The Financial Forecast That CEOs Are Worried About—And You Should Be Too

A Financial Reset Looms: How to Protect Your Future in Uncertain Times

For several months, or rather several years, a series of strange events (to put it mildly) have been occurring in the world that I do not particularly like.

To understand this, I want you to consider the following phrase that I recently read in a very good book by Howard Marks:

I couldn't agree more. We live in a complacent world, where people live day to day without the slightest incentive to save. You know what they say about strong generations making weak offspring, and that is precisely what is happening.

Not to mention, the main problem CEOs face, according to a survey conducted this year, is their inability to find talent.

So, many years ago, I decided to take some measures to safeguard the financial security of my family and, why not say it, to benefit from this lack of talent.

As I always like to remember, it's important to get rich, but it's even more important to avoid going broke.

The former requires the latter.

With that said, in today's newsletter I will tell you the reasons why I've been a bit worried lately (financially speaking), and in the following ones (I'm not exactly sure which one)...

...I will explain the defensive measures I am going to implement in my portfolio, my finances, and my life to be antifragilely exposed to these events.

As I was saying, the world has become a rather uncertain place where it is increasingly difficult to keep your money in your wallet.

Judge for yourself:

1. Prices are the enemy

As I write these words, inflation is skyrocketing worldwide, whenever I speak to people older than me, they talk about something unprecedented. Their purchasing power has been reduced like never before. I could show the chart of how much a dollar has depreciated in recent years, but it's not worth it.

Especially worrying to me are the price increases in:

- Electricity.

- Fuel.

- Food.

- Housing.

These goods and services are essential for most people, and their prices are practically at an all-time high.

We would have to go back to the 80s (a decade in which people lived with very few luxuries and in a very austere way, by the way) to find similar inflation.

2. Politicians worldwide are idiots: or rather, they are not at all good

Intervening in the economy is not a good idea.

It sounds good in the (immature) minds of some (immature) people, but it goes wrong in practice. Always.

History shows that when politicians decide to meddle in a country's economy with the pretext of

"helping the poorest," that country ends up becoming an inexhaustible source of poverty, hunger, and misery.

Cuba, Venezuela, and Argentina are good examples.

This money and these aids generally end up in the hands of people who do not add value (and who also do not save it).

