The Most Important Week of the Year for the Global Economy

Massive Drawdown Coming

We are on the brink of a significant drawdown in the markets. We already warned about this in late 2021. We came from a period of "transitory inflation" and witnessed the market drop by around 25-30%. Those growth investments, which had been the panacea and which everyone believed would be the future, faded away. Cathie Wood's famous fund fell by 80%.

I still remember how, back then, most people said that, even if it fell, it was still a good investment because growth companies always bring good results in the long run.

Our subscribers, for the most part, kept a large portion of their assets in cash and were able to buy leveraged indices at a 50% discount and Bitcoin at $16,000.

Since then, in just a year and a half, we’ve seen these funds appreciate by 100%, just like cryptocurrencies.

The factors that led us to predict this downturn were all, I repeat, all macroeconomic. We’ve explained many times that people don’t really understand money; it’s just an accounting entry.

This causes the value of money to fluctuate much more often than the actual price of assets, yet we keep trying to guess the "fair price" of a company based on its P/E ratio.

This is extremely naive. It might have made sense in the past to say that a P/E ratio of 15 was "normal," but today that’s no longer the case.

The main factors we anticipated, and which ALL have come true, were:

Interest rate hikes: We predicted that rates would be raised to curb credit and prevent that "transitory inflation" from getting out of control. What happened? We witnessed the longest interest rate hike in history.

Liquidity reduction: The second tool central banks have to curb consumption is liquidity. Not only was it reduced, but tools like Reverse Repo were used to decrease it even further. With less money in circulation, people spend less, profits decline, and prices drop.

A crucial decision by the FED

I believe we are at an important turning point in macroeconomic trends. This led me to write this article for subscribers. This week, what appears to be the first interest rate cut by the FED is expected.

Whenever this has happened, significant market declines have followed.

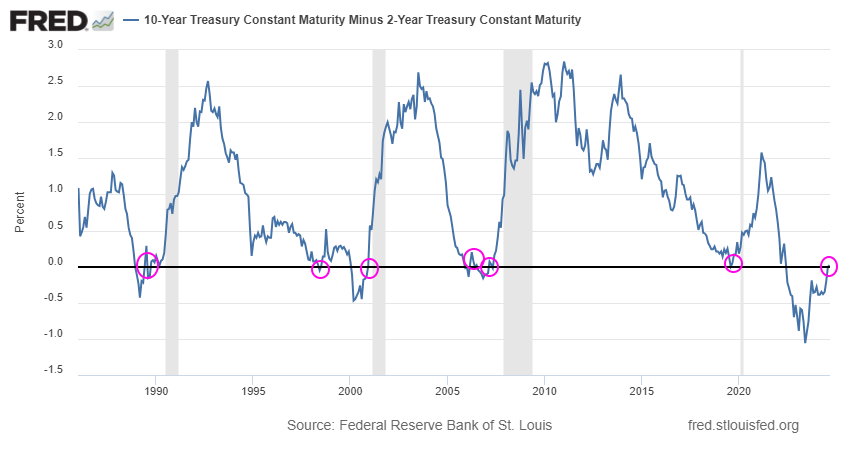

On the other hand, one of the indicators that better predicts future recessions, even more so than rate cuts, is the yield curve inversion. This means that if the government pays you more for a 2-year bond than for a 20-year bond, it’s because buyers don’t trust the government or the currency in the long term.

As expected, this always ends badly.

Lastly, Ray Dalio published a detailed report of over 150 pages this week on his vision of the markets. He emphasized that China is getting closer to becoming the new global order. He also warned that the American population is in decline (divided, with lower life expectancy, etc.), and that the coming years will be crucial.