The Most Coveted Asset in History Returns to ATH

Gold Skyrockets: Why You're Missing Out

Without making much noise, one of the main assets in our portfolio has turned into a win that has reached historical highs. This time, I'm not here to talk about Bitcoin, but rather about the most coveted asset for millennia, gold.

I often read that these highs are solely due to the liquidity of the asset, and this is unequivocally false. Today, I want to discuss why it can be a very good investment in the medium to long term.

We have been announcing this for many months. Obviously, gold does not follow a structure as cyclically as Bitcoin does. However, it is not deviating much from our initial thesis.

First of all, it's because we prefer gold over silver. There are several reasons, but the main ones are:

The market cap of gold compared to silver. Obviously, it is much safer to trade assets with a higher market cap because the volatility will be lower. In the case of gold, we are talking about the asset with the highest market cap that exists, approximately $13T.

It is an asset that all governments hold as a reserve of value. This makes it even more attractive. I remind you that governments are the ones that urge central banks to print more or less money.

The reason we prefer gold over silver is the following. While in times of price growth of silver, an increase in its extraction can be experienced, the same does not happen with gold. If the price of gold rose by 100%, miners could only extract at a maximum rate of 5% annually.

Once we have resolved why one metal over the other, what acquaintances and family always ask me is why not invest in miners (The same question arises with Bitcoin).

I always ask them the same thing, "What do you want to achieve with gold?". I always hope they have read this newsletter and the answer is to diversify, but that's not always the case.

If what they want is to diversify, that's not achieved with miners. Because while their price is highly correlated with gold during rises, the same does not happen during falls. If the stock market falls, the miners will also fall.

What we aim for with gold is to be uncorrelated and have an asymmetrical portfolio.

Gold is the clear example that correlation does not imply causation. Often in the world of finance, graphs indicating rises or falls are used, assuming that history will repeat itself. This is not always the case, as there are as many graphs as there are data, infinite.

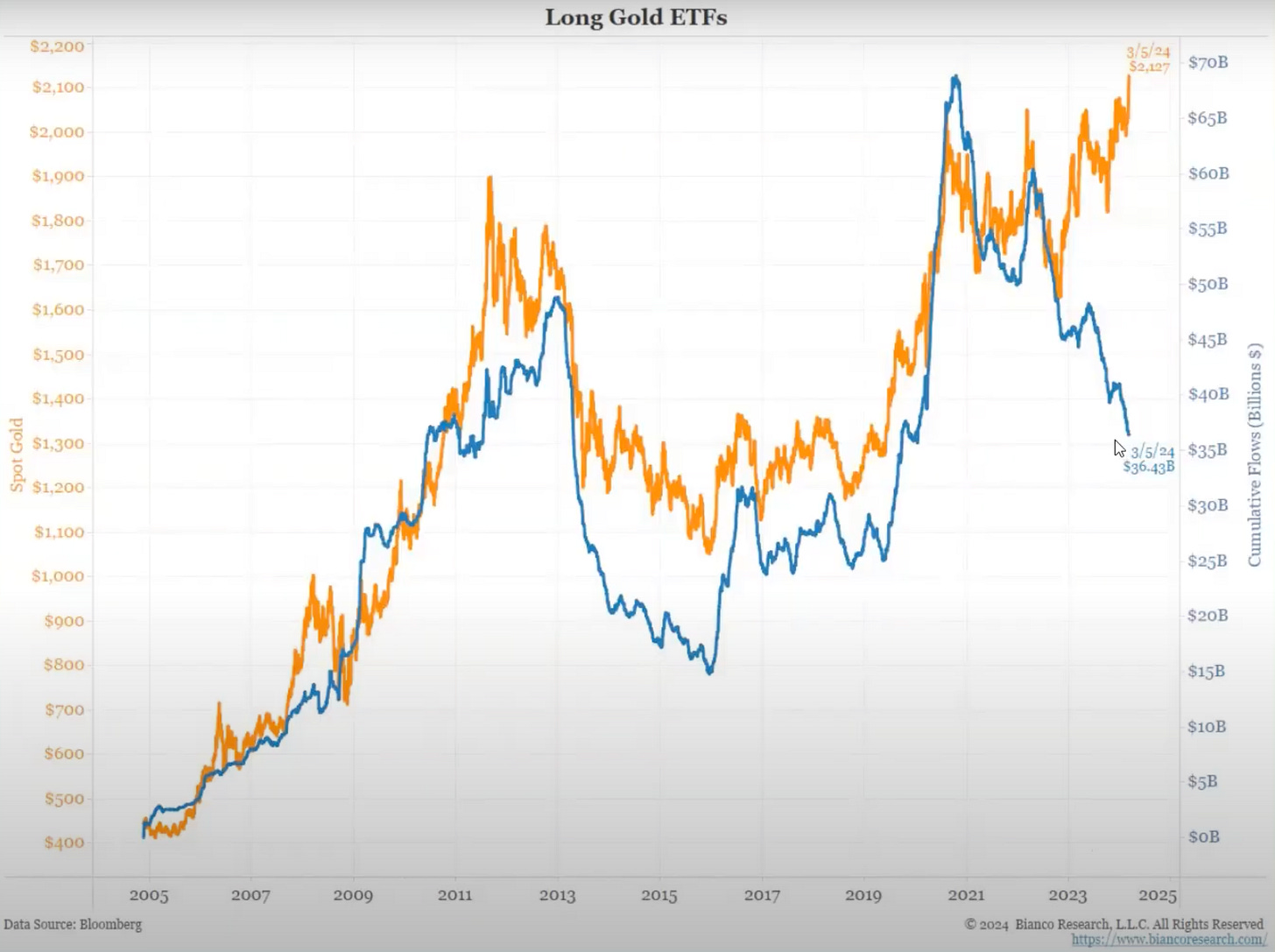

One of the most commonly used theses has always been that the greater inflow to ETFs, the greater the rise or fall. As we can see with gold in the following graph, this is not always the case.

This opens a very interesting intellectual reflection. Today, I'm going to write about the reason that moves the price of gold and which I believe should make us reflect very carefully about how the world works, and it is basically the second reason I described earlier, which is that governments are buying gold in unprecedented magnitudes. And these are just the official data.

Lastly, as we have mentioned many times, gold follows real interest rates. These have been negative over the last year, but even so, gold has risen. This is due solely to what we just discussed.

Now, it seems that real interest rates are starting to rise, this could cause the price of this asset to skyrocket even more. Without a doubt, it is an asset that everyone should keep in a proportion of 5-15% of their portfolio.

Sorry for being so theoretical, and I hope this has helped you better understand this asset.

This is the first week after 8 that our portfolio has not yielded positive returns. However, even though there have been declines in both the markets and in high-risk assets, we see how having an asymmetric portfolio significantly reduces the risk. We show this in detail in our portfolio.