The Fed Has Just Made a Huge Policy Mistake

It's the time for Small Caps

The Federal Reserve of the United States has just announced a decision that has left many finance experts perplexed: increasing the benchmark interest rate by 25 basis points and continuing with their balance reduction program amidst a banking crisis, tightening lending standards, and deeply negative leading economic indicators. To put it plainly, the Fed has just made a serious mistake in their monetary policy.

Every time the Fed has left such a long period without incoming (or negative) money flows, the same thing has always happened… Recession.

It is striking that in 2021, when inflation was at concerning levels, the Fed kept the interest rate at zero and continued with their quantitative easing program. However, now that banks are in crisis, credit is tightening, and leading indicators are in the red, the Fed does not see a recession on the horizon. Surprising, isn't it?

It is important to highlight that several ecommerce, fintech, and software companies are currently unprofitable according to GAAP, but are already generating free cash flows. If interest rates have reached their peak for this cycle and the economy weakens, these companies should once again attract investment dollars.

Although software stocks have undergone a strong correction recently, their valuations are now much more attractive and their growth, recurring revenues, and stable cash flows could be very interesting during a recession, when other companies see declines in their revenues. Additionally, the decrease in interest rates should also benefit them.

It is highly likely that today was the last Fed rate hike for this cycle. Under this scenario, a major obstacle for long-term stocks has now disappeared. As the economy wobbles and the recession looms closer, it is likely that growth stocks will show relative strength compared to cyclicals and "old economy" stocks.

This bear market in the high-growth tech space is very similar to the TMT collapse of 2000 to 2003. Similarly, the 70% to 90% drops in high-quality ecommerce, fintech, and software stocks present investors with a good opportunity to generate a high internal rate of return in the long term.

https://twitter.com/asymmfinance/status/1653995831647666177?s=20

The second half of 2023 may be a turbulent period due to the impending recession, but the valuations of out-of-favor secular growth businesses are now quite compressed, so shareholders are likely to capture most of the long-term business growth.

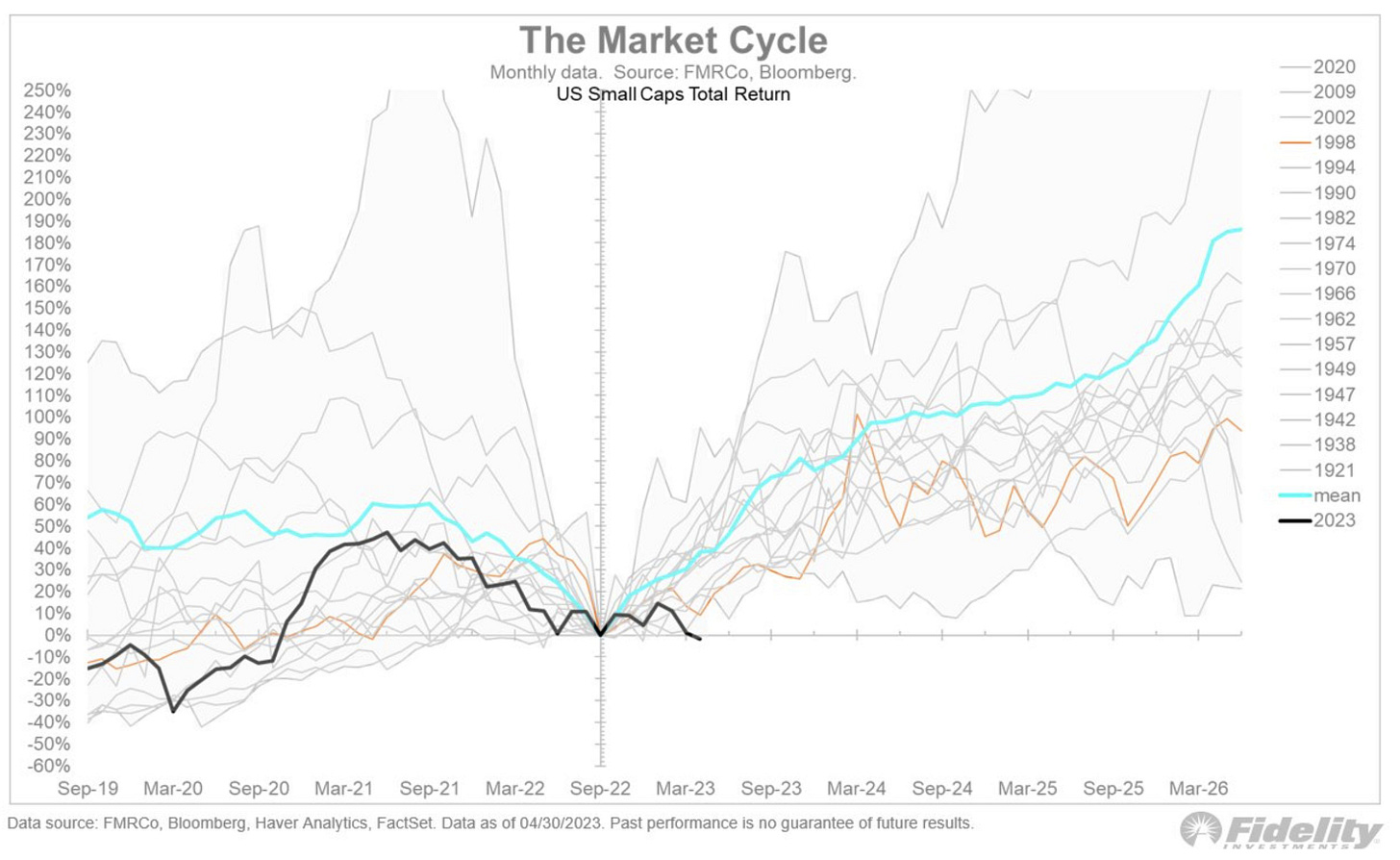

Small Caps

Undoubtedly, over the next two years, we will see high-growth and high-risk stocks have a major rally. This is usually because the Fed will quickly start printing again, which is good for assets like gold and Bitcoin (as we have said several times before).

But if you are not into investing in these types of assets and prefer to look for the next Amazon, this is also your moment. To do this, it is ideal to look for growth stocks with a low market capitalization (small caps). This type of stock has generally performed very well in these types of situations, and there is a great deal of potential for all of them.

Doing a quick screener on Finviz, we would be left with the following: high growth, high margin, and high ROIC.

Now our asymmetric portfolio in detail