The Greatest Recession of the Last 100 Years in 2025

The Impending Recession

If you have been following us for a while, you'll know that we don't pay much attention to the major newspapers or economic magazines. In fact, we prefer to do the opposite of what they suggest.

We have several reasons for taking this stance, but in the past three years, we have witnessed two clear examples. Firstly, when the Federal Reserve (FED) stated that inflation would be transitory, we disagreed from the start. We argued that the doubling of money in circulation would have severe consequences for the economy, and that turned out to be true.

On the other hand, we have the case of this year, 2023. All analysts warned us that it would be a tough year for the markets. However, we are seeing the major indices grow by over 20% so far.

This growth can be attributed to global liquidity. In recent months, liquidity has increased, and this has been reflected in the indices. In fact, the indices don't reflect the profits of the companies but rather allow us to maintain our purchasing power in relation to the liquidity generated in the markets. It's sad, but it's the reality.

It's important to note that traditional media is often influenced by specific interests and may not provide a complete picture of the economic situation. Instead, we prefer to rely on our own analysis and evaluate economic trends from a broader perspective.

Although this doesn't mean that we always get our predictions right, we have learned to be cautious and consider multiple factors before making investment decisions. We maintain a critical mindset and seek diverse and reliable sources of information to make informed decisions.

These informed decisions are backed by macroeconomics 95% of the time. Macroeconomics guides the markets, and its influence is growing. While it's possible to play the game of picking the best company that will achieve a 10x return in the next five years, those involved in sectors like professional services often find that an investment thesis rarely moves a company's stock price significantly. It's common to encounter people who argue things like:

"This company will grow because it is investing in this raw material..."

"This company will double its sales because it has an AI department..."

It's understandable that friends and family may try to convince us with such categorical statements. However, for some time now, when someone makes a strong assertion like the one I just described, I prefer to remove that company from my list of investable options.

Now, what will happen to the markets?

The value of this email that I am sending this week is invaluable. I would say it is infinitely better than anything you can read on any forum. Let me talk to you about what your investment strategy should be for the next 12 months (until 2025).

While I have already shared this chart on previous occasions, I will proudly present it again.

It is highly likely that we will see new all-time highs in the indices in the coming months, despite the recession predictions for 2023 made by those analysts. This is mainly due to the return of liquidity to the markets, as mentioned earlier.

In fact, Bitcoin could be the big beneficiary in this situation. Last week, we already discussed the price target for 2025, one year after its halving. The prospects are favorable for this cryptocurrency.

The Impending Recession

We are facing the worst recession in the past 100 years, which is a cause for concern. This period of economic growth is not sustainable on its own, as it is accompanied by an economic cycle that is likely to burst. In fact, there is a possibility that we may face one of the worst recessions since 1929.

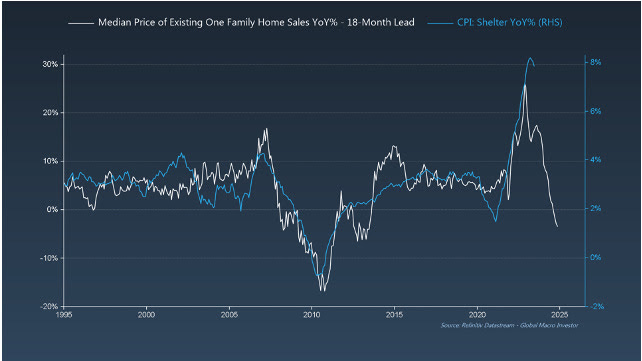

This situation arises from the likelihood of housing prices plummeting and presenting investment opportunities in stocks and the real estate market. If we look at the following chart, we can see how housing prices could be affected.

In light of this scenario, it is essential to have a portfolio that is fully prepared for any eventuality. Additionally, it is important to have a portion of our portfolio in out-of-the-money (OTM) options to protect ourselves against possible unforeseen events, such as black swan events.

It is crucial to have a solid and cautious strategy during this recession, carefully considering the opportunities and risks that arise. Staying informed and making decisions based on sound fundamental analysis will be key to successfully navigating this challenging period.

Our portfolio…