The Farmer Who Predicted 100+ Years of Market Cycles Has Done It Again

Navigating Uncertainty: Insights from Historical Trends

On April 5, 2023, I published one of the articles that has been read the most times. With an opening rate of 73%, that's saying something. This when there are newsletters (not this one) that can barely reach 30%, and if you work in the marketing world and launch campaigns for big companies, consider yourself lucky if you reach double digits.

This means that I have committed subscribers, and this pleases me.

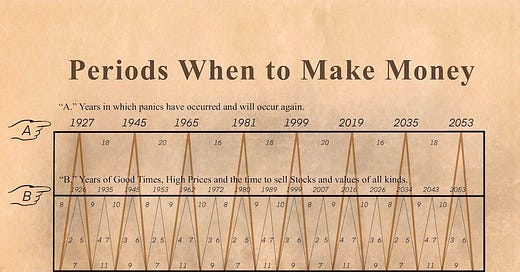

The article I published exactly a year ago spoke of a farmer who, with a simple graph published over 200 years ago, has predicted all economic cycles.

To give you a bit of context, the graph is as follows and the farmer's name is Samuel Brener:

To give you context, this farmer lost everything during the crisis of 1873. In response to this event, he composed the aforementioned graph.

Regardless of whether this graph can make you rich or not, I believe there are several things we should consider and take away from this farmer.

The Importance of Cycles

A few months ago, I was reading the biography of Nike's creator, Phil Knight. This man had to go through many ups and downs throughout his life until he managed to found one of the largest companies in history. The curious thing about his life is that when things seemed to be going well, they always went wrong. Conversely, when things were really bad, he kept working and pulled through.

But it's not all about work; the company went public in the 1970s, which was what really made him rich and got him on the famous billionaires' list. Everything seemed to be going really well, but one of the most tragic events in his life occurred: the death of his son.

This makes me reflect on the importance of cycles. From Howard Marks to Ray Dalio, they have all taken this into account, and it has allowed them to earn many (b)illions.

That's why, perhaps, what Samuel teaches us is more of a life lesson than anything else.

Back to the Markets

When I first published this article, Bitcoin was trading at $28,000.00, the S&P 500 at 3,855, and the price of an ounce of gold was around $1,800. It seems like magic, but it's not. At that time, most investors were talking about 2023 being a bad year. We thought just the opposite, and the facts speak for themselves.

In case you haven't noticed, the year 2023 is on line 'C,' which means it's a buying season.