The Biggest Money Lesson from My Trip to Bali

This Hidden Currency Crisis Will Change How You See Money Forever

Back to the routine, an exciting year lies ahead where we might see the (possible) election of a pro-crypto president, significant cuts in interest rates, and, most importantly, the need to pay off short-term maturities, resulting in more liquidity than Venice after a tropical rainstorm.

Raoul Pal, a prominent macro investor, warns that this could be one of the clearest opportunities to make money in history.

We'll keep you informed about all of this, but today I want to take the opportunity to share some memories and, hopefully, important reflections from my trip to Southeast Asia this summer.

The best part of traveling is always the cultural impact, and when that impact is profound, it creates temporal connections in your mind that can help you understand the progress that still lies ahead in developed countries.

Here’s one of the most important money lessons I brought back from Bali:

The official currency of Indonesia is the Indonesian rupiah, which was adopted in the post-World War II era after gaining independence (1945 and adoption of the currency in 1949).

The most striking fact is that the initial exchange rate from USD to IDR was 1:3.8. This means that each dollar was exchanged for 4 rupiahs.

However, due to restrictive policies, the government decided to isolate itself from globalization, control prices, and heavily indebt the country (I know everyone is thinking of Venezuela, Bolivia, Cuba, Argentina... and you're right). This led to what always happens: low supply, the public turns to foreign currencies, and confidence in the currency is lost (everything in life is about confidence).

This caused a 600% hyperinflation in just 2 YEARS in the 1960s. No one wanted the currency, and as soon as they had it, they exchanged it (last one is a fool).

Inflation was so severe that in 1965 the government decided to remove three zeros from the currency. How do you do this? Very easily, a new rupiah is created, and where you previously had 1,000 old rupiahs, you now only have 1 new rupiah. Where you once had 100k saved, now you have 100.

After further research, I found that this is not the only example; there have been many more cases throughout history.

Despite this reform that promised to be effective, the Indonesian rupiah continued to devalue until the Asian crisis of the late 20th century, where it again lost a significant portion of its value.

Although the cover photo isn’t mine, you can see the exchange rates as of today (approximately).

For the dollar, 1 USD exchanges for just over 15,000 IDR.

The most striking fact is that considering the old rupiah, the convertibility has gone from 1:3.8 to 1:15,000,000. This represents an annual compound growth rate (CAGR) of 22.5%.

Considering that the S&P 500 averages 8-10%, it would have been much more profitable to go long on USD/IDR.

The reflection I've drawn from all of this is something trivial but important: as citizens of developed countries, it’s very difficult to realize how crucial it is to have a strong currency. Whether it’s the USD, EUR, AUD, JPY, CHF, GBP, CAD... they are all good currencies compared to others.

Now, what I’ve learned from the Bali case is that:

A currency only works if there’s confidence in it.

When confidence is lost, the cascading effect is rapid. We saw this with Silicon Valley Bank, which lost much of its funds in just a few days.

When a currency depreciates, the same thing always happens (read history books and see what happened in other empires).

Those with globally diversified assets (this is important) didn’t lose as much purchasing power.

I think you know where I’m going with this: we need to change our perspective and imaginatively migrate to a country where only Bitcoin exists. That country will look at traditional currencies the same way we look at Indonesia (among others) today. It will say it’s incredible that we don’t realize that, often, we overcomplicate things by searching for the ideal company to invest in, while the real risk lies in the currency of exchange.

Another day, I’ll tell you about my experience with the largest Bitcoin community in Southeast Asia.

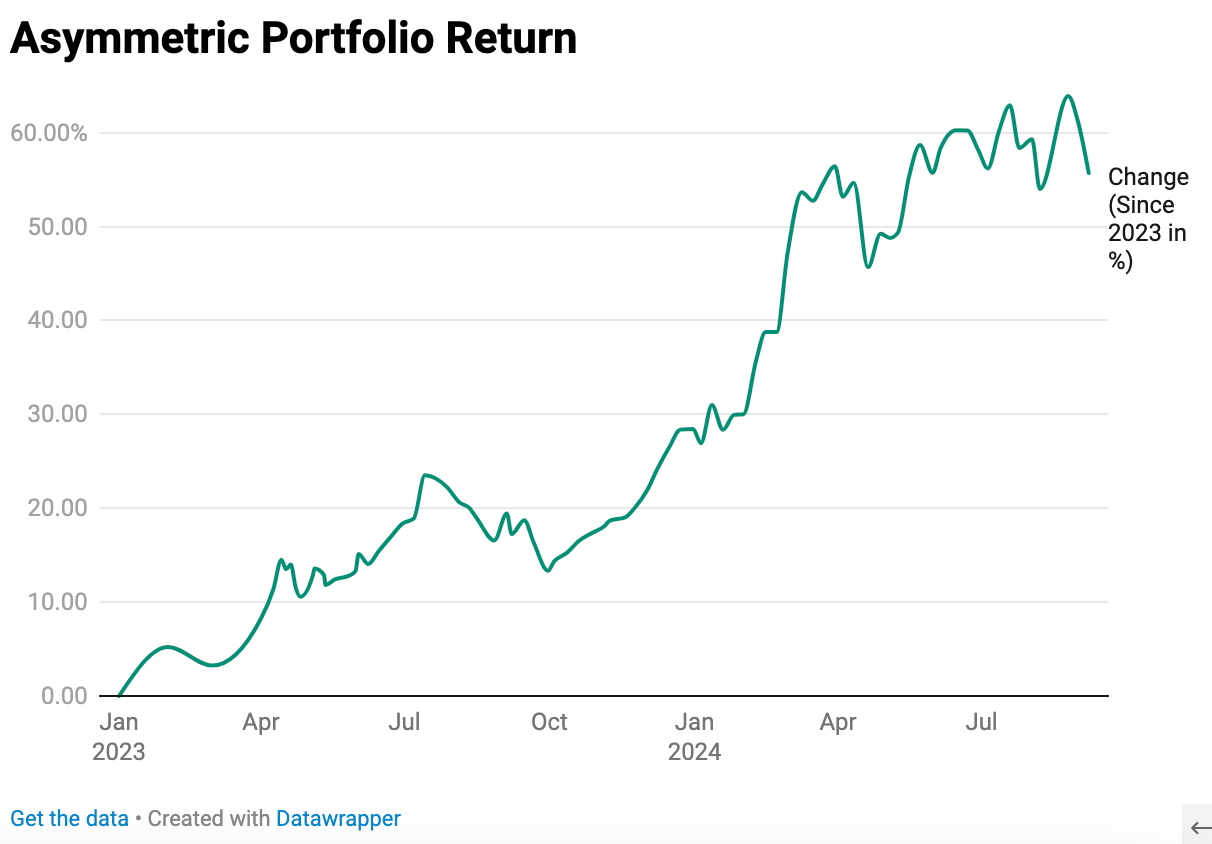

Now our portfolio on detail: