The Freedom Portfolio

How to Live Without Selling Anything

Most people stay stuck because they don’t understand where the real numbers are. They keep playing the game of small savings, spreadsheets, and 7% compound returns. You know the story: if you skip your daily five-euro coffee and invest it in an index fund, in 40 years you’ll have a million dollars. It sounds clean, logical, and safe. But nobody ever gets there. Because nobody lives 40 years in a straight line, and the world doesn’t stay stable for four decades. It’s a mathematical illusion designed to keep you obedient.

Small savings don’t make you free. They just keep you busy.

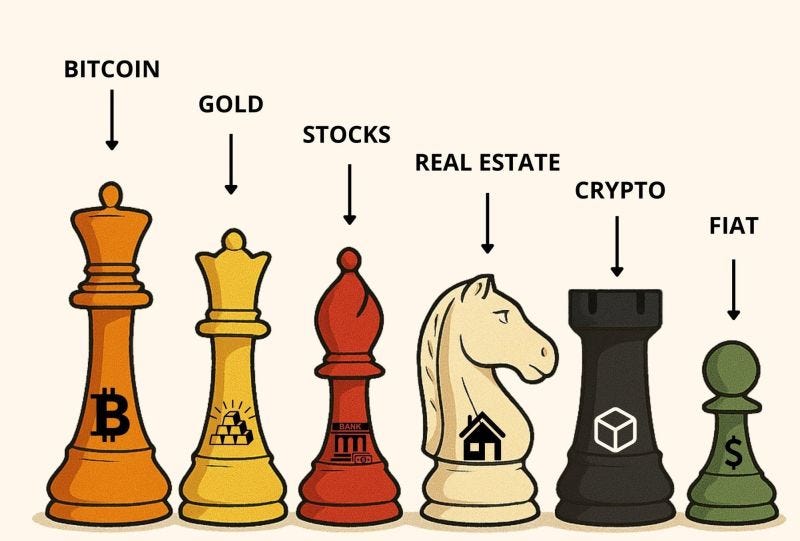

Freedom comes from understanding scale. If you have half a million in hard assets: Bitcoin, gold, solid real estate, real equity you don’t need to think about coffee or budgeting. You think about structure. Because when you own hard assets, you don’t need cash, you can create it.

Imagine you hold €500,000 in Bitcoin. You sit down and ask yourself, “How much can I spend each month without touching my base?” The answer isn’t selling. It’s borrowing.

Today you could easily borrow €5,000 to €6,000 a month against that collateral. Suppose it costs you 5% per year in interest, while Bitcoin compounds at 10% on average (a conservative assumption over a long horizon). The net difference is 5%.

Five percent on half a million is €25,000 a year. Over 10 years, without selling, that base grows to over €1.1 million, while you’ve used around €600,000 of borrowed liquidity to live. All while your core position kept compounding.

See the difference? The traditional saver spends 40 years trying to hit one million. You live ten years off your asset without selling it and end up with double the wealth.

Now imagine your base is one million. You can live comfortably on €10,000–€12,000 a month without touching it. The cost of debt is marginal compared to the growth rate of your hard assets. And if the asset drops, fine, you adjust the debt layer, rebalance, and keep compounding. It’s a dynamic system.

The coffee saver isn’t investing, he’s avoiding risk. But the one who understands that wealth comes from using his balance sheet as a weapon, not a prison, plays a completely different game.