The Importance of Monitoring the Short-Term Yield Curve for Financial Professionals

A Critical Indicator for Financial Planning and Investment Strategy

It's crucial to understand the importance of monitoring the short-term yield curve for predicting potential market movements. The yield curve is a graphical representation of the relationship between interest rates and the maturity of bonds of the same credit quality.

The yield curve is generally upward sloping, which means that longer-term bonds have higher yields than short-term bonds. However, there are times when the yield curve can invert, which occurs when short-term bond yields are higher than long-term bond yields.

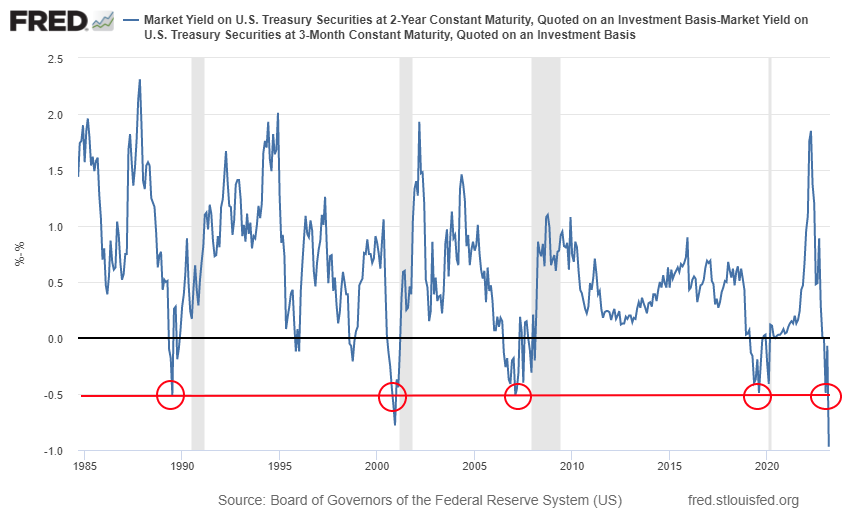

The short-term yield curve, which is the difference between the yields of 3-month Treasury bills and 2-year Treasury notes, is a critical indicator of market conditions.

When the short-term yield curve is inverted, it can signal that the market is at a critical point where significant events may occur. The reason for this is that an inverted yield curve typically indicates that the market is expecting a decrease in interest rates in the future.

It's essential to note that the short-term yield curve is not the same as the more popular yield curves between short-term and long-term bonds.

However, the short-term yield curve can still provide valuable insight into market conditions.

When the short-term yield curve is inverted and falls below -50 basis points, it's generally a sign that the current cycle of interest rate hikes is coming to an end. This means that it's crucial for financial professionals to pay attention to the short-term yield curve and its movements.

It's worth noting that some market participants believe that it's dangerous to go against the Federal Reserve's (Fed) interest rate decisions. However, historical data shows that when the short-term yield curve inverts by -50 basis points or more, the market has consistently predicted that the Fed will start lowering interest rates immediately or has already started doing so.