The Best Buy Recommendation We've Given at Asymmetric Finance

Bitcoin Boom: Why Big Banks Are Finally Buying In

Today, I couldn't talk about anything other than the asset of the week. Society is beginning to understand what it entails. The important thing about this is not that the average person understands it, but that large institutions are starting to add Bitcoin to their balance sheets.

How do we know this rise is not merely speculative? We simply need to look at Google Trends and understand that it's not people who are searching for digital assets. This is what happens when we search for 'Bitcoin' on Google Trends.

As with any asset that appreciates exponentially, it's very important to understand two things:

1. It will tend to pull back. How much? It all depends on how vigorously it rises (this article is being written on February 29).

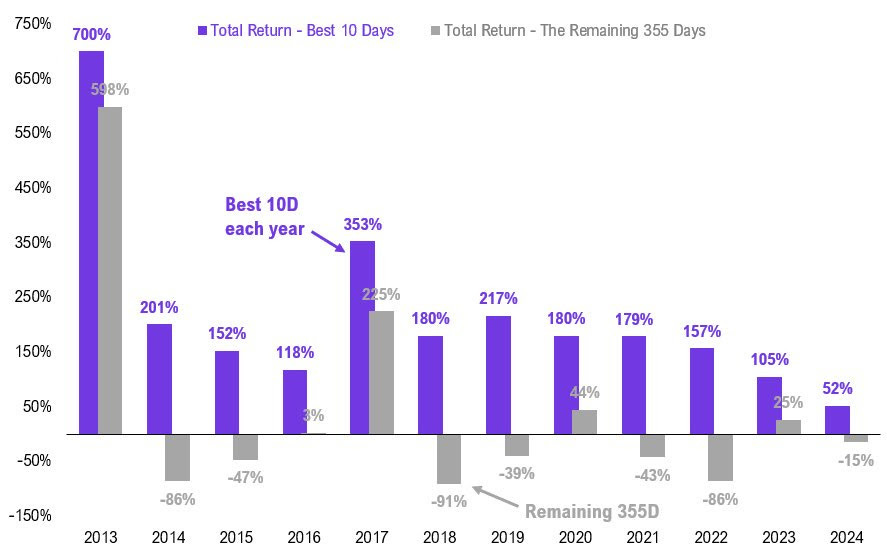

2. Specifically for Bitcoin, and for any asset in general: 'Time in the market is better than timing the market'. If not, here is a comparison between being invested in Bitcoin on its best days or not being invested at all.

We don't have a crystal ball, far from it, but just a year and a half ago, we recommended buying Bitcoin. We saw that the pessimism around this asset was extremely high. This is a clear indicator that it's time to buy.

Similarly, we can say that the global economy is experiencing an excess of optimism. We always count on the Fed and the main central banks to come to the rescue, but this will end, and we will have a period of recession. "That's impossible to happen in America," it's not. For the younger ones, Japan was a powerhouse of a magnitude similar to what Europe is today, in the 80s its valuation fell by about 70%, and it has taken more than 30 years to recover historical highs. The same could happen in the US or any market.

My opinion about Bitcoin is clear; it is an asset that serves as a shield against market liquidity. It has no other function. The most skeptical who have always said that an asset that falls 70% cannot be a safe haven, I disagree. Gold itself (currently with a market cap of 13T) fell about 40% in 2012. If that happens to an asset with a market cap 12 times that of Bitcoin, perhaps the falls in Bitcoin are not so significant.

My thought process has always been to let the best performing asset over the last 15 years continue to do its thing. It will go up, it will go down, and it will go sideways. But over a long enough time period, bitcoin seems to go up because it serves as an index for global liquidity.

The government is not your friend; they are people who only want to hold on for four more years. The conflict of interest is huge.

Our obligation is to seek autonomy so as not to depend on third-party legislation, and this involves decentralizing our money.

A very simple case, you have an ETF domiciled in Ireland, whose manager is in Luxembourg, and which your Italian bank markets.

Scenario 1: what happens if Ireland goes bankrupt.

Scenario 2: what happens if the manager is poorly audited.

Scenario 3: what happens if Italy cannot manage its huge debt and bans the withdrawal of money from its banks. Or what happens if your ETF is omnibus and not nominal.

This is an extremely catastrophic scenario, and most likely it will not happen. But in these cases, it would take many months to recover your money.

This is the reason for Bitcoin's existence.

In conclusion, governments are not your friends, and large institutions are realizing this. Meanwhile, our portfolio continues to rise and is back at an ATH with a 9% increase.