The Market Is Overbought, And You Are Going To Lose Money

In a bull market, the game is to buy and hold until the bull market nears its end

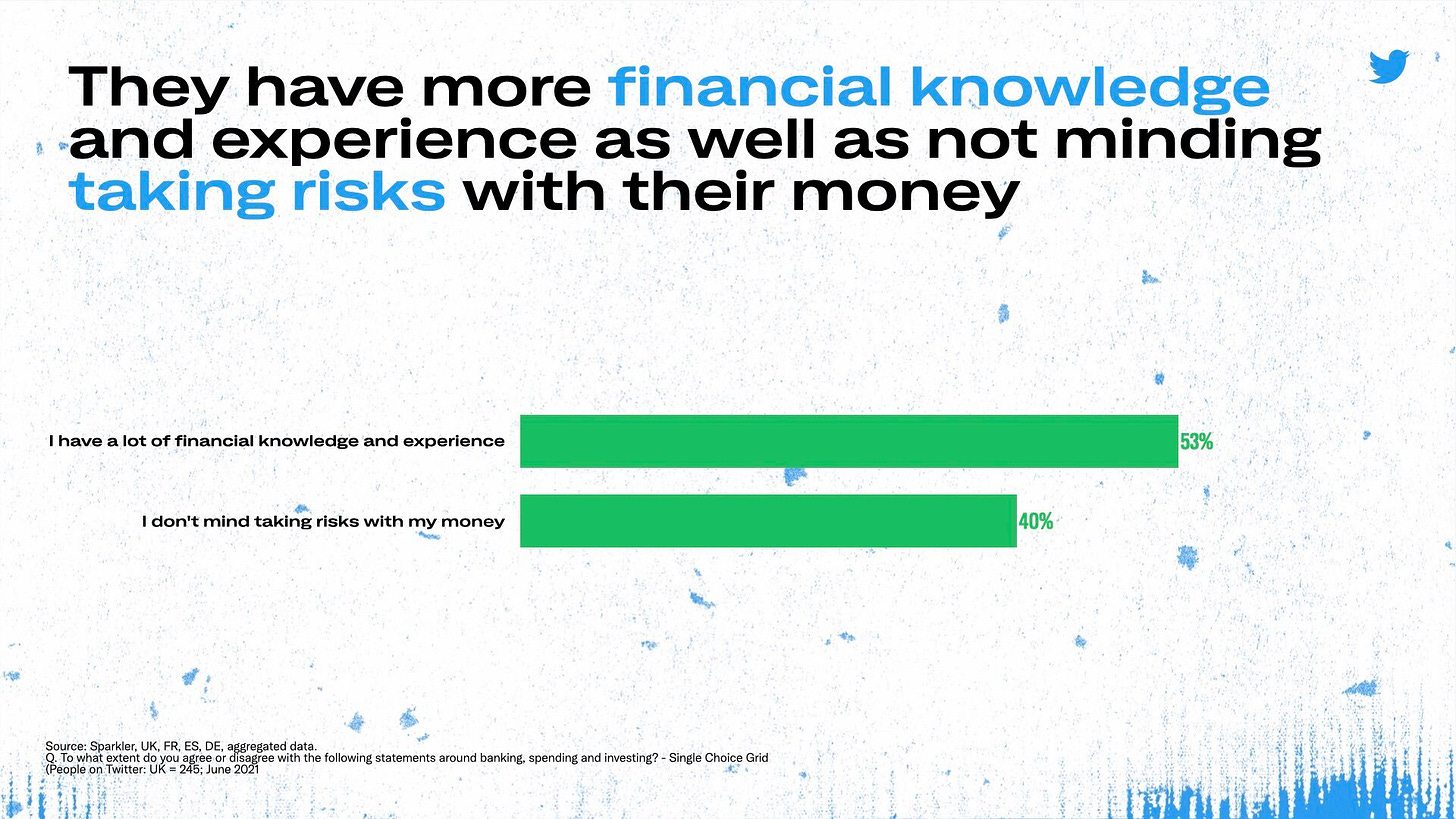

Twitter has become an extraordinary social network for the world of investment. You will find truly talented individuals who selflessly share investment analyses that surpass those of MBA graduates from the prestigious HBS. These individuals are passionate about the world of investment, and while some may label them as nerds and others accuse them of being impostors, they do it out of pure passion without seeking economic benefits.

Personally, I believe we are talking about true experts whose contribution is fundamental to succeed in this field. However, the most crucial aspect of investment is often overlooked: psychology. If I were to estimate its relative impact, I would say that psychology represents 80%, while selection represents 20% in the investment process.

In the second part, we can take advantage of the analyses shared by these accounts. When it comes to psychology, we can use the general sentiment on Twitter as a reference. Although I don't want to re…