The Importance (and Cost) of Staying Invested at All Times

'Market Timing' or 'Buy and Hold'

Investing is an activity that requires constant decision-making, and generally, investors are divided into two groups:

Those who try to predict market movements to buy and sell at the best time (market timing).

Those who choose to hold their investments for the long term (buy & hold).

In my opinion, for a small investor, the most efficient option is to always stay invested, and I will explain why below.

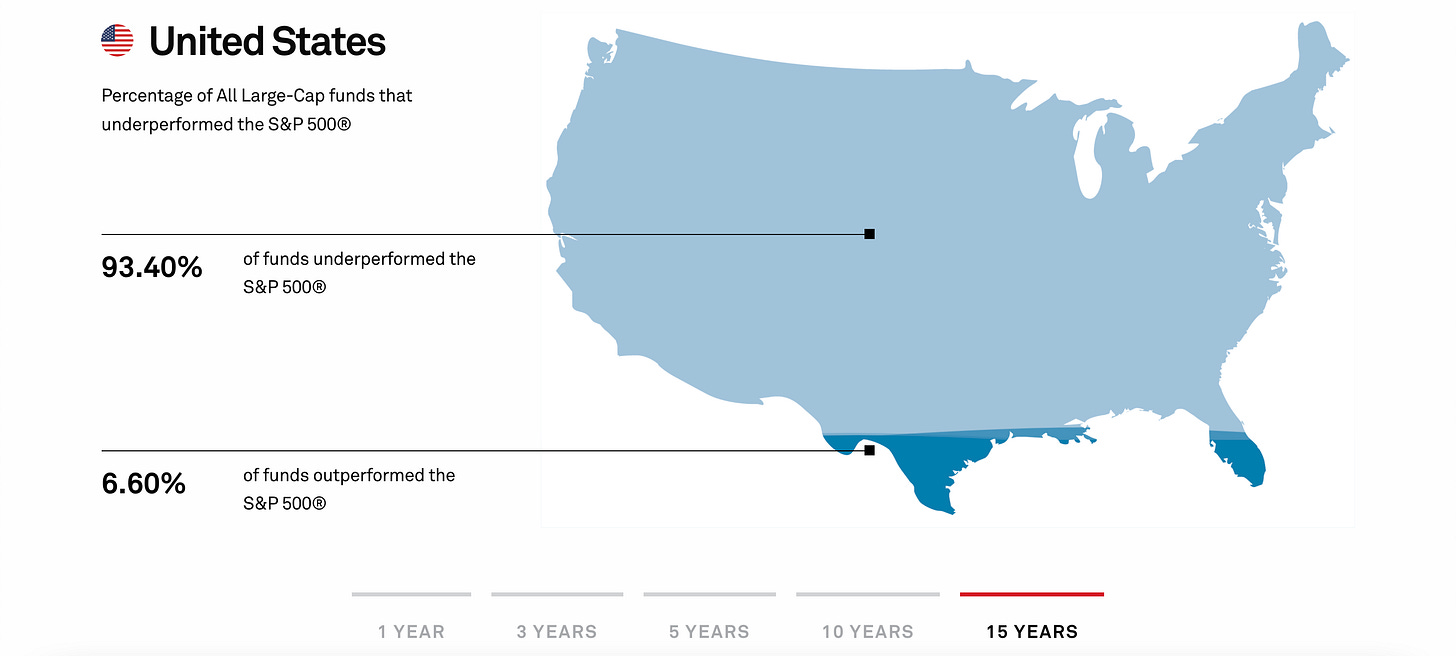

Firstly, getting the timing right to enter and exit the stock market is not an easy task, but rather impossible. Even the best investment fund managers are not able to achieve it sustainably for several years. According to the SPIVA report, around 90% of investment funds in the United States were unable to outperform the S&P Composite 1500 index over a period of 15 years.

Additionally, any unexpected event, such as an economic crisis or a pandemic, can derail the investor's initial intention. On the other hand, continuously buying and selling incurs an additional cost in commissions and taxes, which reduces the actual profitability.

