The End of Housing as an Investment

What Demographics Are Telling Us

For many years we were sold the idea that housing was the ultimate safe haven. The secure asset. The place to store the fruit of our labor and, in the process, multiply it. But let me share my opinion: I believe that paradigm is starting to break. And what lies ahead may be far more complex than most people assume.

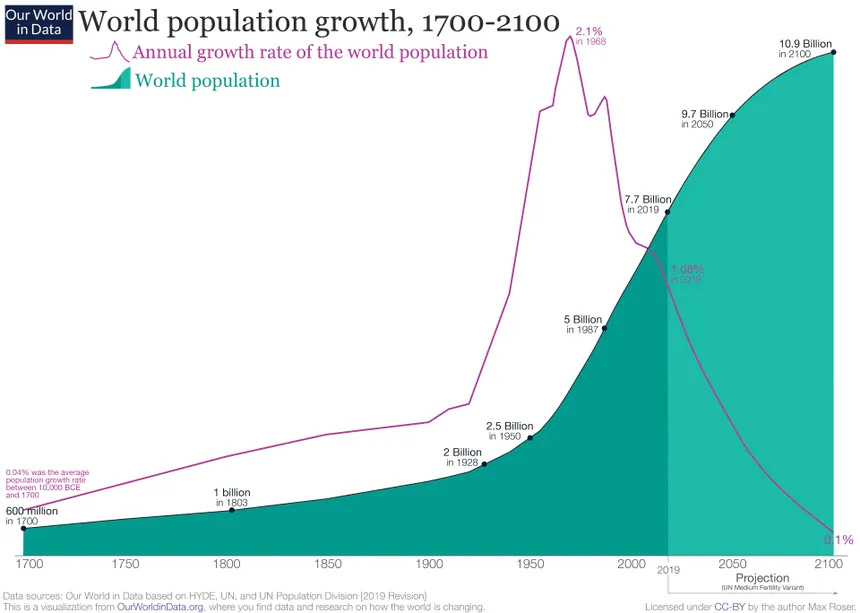

We advised you to sell your house and become millionaire and free (since then +85%). Let’s look at history. For centuries, housing prices were tied to average wages, savings in hard money, and the simple fact that there were always more of us. More families, more children, more cities. Between 1800 and today, the global population multiplied eightfold. That demographic explosion was fuel for a real estate market where demand never seemed to run out.