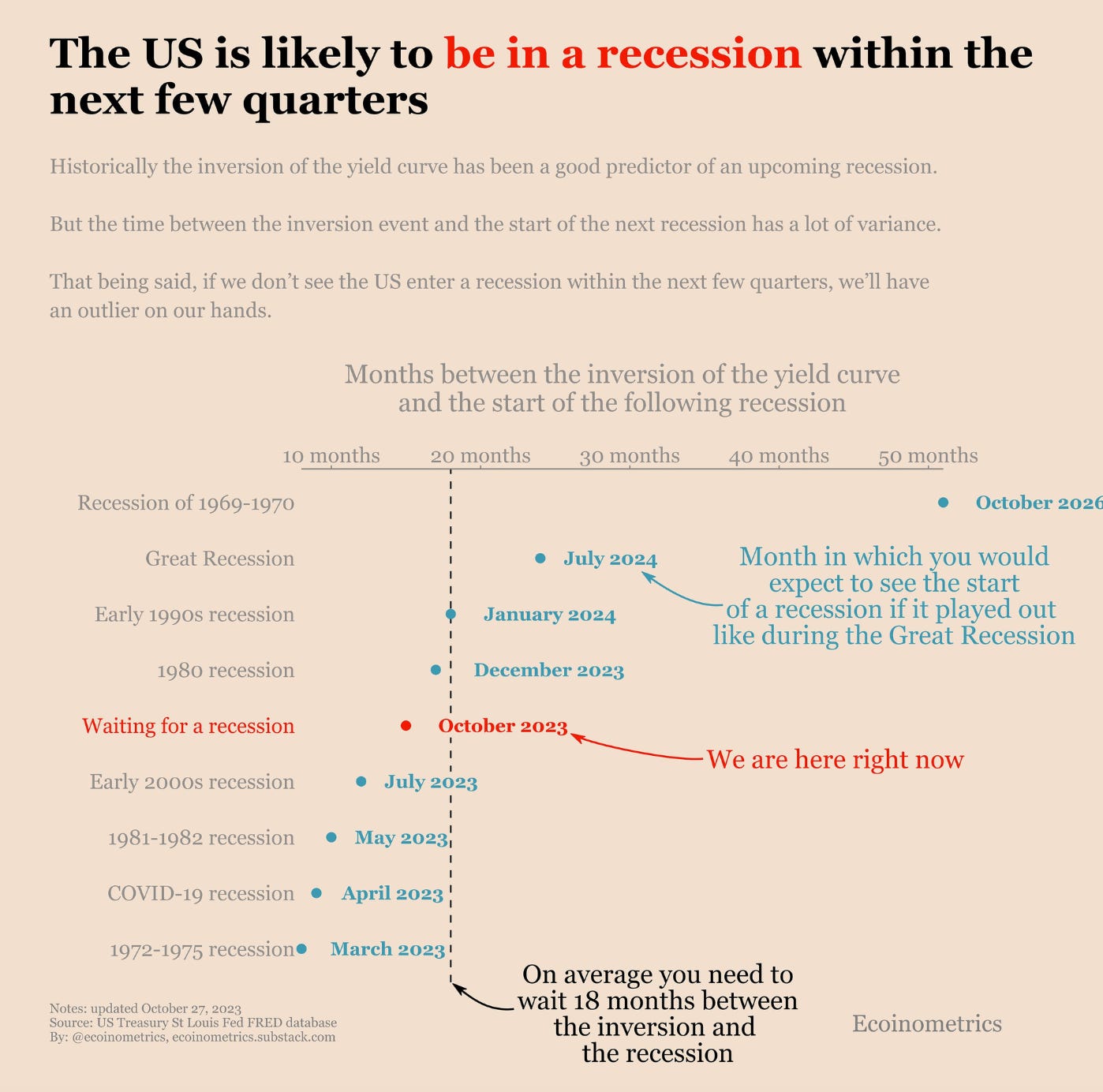

The economic environment is quite desolate. An inversion of yield curves has always led to an economic recession. Again, always. If you want to know when it would hit us on average, it would be in January 2024. Although I believe it will not be exactly at that time.

3. A real estate bubble is brewing

I have a very fresh memory of the last real estate bubble (2006-2008). When it burst, it caused a huge mess.

Now I look around and see cranes everywhere, "For Sale" signs, continuously rising prices, and people still unable to afford mortgages, taking them non-stop. It seems history rhymes.

Despite this, at this point, we should make a distinction.

A real estate bubble is bad or very bad for 99% of people, but it can benefit those who:

A real estate bubble is bad or very bad for 99% of people, but it can benefit those who:

1. Have brains and know how to use them.

2. Have liquidity.

If you meet both requirements, you might be able to find a good investment opportunity when the bubble bursts and everything goes to hell.

4. Interest rates are on the rise

When the Central Bank raises interest rates, what it's really doing is charging private banks more money for the loans they take out from it.

The main banks of the countries buy "expensive" money, to compensate for it in their results they raise the interest rates of the loans they offer to their clients.

In parallel, the interbank interest rates (which is the rate at which banks lend money to each other) are also affected by the rate hike and rise, thus mortgages become more expensive.

The result of all this is that personal loans, mortgages... (all debts, in general), become extremely expensive.

This expensive debt is bad news for people who have a variable-rate mortgage, for example.

Also for those who, for some reason, need to go into debt (to buy a car, make a renovation, start a business...).

If loans are becoming more expensive, people borrow less, which contracts consumption and slows down investment.

And this is not good for the economy.

On the other hand, mortgage defaults increase.

5. The system is completely adulterated

I could go on and on about this point, but I'll summarize it with two very simple and easy-to-understand facts:

1. Public debt (money borrowed by governments) has been out of control for at least a decade. This has never happened before in the history of humanity. Or at least not in such a wild way. The debt in (almost) all countries of the world is over 100% of GDP.

2. The printers that produce euros/dollars are also out of control. We are creating money out of thin air beyond our means. This has also never happened before in the history of humanity.

These two circumstances could blow up the financial world as we know it. Our welfare state and our quality of life could go to absolute zero overnight.

It would be apocalyptic. A reset. Something never seen before. For the human brain, this hypothetical situation is almost unimaginable.

But... will we come to see a financial collapse of these dimensions?

I would say no, but we must be prepared for what we do not know we do not know.

So call me a conspiracy theorist, demented or idiotic, but this smells fishy to me.

I see hidden interests to destabilize our current situation and I see that there are things that are not being told to the citizen.

I will soon tell you what can be done, or rather what I am doing to make a portfolio as asymmetric as possible. In fact, below I leave you our current portfolio.