The Fed’s Decision Could Change Everything

Why This Cycle Could Be Your Last Chance to Profit Big

Let’s Talk About Current Events. We’re in a moment of pure optimism. Markets are riding the wave, with the S&P 500 hitting over 50 record highs this year alone. Meanwhile, the "Magnificent Seven" keep doing what they do best, driving the show upward.

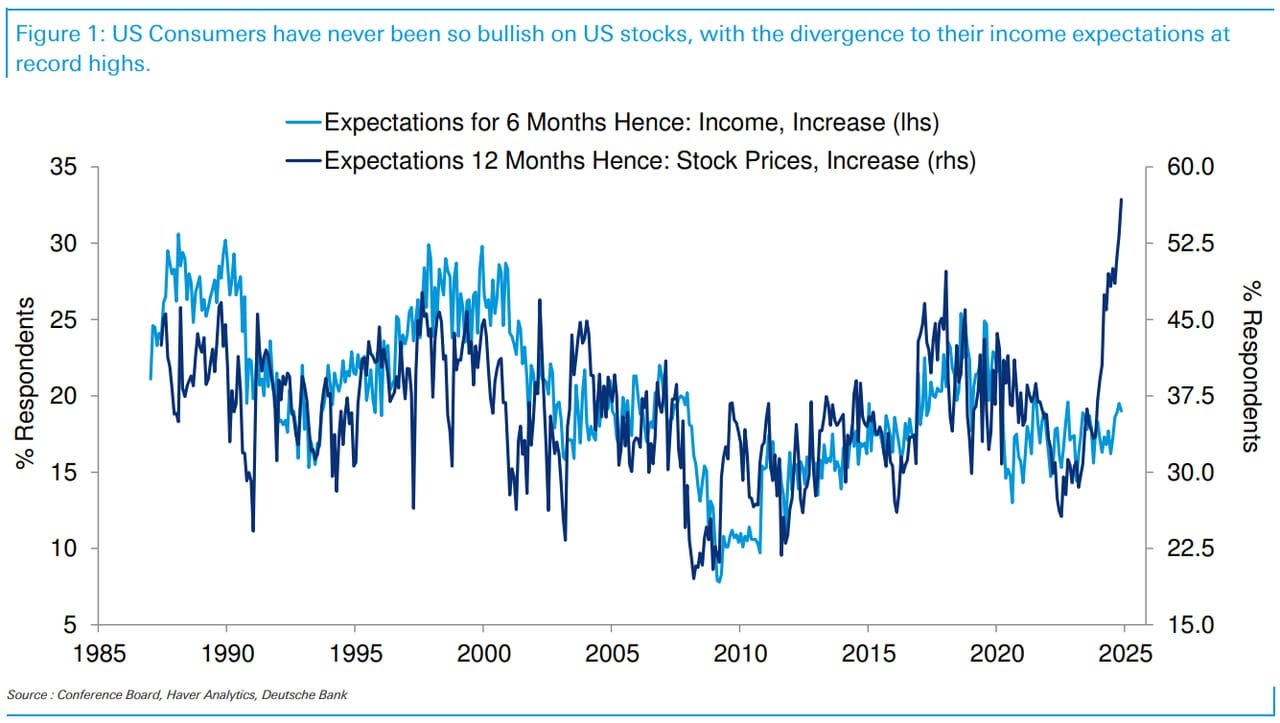

It feels like we’re caught in an endless spiral, with the moon as the only limit. In fact, investor confidence for the next 12 months has reached unprecedented levels. The last time we saw optimism like this? The year 2000.

As you know, this kind of euphoria often coincides with periods where real and nominal returns on assets take a nosedive. It’s precisely during these moments that we see everything contract significantly.

From our perspective, things are playing out exactly as we anticipated. With remarkable accuracy, the markets are behaving just as we expected—following, yet again, the liquidity cycle.

This cycle, which lasts about four years, perfectly outlines where we are now and how long this party might continue.

A Familiar Chart

The chart below may not surprise you. Interestingly, we shared this same chart a few months ago, predicting Bitcoin's behavior. Back then, many were skeptical, as Bitcoin had dropped from $70k to $50k.

So, what happened?

Exactly what we predicted—with impressive precision.

This isn’t unique to this cycle; it’s something we’ve observed in markets for years. Liquidity significantly influences how high-risk assets perform. The higher the asset's risk, the stronger its correlation to liquidity.

The Capitalist Engine. Just like any business in a capitalist world, when money runs out, more is needed. And usually, this happens every four years. This new influx of cash serves two purposes:

Paying off interest.

Ensuring survival for another four years.

This process results in two inevitable outcomes:

Money loses value over time.

More money is required each time.