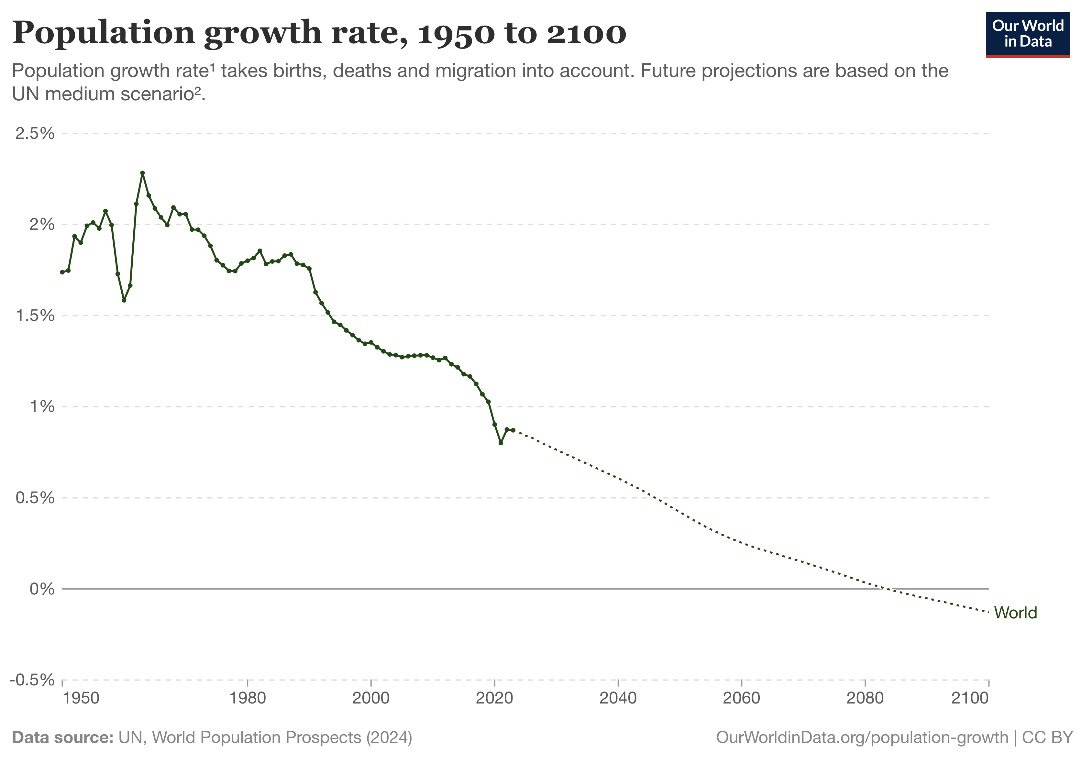

But the engine is shutting down. The demographic charts are clear: in 1968, the world population was growing at 2.1% per year. Today it’s around 1%. In a few decades it will be close to zero. And this is not some fringe prediction, it’s the strongest demographic consensus we have. You and I may very well have lived through the peak number of humans that will ever exist on this planet. Everything that follows is a long slowdown.

Fewer people means structurally less demand. If the population stops growing and households keep shrinking, what sustains the idea that housing always goes up? The argument of “scarcity” loses its strength when the shortage is not of homes, but of solvent buyers.

Thats why I wrote: “Most investors will go bankrupt in the next five years here’s why”

Since 1971, when the dollar stopped being backed by gold, houses became the middle class’s hedge against inflation. We stopped saving in dollars and started “saving” in bricks. But that logic was supported by five simultaneous forces: a population explosion, mass urbanization, shrinking households, bigger homes, and the financialization of real estate. The result was a perfect storm of demand.

Today, those forces are reversing. We’re already seeing symptoms. Blackstone and other funds pausing redemptions in their real estate vehicles. Office buildings selling for 20% of 2019 prices. China’s property sector imploding. Smart money doesn’t wait for the average citizen to catch up with reality: it’s already leaving.

And there’s a second angle almost nobody mentions. With fewer people working and consuming, governments will collect less tax. At the same time, public debts are ballooning to unsustainable levels. What happens then? Either they start taxing artificial intelligence and machines, or the debt must be financed at higher interest rates. And if nobody wants that debt, who will buy it? Central banks. The big institutions. With more money created out of thin air to sustain the system. That means one thing: further debasement of the currency against truly limited assets.

Real estate is not infinite, that’s true. But it’s also not truly scarce if demand erodes. What is genuinely scarce are the assets that don’t depend on how many humans exist on the planet: Bitcoin, gold, high-quality farmland, companies paying real dividends. Those are the assets that win when the currency burns from within.

Now, to be fair, one of the reasons many people felt safe in real estate was leverage. Access to cheap mortgage debt allowed them to multiply returns with what felt like low risk. And yes, leverage used wisely can turn a boring asset into something explosive.

