The Cantillon Effect Explained: How the Rich Play a Different Game

Sheep, Markets, and Debt

Finance is no different. We’re pure herd animals. S&P 500. China. India. The same narratives on loop. Everyone repeats them as if they were commandments. “Preserve purchasing power.” I hear that phrase so often it’s almost comical. Preserve? I don’t want to preserve anything. I want to make money. A lot of it. Ideally, without lifting a finger.

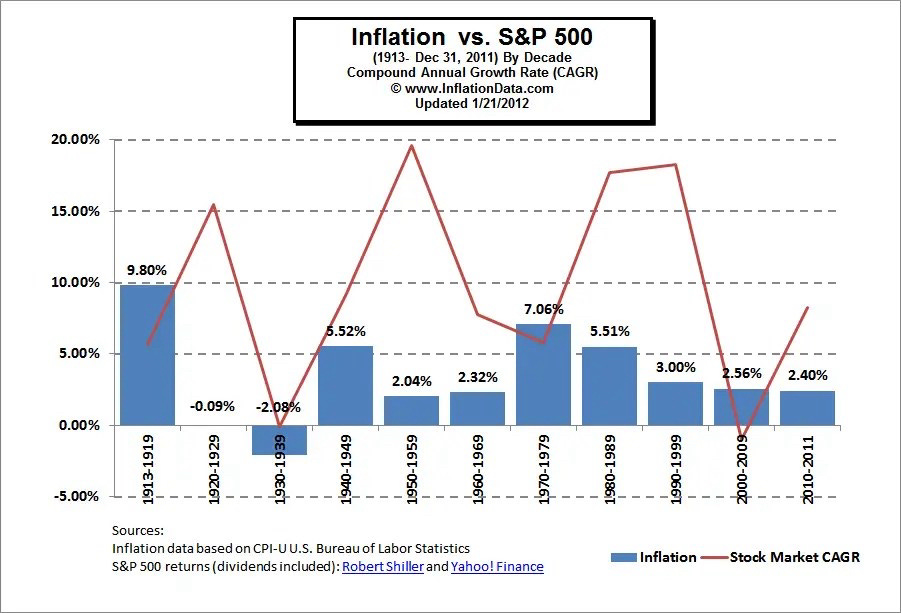

So I ask myself the hard question: if that’s the goal, does the S&P 500 get me there? No. China? No. India? No. Gold? No. All of these are just ways to keep pace, at best. They’ll preserve, maybe. But they won’t multiply. If the market cap is already massive, you’re not going to pull extraordinary numbers in the short term.

The herd doesn’t think that way. The herd wants comfort. Predictability. Benchmarks they can compare themselves against. But benchmarks don’t pay your bills. They don’t build freedom.

If you want extraordinary results, you need to step outside the herd. Derivatives, maybe. Asymmetric bets, definitely. But the simplest answer that becomes clearer to me every day is this: borrowing.