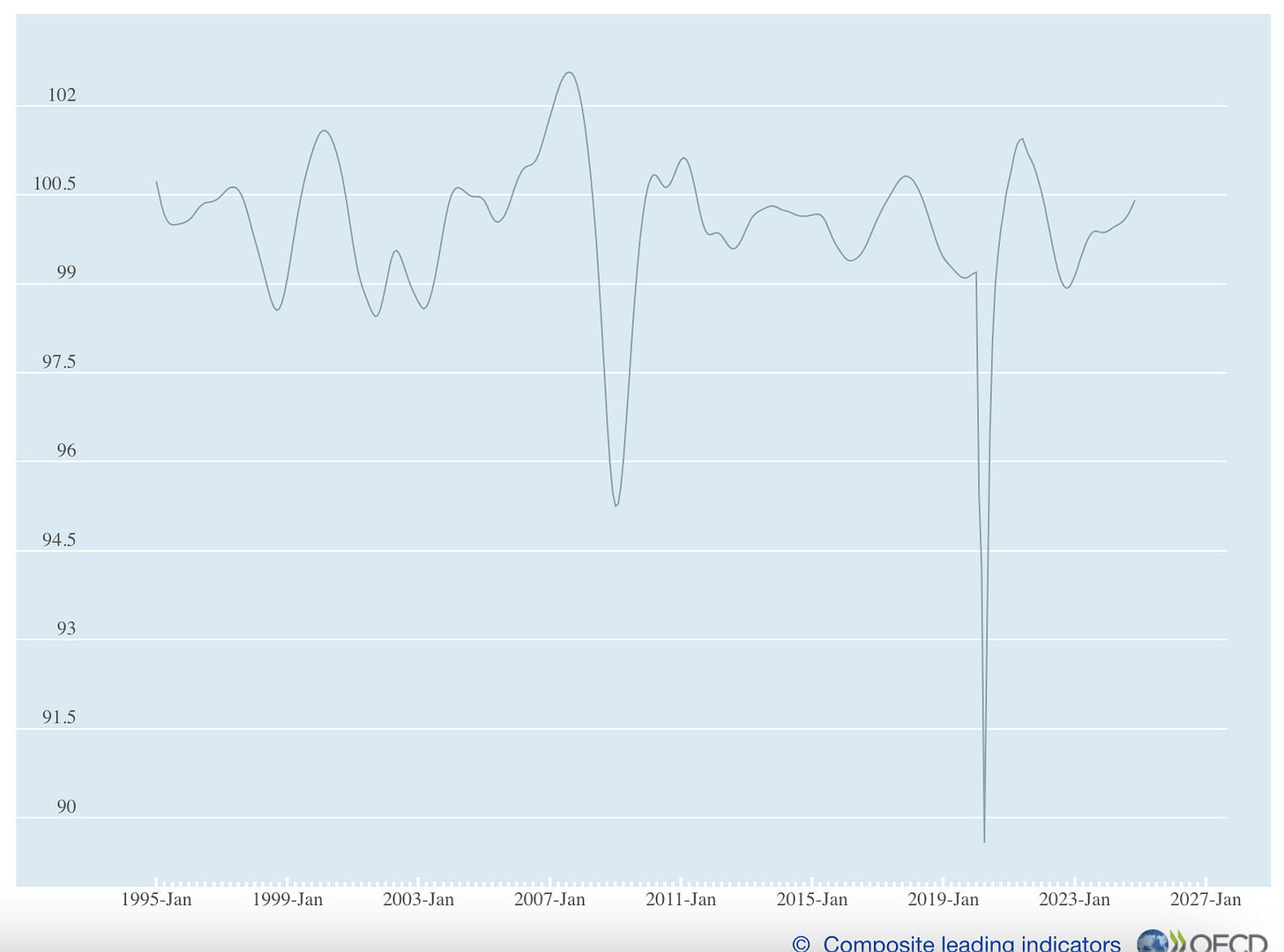

As you can see, the years of declining liquidity follow a predictable pattern: 2014, 2018, 2022… and now, 2026.

It seems we’re entering the beginning of another bearish cycle, which could last throughout next year. If we look at one of the most reliable forward-looking indicators of market behavior, it suggests we have another 6–12 months before reaching previous peaks.

The Key to Winning

One thing is clear: in today’s world, if you don’t understand money, you can’t make money. That’s why, week after week, we explain what money is, how to protect yourself from inflation, and how to use the right tools to grow your wealth meaningfully.

Next week, the Fed is set to meet and decide whether to lower interest rates. All signs point to a cut. But the challenge of doing this in a roaring bull market is that when you need a tool to stop a market collapse later, you won’t have one.

Let’s hope the Fed plays this wisely. They’ve perfected their mechanisms remarkably to sustain this entirely imaginary spiral.

We’ll see what next week brings. Meanwhile, our portfolio continues hitting record highs week after week. Let’s dive into the details of what we’re doing.