The Secret to Surviving an Economic Collapse

Why Ray Dalio Thinks the Dollar Could Fail (And What to Do)

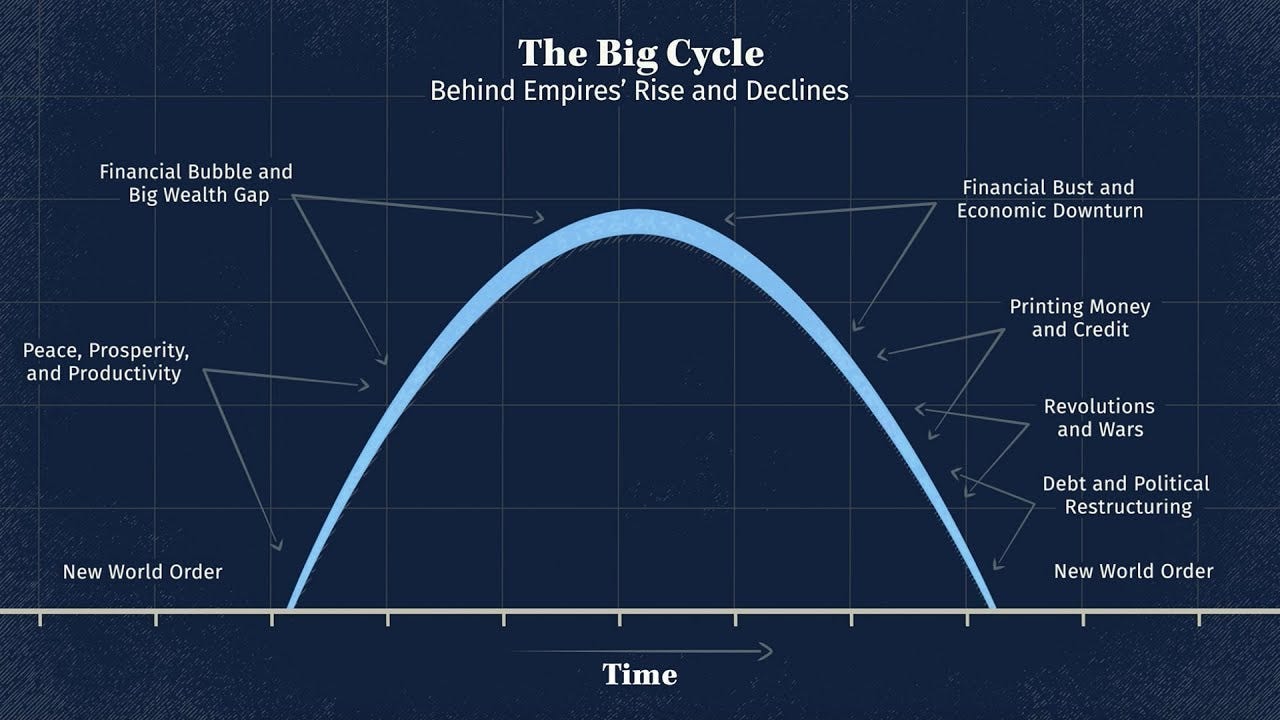

Throughout history, economic empires have risen and fallen. From the Roman denarius to the British pound sterling, every dominant currency has faced its decline. You might think this time will be different, but it’s not. In fact, if you look a little further, you’ll find that even Isaac Asimov’s books remind us that what seems important today might not matter as much in the grand scheme of things.

Today, the U.S. dollar, which has been the cornerstone of the global financial system for decades, could be in jeopardy. Recent economic policies, such as Donald Trump’s tariffs and the rising national debt, coupled with warnings from experts like Ray Dalio, suggest that we might be on the brink of a significant shift. But what does this mean for you, and how can you leverage it to build wealth and achieve financial freedom?

Lessons from the Fall of Past Empires

The collapse of the Roman Empire offers a fascinating perspective on how economic decisions can destabilize an apparently solid system. At its peak, Rome used the denarius, a currency backed by pure silver. However, emperors’ ambitions led to its debasement to fund wars and massive projects. This triggered rampant inflation and paralyzed an economy that eventually relied on bartering.

Similarly, the U.S. dollar faces significant challenges today. National debt has reached record levels, while protectionist and tariff policies have created economic uncertainty.

According to Ray Dalio, excessive debt and money printing without real backing could lead to the dollar losing its dominance to currencies like China’s renminbi or even cryptocurrencies like Bitcoin.

The Impact of Trump’s Tariff Policies

Donald Trump used tariffs as an economic tool to “make America great again.” However, these policies have had unintended consequences. Tariffs have increased production costs in the U.S., negatively affecting key sectors like manufacturing. Additionally, they have contributed to rising inflation and added pressure on the dollar.

For those who don’t remember: 60 years ago, everything was produced in the U.S.; 30 years ago, everything was made in Japan; now it’s all made in China. This raises questions about whether such policies are truly beneficial.

Historically, trade wars tend to temporarily strengthen dominant currencies due to global uncertainty. However, if these tensions persist, they could erode confidence in the dollar and pave the way for alternatives like foreign currencies or digital assets.