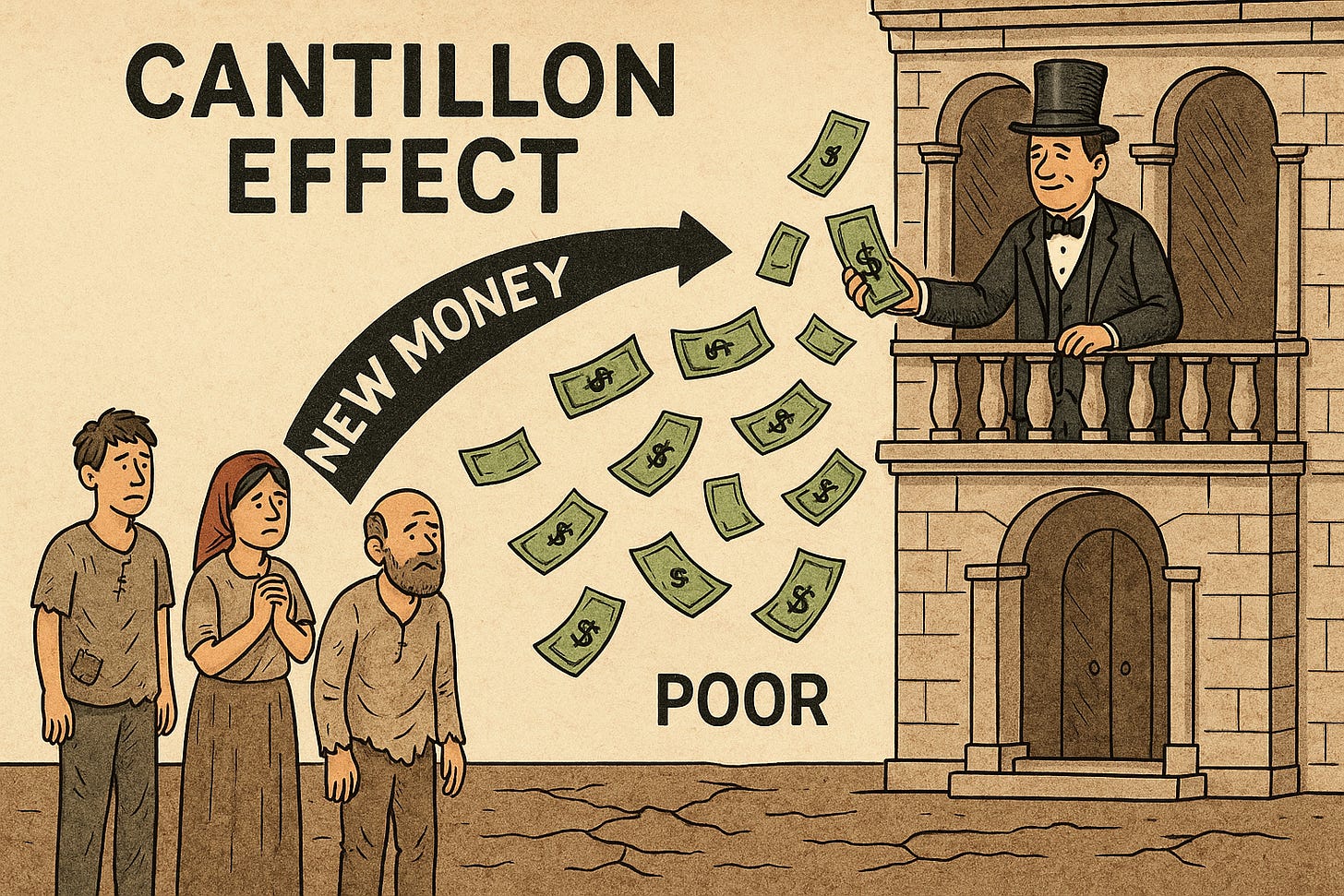

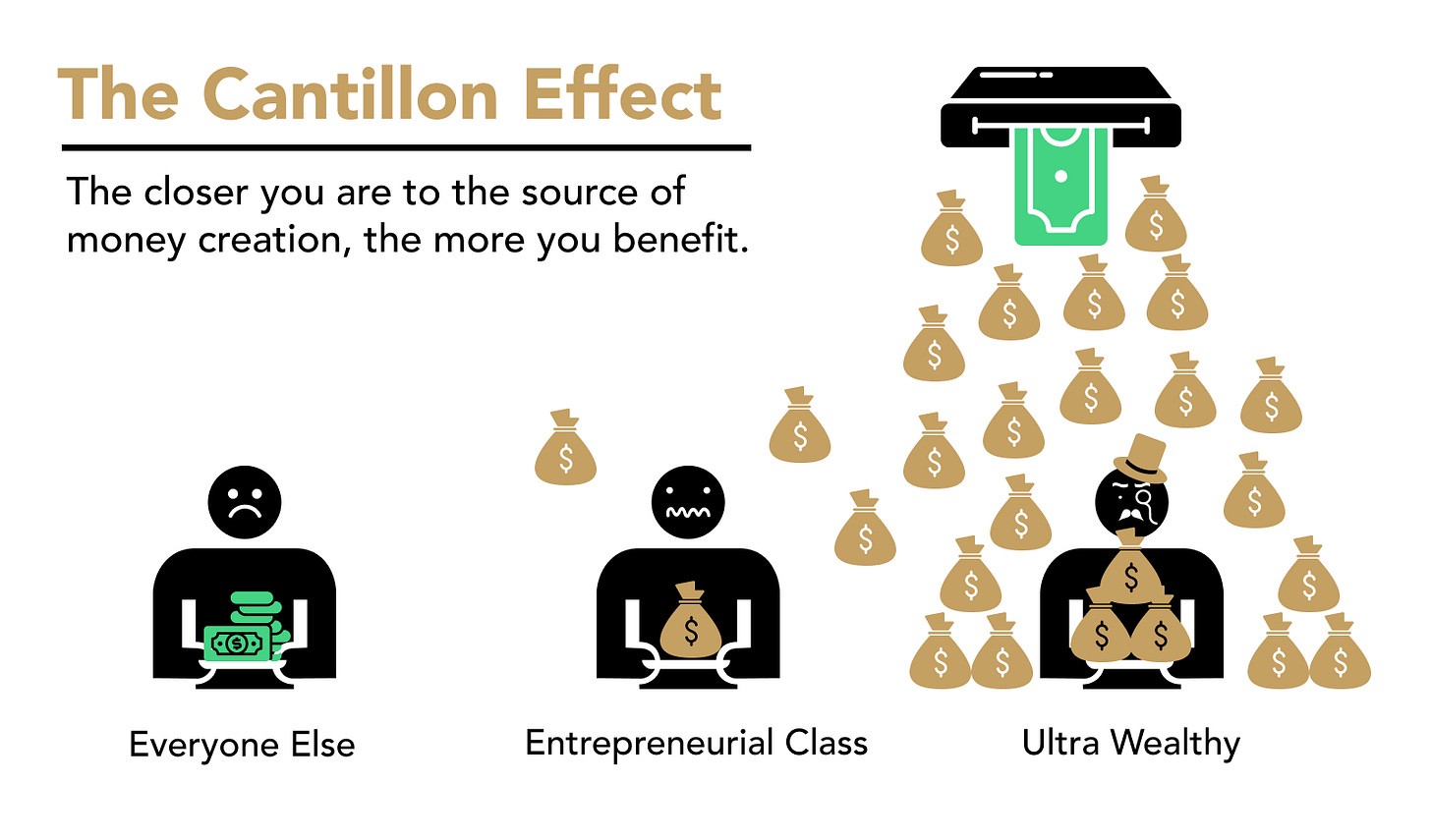

Money itself is debt. If you understand how debt works, you’ve just unlocked the real game. That’s where the Cantillon Effect comes in. The earlier money flows to you, the cheaper you buy. Then you buy even more at a discount, compounding your edge. That’s how the rich keep pulling ahead while the poor fall further behind. It’s not luck. It’s not IQ. It’s timing and access.

But here’s the catch: to borrow money, you need money. Skin in the game. Doesn’t matter if it’s in China, India, or Switzerland. The safer, the better. Once you have the base, the system rewards you. You suddenly play on the same side as central banks and large institutions. You stop being prey and start hunting.

That’s why every time I see a financial newsletter digging deep into Company Y in the renewable sector, I can’t help but roll my eyes. At best, you squeeze out 10 or 15 percent in a year. And that’s if the sector isn’t hit with tariffs, regulatory shifts, or political games. Meanwhile, those who use leverage intelligently can double or triple their flow without ever touching a “hot” stock.