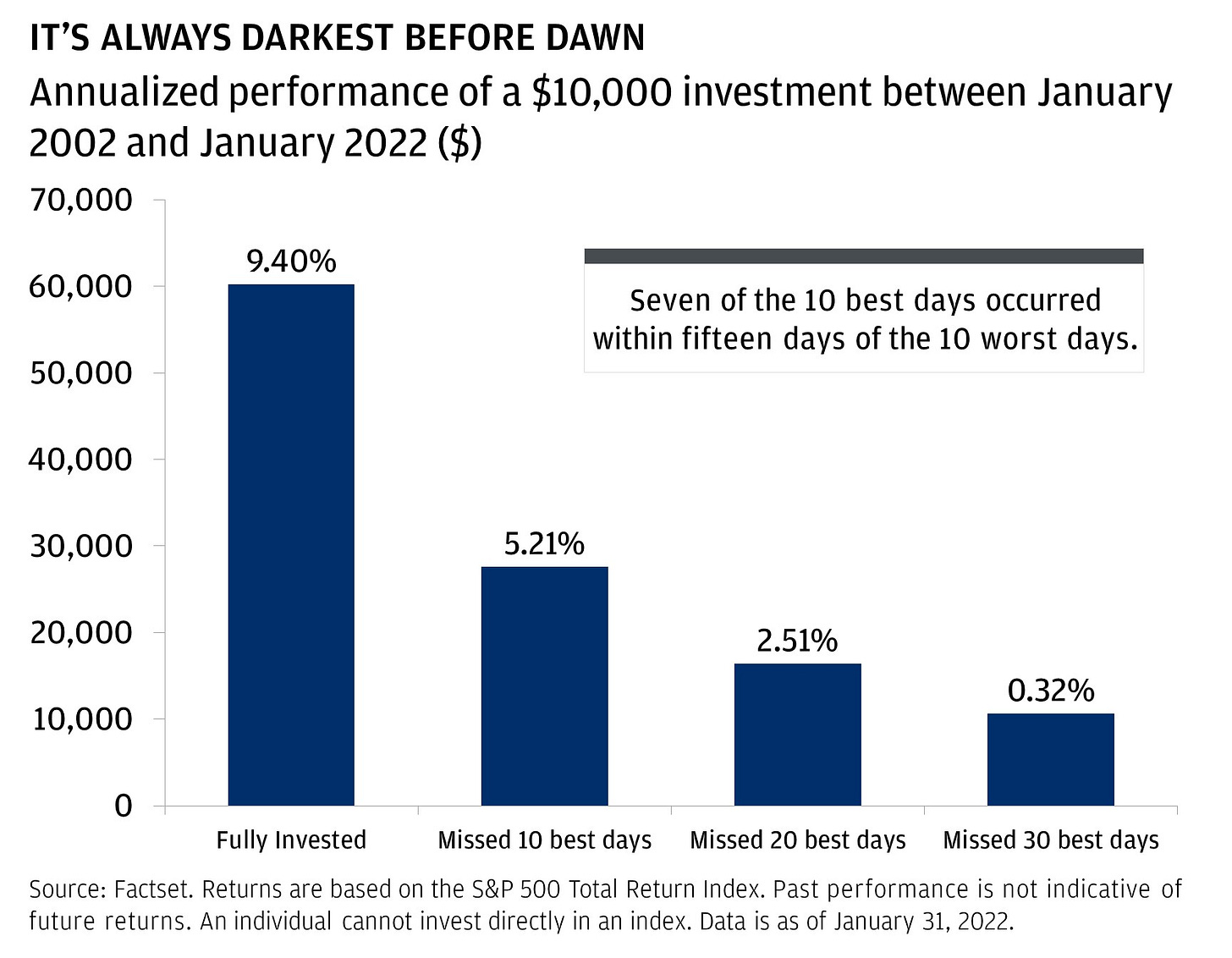

Secondly, when doing market timing, there are times when one is not invested, which carries the risk of missing the best days of the market. An analysis by JP Morgan Asset Management shows significant differences in returns based on the market days missed. Missing the 30 best stock market days out of a total of 20 years makes the return almost 0%, even though one has been invested the rest of the time.

And missing just 10 days reduces the return by half. The biggest stock market gains are usually concentrated in a few days, right in the middle of periods of instability and high volatility.

Lastly, long-term investment is the most profitable and efficient. Compound interest and risk reduction over time work in favor of the investor. According to a Bloomberg study, no investor would have lost money in the US stock market during periods of at least 15 years, even if they started investing at the highest point before any economic crisis.

In addition, minimum and maximum returns narrow as the investor remains invested. For example, if the MSCI ACWI index is used as a reference from 1989 to 2019, the return would fluctuate between -49.5% and +54.7% if invested for only one year, but would stabilize between 0.8% and 10.5% if held for 15 years without touching the investment.

