The Best Hedge to Avoid Margin Calls These Days

The Secret to Surviving Market Chaos

We are living through particularly turbulent times. I believe this is the perfect moment to put things into perspective, distinguish between volatility and risk, and truly understand how to make money in a market like the one we are facing. The other day, I was reflecting on how to become even more antifragile in the face of events like those we've seen in the markets, and it reminded me of a strategy Puru Saxena shared on Twitter several years ago.

To be honest, all of this came about after seeing several accounts I followed on social media, with high exposure to certain assets and excessive leverage, end up in Margin Call. This means many of their positions were liquidated.

Most of them used Robinhood accounts, which allow you to leverage at around 5.5%. From what I’ve read, the “SAFE” leverage metrics set by Robinhood would be practically wiped out with drops of about 20-25%—numbers that are quite likely over an investor’s lifetime.

But how can we protect ourselves in these circumstances? Years ago, Puru Saxena shared how he did it. Although his investment service is now paid, I’d like to share what I’ve learned.

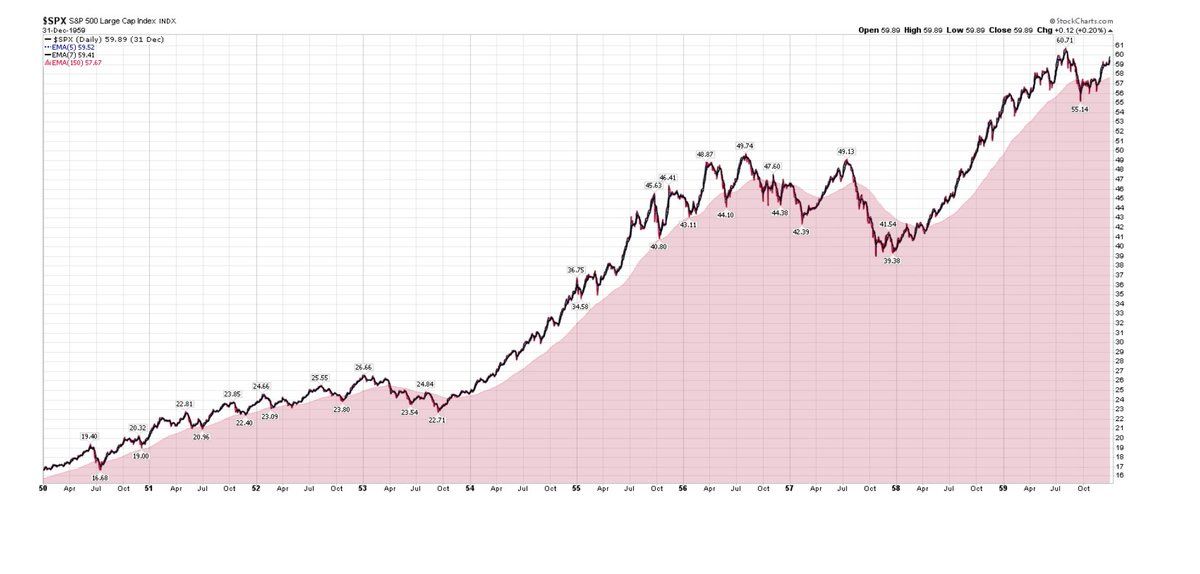

First of all, he uses technical indicators to know when to hedge, specifically exponential moving averages (EMA). Many of you will ask if this makes sense, and my answer is that they are a derivative of the market’s “Fear and Greed” indicators. But they can be useful.

Basically, if your asset’s price falls below its 150-day EMA (long-term bearish trend) and the 5-day EMA is below the 7-day EMA (short-term bearish trend), you should short your portfolio. As long as the price remains below the EMA(150), if 5<7 you are hedged; if 7<5, you stop hedging. When the EMA(150) is less than the price of the index or asset, you stop hedging regardless of the short-term indicators.

Puru then adds several historical examples of how this strategy has performed over the last 100 years.

$SPX (1 Jan 1929-1 Jan 1940)

$SPX (1 Jan 1940 - 1 Jan 1950)

$SPX (1 Jan 1950 - 1 Jan 1960)

$SPX (1 Jan 1960 - 1 Jan 1970)

$SPX (1 Jan 1970 - 1 Jan 1980)

$SPX (1 Jan 1980 - 1 Jan 1990)

While on paper it may seem effective, not everything is as simple as it looks. Today, I want to share a more optimal way to implement a good hedge: simpler, less time-consuming, and truly effective.