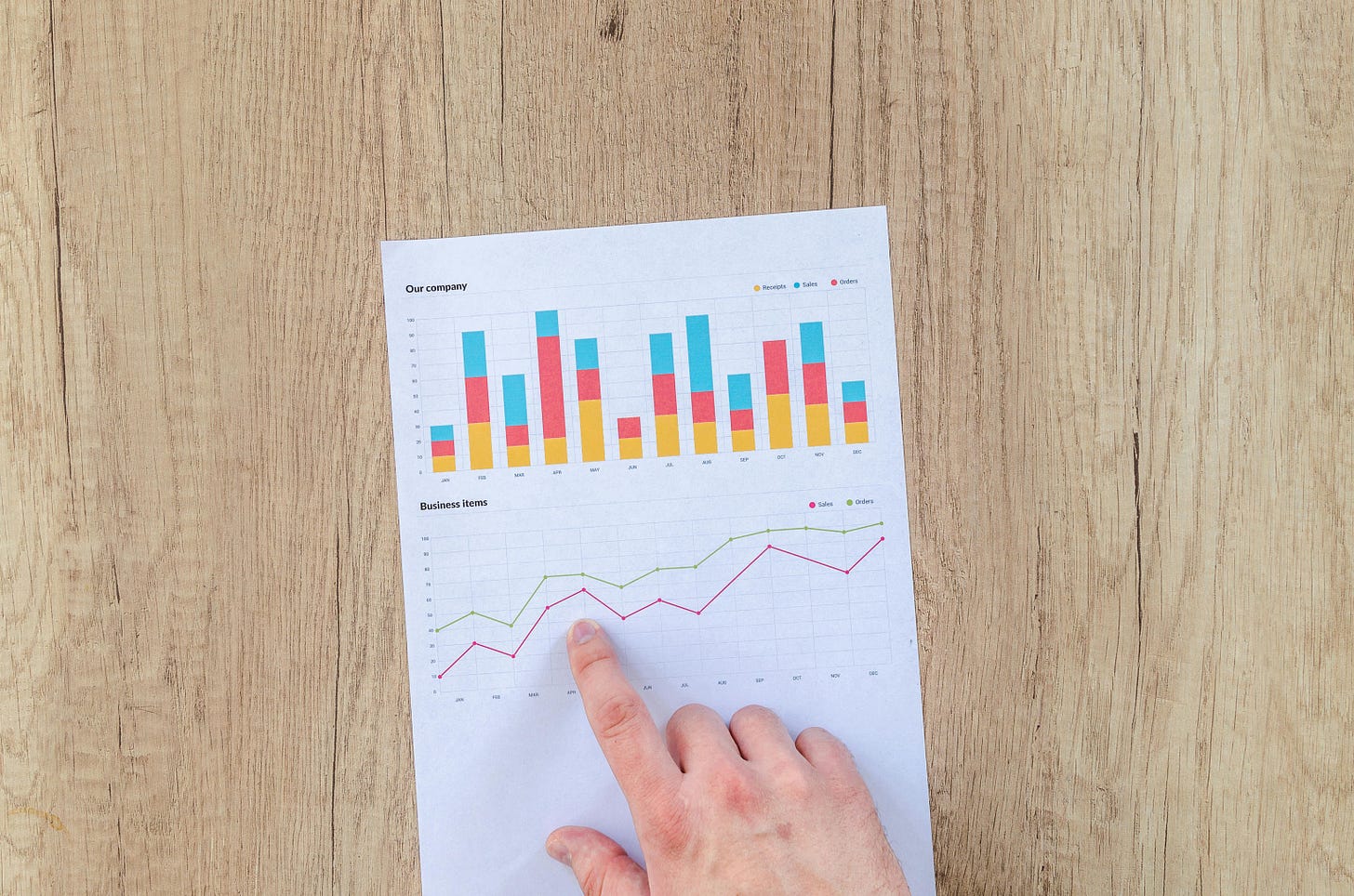

For example, in the following backtest, I do an asset allocation as Warren Buffet recommended to his relatives (90% S&P 500 and 10% in bonds).

"My money, I should add, is where my mouth is: What I advise here is essentially identical to certain instructions I’ve laid out in my will. One bequest provides that cash will be delivered to a trustee for my wife’s benefit. (I have to use cash for individual bequests, because all of my Berkshire shares will be fully distributed to certain philanthropic organizations over the ten years following the closing of my estate.) My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers."

What's interesting about this asset allocation is:

The highest return is with a 100% stocks portfolio, obviously.

The maximum Sharpe ratio is with 78% in stocks and 22% in bonds.

The lowest risk is 28% in stocks and 72% in bonds.

This suggests that WB's proposed asset allocation is (very) interesting for trying to maximize returns and minimize risk, as seen below:

This asset optimization is what we try to do daily, which is why this last week the return on our portfolio has skyrocketed by 5%.

The Case of Bitcoin

I haven't talked about Bitcoin for a long time after the complaints I received about being biased (this was when we bought 5% of the portfolio at $16k).

Today I want to talk about the enormous correlation it has with risk/volatility and how the volatility is being reduced so that it slowly becomes one of the best assets out there.