As a seasoned finance professional, I would like to provide some honest insights on the world of investment. While a buy-and-hold strategy may seem like the go-to approach for many investors, the truth is that it is not always feasible in today's market. This is due to the fact that funds/ETFs are often created in response to major crises, with a primary focus on generating higher returns and, consequently, more revenue in fees.

As a result, witnessing days of significant growth in the S&P 500 may not always be as straightforward as it appears. Take the following ETFs, for example, which have some of the largest capitalizations:

SPY: the only one that has truly delivered on its promise, created in 1993.

IVV: created in 2000, just after the dot-com bubble.

VOO: created in 2010, just after the 2008 crisis.

VTI: created in 2000, just after the dot-com bubble.

QQQ: created in 2000, just after the dot-com bubble.

As you can see, it can be quite challenging to achieve consistent returns over this period.

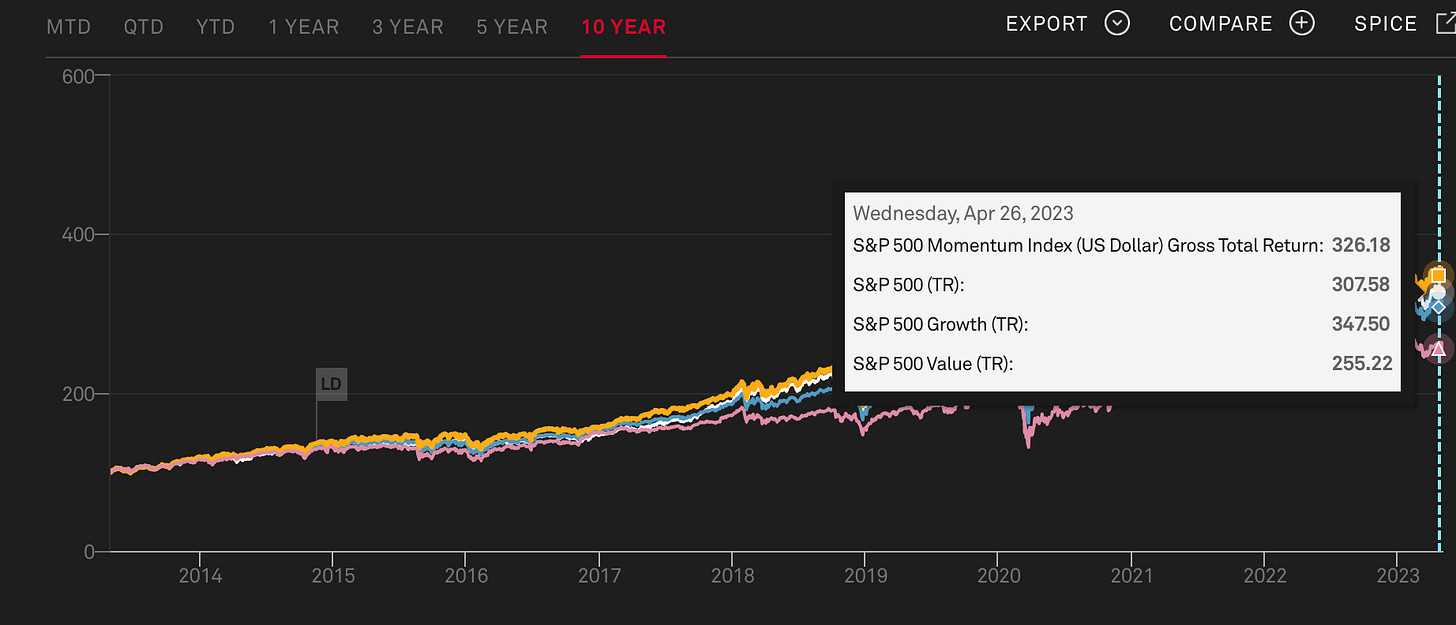

However, there are certain patterns that have been shown to outperform the index significantly. To achieve this, a well-defined system must be in place. For example, investing in factors with a growth or momentum strategy is much better than investing directly in the index.

This holds true on a global scale as well.

In conclusion, investing in the index may allow you to avoid many headaches, and even major market fluctuations. It won't matter if value or growth drops or if a particular bank goes bankrupt. You know that your index will never, and I repeat never, go bankrupt.

However, having entry and exit strategies or playing with leveraged ETFs can give you a clear advantage over always being invested. But this advantage can only be obtained if you acquire a well-defined system.