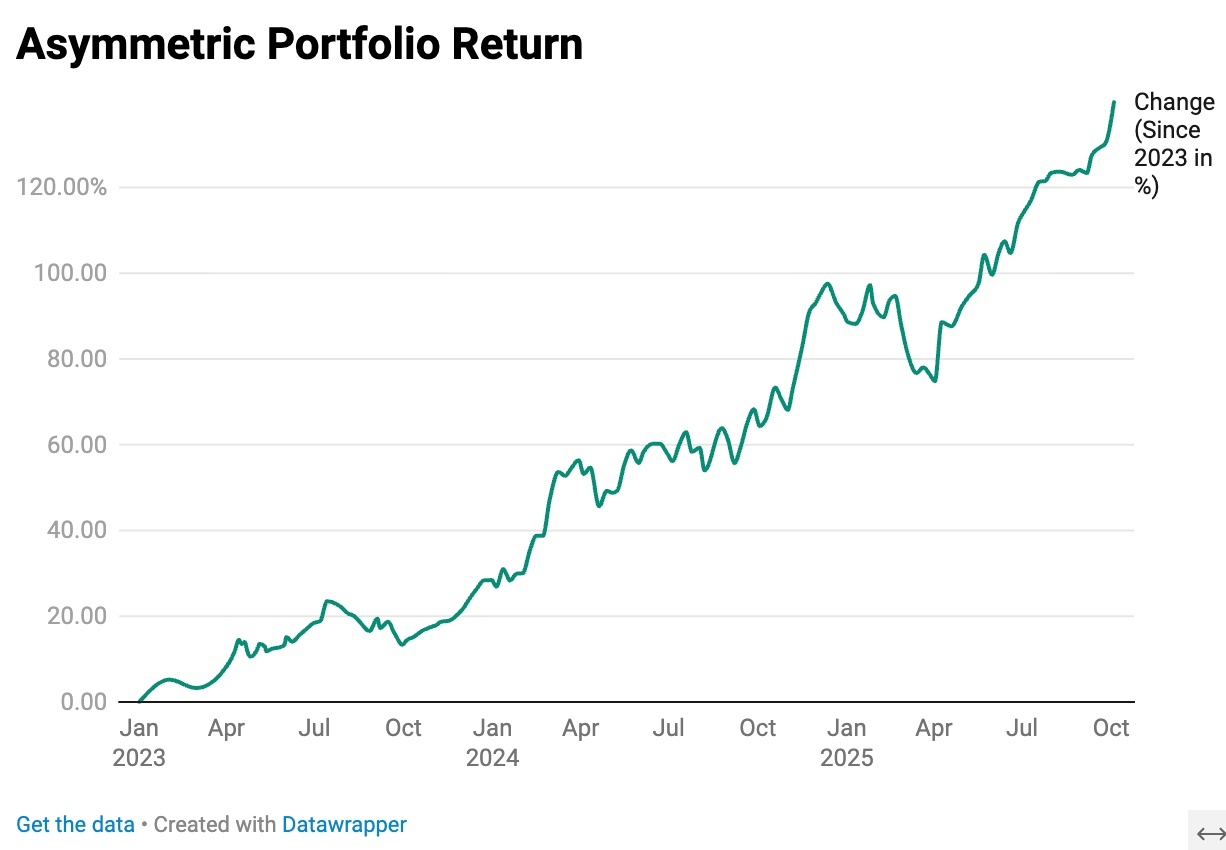

But here’s the uncomfortable truth: you can replicate that same logic outside of real estate. You can achieve similar, sometimes even better, returns in other assets. In equities, you can use intelligent margin to increase exposure to companies with growing dividends. In gold, you can use futures with strict risk control. In Bitcoin, you can access collateralized credit to maintain your position while generating liquidity. Even with short-term bonds and structured financing products you can build leveraged cashflow systems.

The key is not the brick. It’s intelligent debt management. If you understand how to play with leverage, you can build an antifragile portfolio without being stuck in the illiquidity and concentrated risks of a 30-year mortgage.

Housing will remain a place to live, but not necessarily an asset that guarantees financial freedom. Confusing shelter with investment is a dangerous mistake. The narrative that “housing never goes down” could be one of the most expensive beliefs of the coming decades.

My advice is simple: don’t build your personal financial system on bricks. Build it on cashflow, on limited assets, and on liquidity that allows you to strike when the system breaks again. Real estate can have a tactical place, but it’s no longer the strategic core of freedom.

And in the next articles, we’ll share practical tricks on how to leverage intelligently and make your money work multiple times over.

NOW OUR PORTFOLIO… +9% THIS WEEK WITH > 40% IN CASH 🤯