We are witnessing the greatest social inequality of all time. Yesterday, I came across a striking fact: the average European needs to save for up to 37 years just to afford the down payment on a home. I’m not talking about the mortgage itself, but only the initial deposit.

To many, this may seem like just another number, but it made me reflect deeply on our current reality. We are living in a generation whose principles and aspirations are radically different from those that historically existed. The idea of owning a home is quickly fading away, and this is redefining our perception of what it means to have financial stability and to belong to the “middle class.”

In the past, families worked and saved with the intention of building their wealth through tangible assets like a house or a car. Today, many young people have given up on that idea and prefer to spend what little money they can save on services, on experiences that are enjoyed in the moment and disappear instantly. The problem is not the preference for experiences, but that this generation has been left with no other choice.

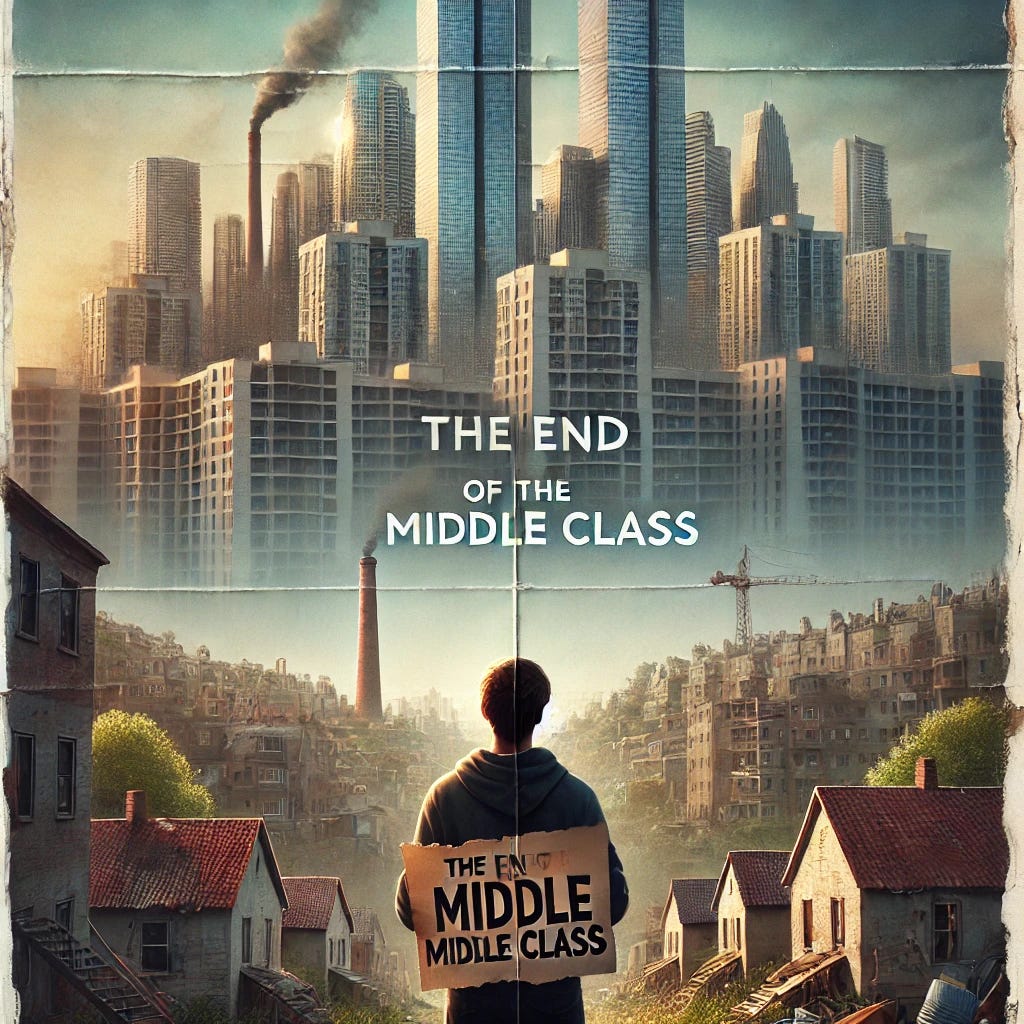

What does it mean to be middle class today?

The expectations and realities of the middle class have changed drastically over time.

40 years ago, being middle class meant owning a house and a car.

20 years ago, being middle class was owning a house (albeit a smaller one) and a car (perhaps a cheaper one).

5 years ago, being middle class meant being able to rent a home.

Today, being middle class means being able to rent a room, which in many cases consumes more than 50% of monthly income.

This transformation is not accidental. Several factors have converged to create this situation: a housing supply that has not kept up with demand, wages that have stopped growing at the same pace as productivity, and uncontrolled inflation due to the continuous printing of money. The result is that those without assets are becoming increasingly impoverished, while those with large fortunes continue to see their wealth grow.

The numbers are staggering: the 100 richest people in the world hold as much wealth as the poorest 50% of the global population. This is not just economic inequality; it reflects a system that does not distribute opportunities and pushes the majority into perpetual precariousness.

Financial illiteracy as a poverty trap

We are also facing widespread financial illiteracy that acts as a poverty trap. People spend thousands of hours studying for a college degree, obtaining titles, or simply wasting time on social media like TikTok, but they don't invest even a fraction of that time learning how money works.

It’s not about being a finance expert or knowing how to analyze companies like an auditor or a professional investor. The basics would be to understand what money is, how it’s created, and how to avoid its value from degrading every day.

This financial ignorance limits people's personal freedom. It prevents them from making informed decisions about their future, like leaving a job they hate, or, in the rare case that they do manage to save some money, they don’t know how to preserve or grow it. In the end, many of these people, even when they succeed financially, end up spending inefficiently and don't know how to build a solid future wealth base.

The intergenerational wealth trap

At some point, I’d love to share in another article how I believe wealth can be preserved across generations. Interestingly, wealth rarely survives beyond the third generation. Statistics show that 70% of wealthy families lose their fortune by the second generation, and 90% lose it by the third.

The cause is not only poor management but also the lack of proper financial education and a clear strategy for transferring assets. It's very common for the younger generations to receive a lump sum without knowing how to handle it. In many cases, this money quickly disappears through failed investments, unnecessary expenses, or lifestyles that cannot be sustained over the long term.

But before we talk about how to preserve wealth across generations, we first need to understand how to create it. And this is where the true value of financial knowledge lies:

Understanding how money is created.

Knowing how to leverage the system to avoid paying for debt and to follow the same rules that the rich use.

Learning which assets will endure over time and which will become a financial burden.

Conclusion: Invest in knowledge and build wealth

I often come across people who focus on things that don’t matter. A classic example is when someone working at a financial consulting firm tells you: “I can’t say much, but I think a green-colored company will perform well on the stock market.” To which I always think the same: the more passive your investment and the better you understand the rules of the game, the more money you’ll make.

The essential thing is not to keep track of which company will go up, but to know the system's rules and how to adapt to them. My recommendation is to start building your own wealth as soon as possible, as this will provide greater financial security in the long run. And if you are no longer so young, teach your children or younger family members. Truly, a small gesture like instilling this mindset can change their lives.

I hope this reflection has provided you with value and, as I mentioned, in another article we’ll discuss how to make wealth last and endure across generations. Because, in the end, what’s the point of earning money if you can’t preserve it and pass it on to those who matter most to you?

Now, let’s dive into the details of our portfolio.